To commercial real estate experts, it looks as if the biotechnology sector, and specifically the biggest players in it, will carry Massachusetts through the current recession.

In the six months ended March 31, tenants took up 673,000 square feet of laboratory space in Greater Boston, lowering vacancy from 14 percent to 9.7 percent, according to a market report from Boston-based commercial real estate firm Richards, Barry, Joyce & Partners.

Large biotech companies like Genzyme, Novartis and Abbott have maintained decent cash positions, are attracted to the “robust offering of appropriately skilled labor” in Massachusetts and have helped offset some of the crushing downward pressure the economy has put on the state as a whole.

Since the middle of 2003, tenants have taken up 4.4 million square feet of laboratory space, outpacing developers, who have built 3.7 million square feet.

The Cambridge Effect

Brendan Carroll, vice president of research at RBJ, said his firm expects a continued positive demand trend, especially in biotech hotspots like Cambridge. Cambridge claims 7.75 million square feet of laboratory space. Boston claims 3.12 million square feet and the suburbs claim 4.4 million square feet.

However, while tenancy by large, rich biotech companies may stave off widespread vacancy and job loss, recruiting employees needed for further expansion may become difficult. And for the smaller, younger biotech companies scattered across the suburbs, being acquired may become the best way to stay alive.

According to RBJ, recruiting has become “strained.” Many potential employees are trapped in homes they can’t sell for anywhere near what they paid for them and the prospect of moving to one of the most expensive areas of the country is proving too daunting for many.

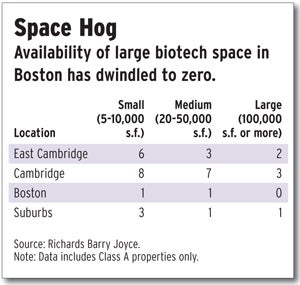

Unable to get new facilities built, Carroll said biotech companies “that really need the space are doing it in-house” simply by adding to existing campuses. Carroll said Genzyme’s facility on New York Avenue in Framingham is a good example. The Cambridge-based company has been gobbling up real estate around its Framingham campus since last year. “If they had been interested in looking around and seeing other options, there weren’t any,” Carroll said.

Carroll said availability is on the increase in the suburbs, but not in a way that is particularly attractive to larger companies. RBJ expects negative absorption, that is, more space becoming vacant than being leased, throughout 2009 in the suburbs. The firm said the availability of sublease space has increased from 162,000 square feet last year to 270,000 square feet in the first six months of this year.

All of this may have biotech companies and developers looking for the next best thing in areas of the state where land is relatively inexpensive and the workforce, while perhaps not ultra-educated like it is in Cambridge, is highly skilled nonetheless.

Two areas that fit that bill are Devens and Worcester’s biotech park, Carroll said.

Even though Cambridge is the nucleus of biotech research, Devens and Worcester could become the nuclei of biotech production, especially with the addition of state and federal funding, which tends to be spread around more than venture funding, which results in concentrations like Cambridge.