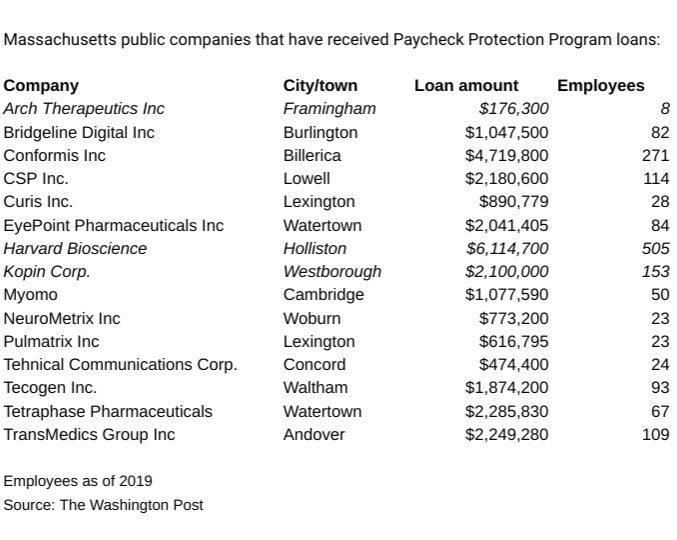

Three public companies in Central Massachusetts have disclosed they received a combined $8.4 million in federal loans for the program intended to bailout small businesses.

The disclosures by Harvard Bioscience of Holliston, Kopin Corp. of Westborough and Arch Therapeutics of Framingham are among the first signs of which area companies have received funding and how much from the Paycheck Protection Program, which was created as part of the $2.2-trillion CARES Act. The program is aimed at helping small businesses with less than 500 employees through the coronavirus pandemic and the related economic hit.

Harvard Bioscience, a biotechnology firm with 505 employees, got $6.1 million, the company disclosed, according to a database of such reporting nationally by The Washington Post.

Kopin Corp., an electronics manufacturer with 153 employees, received $2.1 million.

Arch Therapeutics, which makes wound care products and has eight employees, got $176,300.

Nearly 47,000 small Massachusetts businesses received or were approved for $10.4 billion through the first $349-billion PPP phase, according to the U.S. Small Business Administration. Massachusetts ranked ninth nationally in both the number of businesses awarded and the amount its businesses received. Nationally, nearly 1.7 small businesses received aid, with more than 30 million jobs protected.

The first PPP phase ended in less than two weeks when funding ran out. A second phase of the loan program with $320 billion in funding began accepting applications on Monday.