In 2024, the United States celebrated the 50th anniversary of a woman’s ability to obtain a bank account without her father’s or husband’s co-signature.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

In 2024, the United States celebrated the 50th anniversary of a woman’s ability to obtain a bank account without her father’s or husband’s co-signature.

Yes, you read that correctly.

In 1974, the U.S. passed the Equal Credit Opportunity Act, making it illegal for creditors to discriminate based on sex, race, or religion, meaning women could finally independently open their own bank account and have credit cards in their own names.

Since then, women’s advancement in senior banking roles has moved slowly. While the majority of U.S. bank employees are women, 7.5% of banks have women CEOs, according to the ABA Banking Journal of the American Bankers Association.

In Central Massachusetts, six of the region’s 32 largest banks are led by women: Dana Neshe of Natick-based Middlesex Savings Bank, Kristin Carvalho of Framingham-based MutualOne Bank, Mary Dean of Clinton Savings Bank, Rosemary Picard of Southbridge-based Savers Bank, Mary McGovern of Ware-based Country Bank, and Kathleen Marcum of Millbury National Bank.

For these leaders, navigating the male- and white-dominated field of banking means using prejudice to fuel their efforts to succeed and embracing the collaborative mindset that so often makes women exceptional leaders.

Road to the top

“When I started way back when, all you saw around the table were men,” said McGovern, Country Bank’s president and CEO.

McGovern began her banking career in 1986 as an audit controller at Fidelity Investments. She had majored in math in college because she found it interesting and, truthfully, the range of professional jobs available to women was limited.

“My mother was a nurse. My father was a carpenter. I didn't know what careers were out there,” she said.

Even still, she rose through the banking ranks, entering the C-suite in 1999 at Danversbank and making her way to Country Bank in 2011.

McGovern was named Country Bank’s first female president in January 2024, and in August she became its first female CEO in the institution’s 174-year history.

Neshe, chair, president, and CEO of Middlesex Savings Bank, and Carvalho, president and CEO of MutualOne Bank, began their banking careers as tellers at their local banks. Both are the first women to hold their current positions within their respective institutions.

Neshe has spent 30 years out of her 35-year career at Middlesex. She joined in 1995 as an assistant compliance officer and was named CEO last year.

Carvalho has worked at a number of Massachusetts-based banks throughout her career and spent the past 15 at the presidential and CEO level.

“This has been a long journey for me, not just me, other women at the presidency level,” said Carvalho. “And it is a long, painful journey filled with challenges, filled with disappointments, filled with ignorance.”

Overcoming barriers

To stay empowered throughout her journey to the top, Carvalho has worked hard, stayed focused, and has done as much professional training as she could, she said. Working to differentiate herself from peers regardless of sex has in part led her to earn two master’s degrees and a doctorate in business administration.

“We all know what the issues are. The question is: ‘What can you do about it?’” said Carvalho.

McGovern was used to being the only woman in the room early in her career, a circumstance she simply became used to out of necessity. To make lemonade, McGovern used those experiences as a sort of training ground for the barriers she would eventually break in her career.

As women slowly infiltrated banking leadership, she began to see those possibilities for herself come into focus.

“That was how my perspective evolved, I would say over my career, ‘Well, why couldn't I be that?’” she said.

When Neshe joined Middlesex Savings, women already held senior leadership positions at the bank, which was fortunate for her. Looking back, Neshe doesn’t feel as though she had sex-specific barriers to overcome within the institution, a rarity for many women in the banking world.

In fact, 86 women in financial services are promoted to manager for every 100 of their male counterparts, according to a 2022 Women in the Workplace report from New York-based consulting firm McKinsey & Co.

At the same time, women represent the majority of the entry-level banking workforce at 53% while making up fewer than one third of senior vice president and C-suite positions. Discrepancies are even greater when specifically focusing on women of color, who constitute about one in four entry-level employees and 20% of C-suite roles.

Rising female leadership

“You know, you can name the women that run financial institutions in Massachusetts,” said Carvalho. “You can probably name the women that run financial institutions nationwide. Should you be able to do that? No.”

