The coronavirus pandemic and the economic pain it is causing has brought a flood of new deposits to banks in Central Massachusetts and nationally.

The trend hasn’t been entirely good.

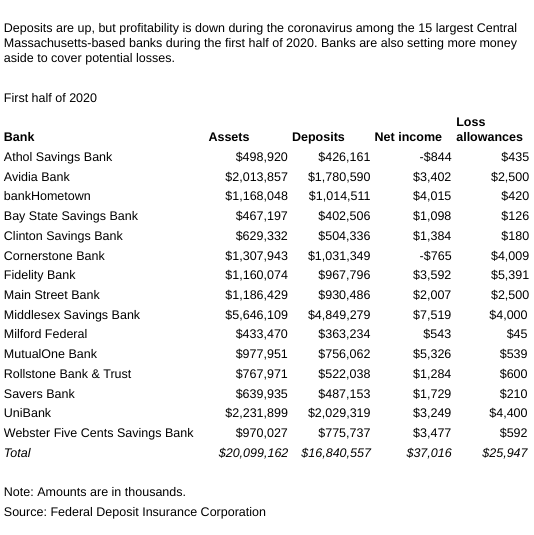

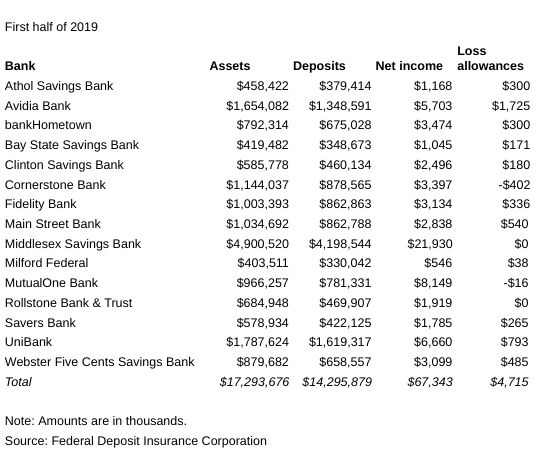

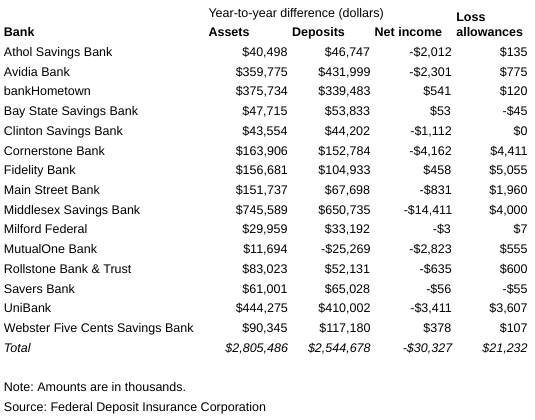

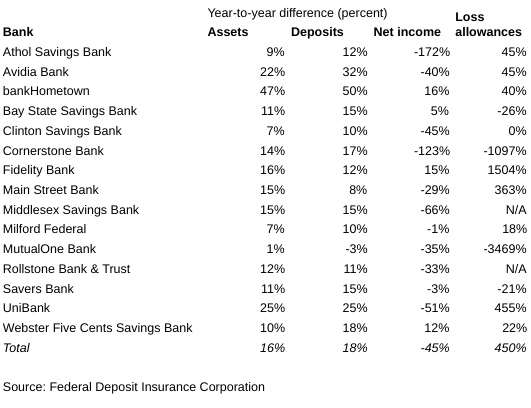

Banks have seen net incomes drop precipitously and are setting aside far greater amounts of expected potential losses in loans and leases, according to a Worcester Business Journal review of Federal Deposit Insurance Corp. data.

Across the 15 largest locally-based banks by deposits, the first half of 2020 saw deposits soar by 18%, or more than $2.5 billion, compared to a year earlier. Net income, though, dropped by 45%, or more than $30 million, due in part by exceptionally low interest rates.

In a sign banks may be expecting credit repayment issues, the amount of money they’re setting aside for those losses is more than four times the amount they set aside for such losses in the first half of 2019. Those banks set aside nearly $26 million for what are called credit-loss provisions in the first six months of 2020. Among them, Middlesex Savings Bank, the largest Central Massachusetts-based bank by deposits, put $4 million aside for those losses this year. Last year, it didn’t have a dollar in that account.

Nationally, the FDIC has seen the same trends.

For the second straight quarter, new deposits exceeded $1 trillion, something FDIC Chairman Jelena McWilliams said surpassed anything seen nationally by banks before. Deposits grew 21% from a year prior.

“These inflows demonstrate public confidence in the banking system, as well as the system’s ability to accommodate unprecedented customer demand,” McWilliams said.

Banks’ net incomes in the first six months of the year nationally fell by 70% from a year ago, and what are known as credit-loss provisions spiked by 382%, from $12.8 billion to $49.1 billion.

Riley Garand contributed to this article.