At the end of 2005, Boston Scientific Corp. made the fateful choice to buy cardiovascular equipment company Guidant Corp. for $27 billion. Since then, repercussions from the acquisition have weighed on the Marlborough-based medical device company.

But with the settlement of a lawsuit over the deal in February, the company seems to be moving forward. It recently made its first major acquisition since Guidant (for a far more modest $1.65 billion), and analysts say it’s poised for more good news.

The lawsuit was filed by rival medical device maker Johnson & Johnson, which had reached a deal to acquire Guidant in 2005 before Boston Scientific swooped in with a better offer. J&J sought $7.2 billion in damages.

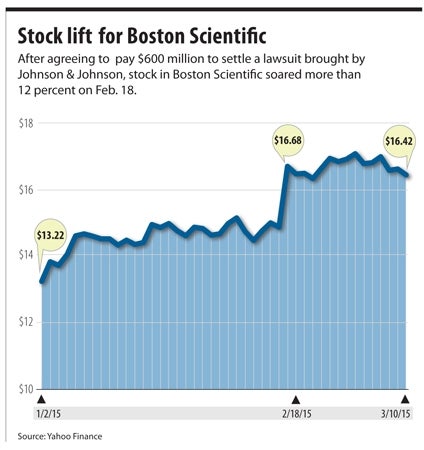

The companies ended up settling for $600 million, and the stock market reacted with a 10.85-percent boost to Boston Scientific shares.

Tao Levy, an analyst who follows Boston Scientific for WedBush Securities, said there had been little chance the company would have had to pay the full $7.2 billion, but the possibility wasn’t zero. That meant it was living under the threat of a disaster until it reached a settlement.

“I wouldn’t say ‘bankrupted the company,’ but it would have been a real big issue for them to deal with,” Levy said.

Shagun Singh Chadha, an analyst with CRT Capital, said both sides should be pleased with the settlement since it avoids dragging out the process with appeals that could have gone on for another year or more. But she said the truth is that J&J didn’t have a particularly strong case to begin with.

“The burden of proof was high in establishing that the breach was not only willful, but also material in causing damage to Johnson & Johnson,” she said.

Acquired company, inherited problems

The idea that Boston Scientific gained a material benefit from the Guidant acquisition is shaky at best, partly because the company has been caught up in legal battles over problems with Guidant products for years.

In October 2006, less than a year after the acquisition, Fortune Magazine was already calling it the second worst deal ever.

Fortune noted that Boston Scientific had already been forced to issue recalls or warnings on almost 50,000 Guidant devices, while its stock had dropped 46 percent.

The important thing, Levy and Chadha said, is that Boston Scientific can now focus on the future. And it went right ahead and did that with the acquisition of American Medical Systems’ (AMS) urology business from Endo International Plc for about $1.6 billion in cash, plus the potential for another $50 million in milestone payments.

In a conference call with analysts, President and CEO Michael Mahoney said the deal helps the company expand in the growing men’s international health market while complementing its existing women’s health and urology products.

“Rather than breadth, our strategy is depth,” he said. “Depth within specific service lines of the hospital, providing a comprehensive portfolio of solutions to our hospital and physician customers.”

Chadha said acquiring the AMS businesses, and possibly making other deals in the future, seems like a good way to use available funds the company has lying around.

“It would be a good use of cash and accretive to the bottom line,” she said.

Strong internal pipeline

But both Chadha and Levy said Boston Scientific’s pipeline of internally developed products is good enough that it can choose whether to make acquisitions based on how they work with its existing businesses, not from a desperate need to grow sales.

“They’ve got a lot of things going on internally right now,” Levy said, citing the Watchman, an implantable device to help prevent strokes that may get FDA approval in the coming months, as well as a new implantable cardiac defibrillator that may move forward this year.

Chadha said that, after suffering from low growth levels since the Guidant acquisition, Boston Scientific is likely to increase sales 3 to 6 percent a year going forward.

“The company has really done a good job in their base business, turning the corner to positive sustainable growth and expanding operating margins,” she said. “We think there is more to come.”

In general, the medical device industry is a good place to be right now. Stocks in the sector have outperformed the broader market over the past year, particularly in the past few months.

While the industry continues to protest the 2.3-percent medical device tax included in the Affordable Care Act, Levy said companies have pretty much acclimated to the extra cost at this point. He said insurance companies and hospitals continue to put pressure on the prices of medical devices, but that’s a steady drumbeat, not a new threat.

Bigger better for medical device firms?

Levy said the big question for the industry is how much consolidation is good for business.

Medtronic plc pushed the issue to the fore with its $50 billion acquisition of Covidien plc, finalized in January. Levy said creating huge companies hasn’t always been the best strategy for medical device companies in the past, but that could be changing.

“If Medtronic’s acquisition turns out to be a positive one and the combined company ends up being a lot stronger (and) captures a greater share than alone, then other companies will begin to revisit that,” he said.

Levy and Chadha said the Affordable Care Act brings a greater focus on the cost and quality of care, which could lead to advantages for companies that have both breadth and depth in their product lines.

Whether Boston Scientific will double down on mergers and acquisitions remains to be seen, but either way the company seems to be emerging from a decade-long shadow.

“I think their balance sheet is getting better; they’re generating cash,” said Levy. “They’re pretty busy.”