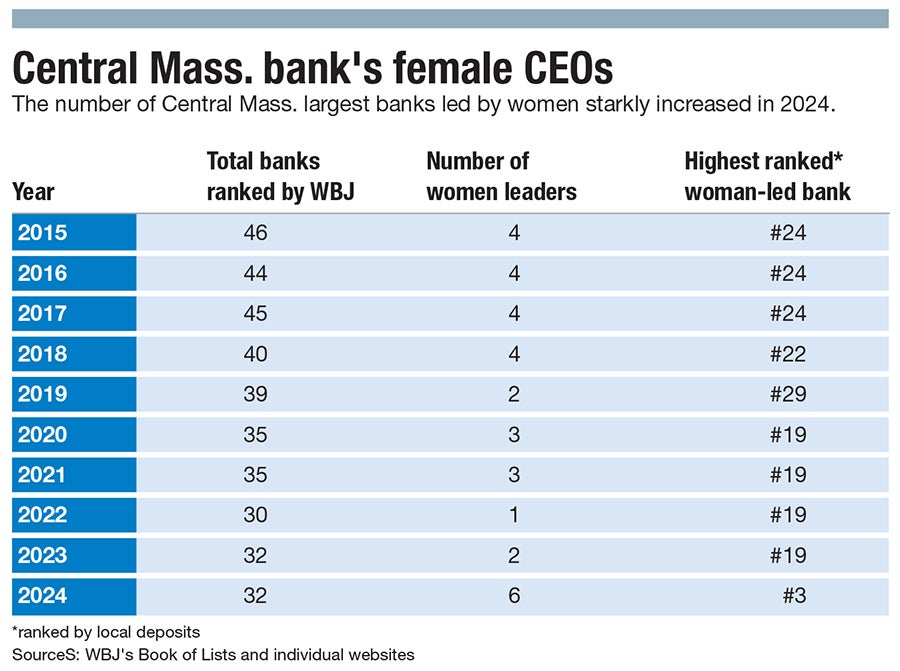

While female representation among banking executives is sobering, the number of women in the banking leadership is growing, especially within Central Massachusetts, Carvalho said. In 2024, the number of women leading the region’s largest banks doubled from three to six.

“We serve as a reminder that financial wherewithal is not restricted to a certain group of individuals or a certain gender,” said Neshe.

The state is home to a number of women who have played integral roles in growing their banks to the leaders they are today.

Gilda Nogueira, former president and CEO of East Cambridge Savings Bank, led the institution for 11 years, retiring in 2023 after having grown the bank’s assets to $1.6 billion, according to a March 2023 press release.

Dorothy Savarese, former CEO of Hyannis-based Cape Cod 5, led the institution from 2005 to her retirement from the role in 2022, according to a February 2022 press release from the bank. Under her leadership, Cape Cod 5 more than tripled its assets from $1.4 billion to $4.6 billion, growing its employees from 295 to 550 and its number of locations from 16 to 26. Cape Cod 5 in 2024 merged its holding company with Fidelity Bank of Leominster.

“Those women were there, just that much earlier than we are here, where they really did forge a path for those of us who are sitting in these roles today,” said Neshe.

Notably, both Nogueira and Savarese’s positions were filled by men upon their retirements.

The female factor

“There's enough of us where we have a cohort, and I think that that's really important for folks to see if they're interested in rising to senior leadership,” said Neshe.

Promoting women to executive banking positions has a positive impact on everyone, all three leaders said.

Women excel in collaborative management, which includes listening and including multiple people in the decision making processes. That trait is undervalued, particularly in financial services, Carvalho said.

The banking landscape of the U.S. is changing rapidly. From shifting regulations to the impact of cryptocurrency, it is arguably now more important than ever to bring together diverse perspectives in order to stay competitive.

Women “just bring varied experiences, and I think that that's beneficial. And I've seen it be more impactful, frankly, than just all men sitting around the table deciding what's going on,” said McGovern.

The corporate world was unforgiving to McGovern in her career as it related to her children. With her daily train commute to Boston and her husband working on a construction site, she was often the one responsible for getting home if anything happened with her kids.

“There was not a lot of empathy, frankly, in my career, and I bring that to my job every day, because I lived it,” said McGovern.

Women tend to bring that empathy to leadership, whether they are mothers or not, said McGovern.

For Neshe, she sees women excelling at team building as they tend to be relationship-focused.

A 2019 study published by the Harvard Business Review analyzing thousands of employee reviews found women outscored men on 17 out of 19 key leadership capacities including in collaboration and teamwork; solving problems; and building relationships. Women surpassed men the most in terms of taking initiative, resilience, and practicing self-development.

These qualities are arguably even more important to have once an employee enters the C-suite, Neshe said.

“Making sure that your team feels safe, feels empowered, allows them to do their best work, and that's ultimately what you're hoping to achieve,” said Neshe.

Mica Kanner-Mascolo is a staff writer at Worcester Business Journal, who primarily covers the healthcare and diversity, equity, and inclusion industries.