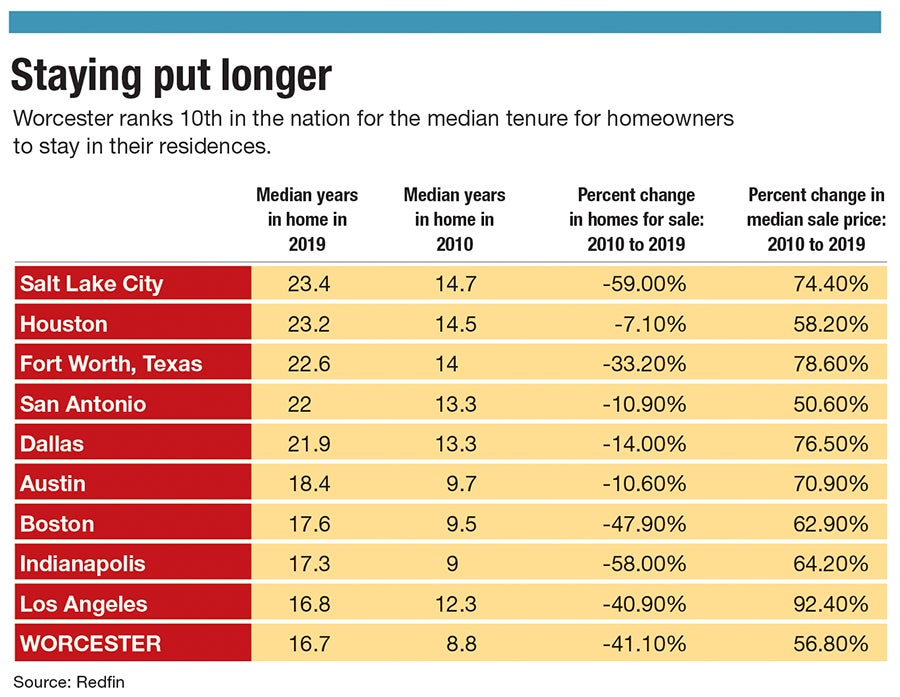

In a nationwide survey of how long people stay in their houses, Worcester ranked 10th with an average of 17 years. That’s up from nine years a decade ago, according to research by Redfin, the national Seattle-based real estate brokerage.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Worcester residents really love their homes.

In a nationwide survey of how long people stay in their houses, Worcester ranked 10th with an average of 17 years. That’s up from nine years a decade ago, according to research by Redfin, the national Seattle-based real estate brokerage.

Worcester was the only Central Massachusetts community to make the Top 55 list. Boston was the only other Massachusetts city in the rankings. The Hub placed seventh with 18 years longevity, up from nine in 2010.

Median home tenure increased in every city Redfin analyzed. The result has led to fewer homes available for first-time homebuyers seeking to end leasing in favor of building equity.

Homeowners have been in their homes the longest – for more than 20 years on average – in Salt Lake City, Houston, Fort Worth, San Antonio, and Dallas.

Fewer homes on the market

Erika Hall, president of the Realtor Association of Central Massachusetts, said no single answer addresses the complicated question of why Worcester homeowners stay in place.

But Hall said one of the major factors is inventory.

As of Jan. 13, there were 78 single-family homes for sale in Worcester, according to the MLS Property Information Network, the Shrewsbury listing service. On the same date one decade ago, the number was 359.

“That is staggering,” Hall said. “When I first got into real estate about 10 years ago, it was a buyers’ market. Today, we are in an inventory crisis. More housing production is desperately needed.”

Kathleen McSweeney, a broker at Collins & Demac Real Estate in Shrewsbury, said homeowner longevity creates problems not just for first-time homebuyers.

“It impacts every sector of the real estate market,” she said. “The family who has outgrown their starter home is reluctant to list their house for sale because a bigger home is unavailable, and empty nesters seeking to downsize from their four-bedroom Colonials can’t find a smaller home to move into.”

The other factor contributing to homeowners staying put is price. Redfin reported the median price of a Worcester home sold last year was $290,000, up 57% compared to a decade ago when the median was $180,000.

Redfin found as housing became more expensive, homeowners saw their home equity swell, making it tough to justify selling when there are few affordable options.

In addition, elder homeowners can tap the equity in their home through a reverse mortgage. These are available to homeowners who are 62 or older who have considerable home equity. It allows the homeowner to borrow against the value of their home and receive cash as a lump sum, fixed monthly payment or line of credit. Unlike a standard mortgage, a reverse mortgage doesn’t have loan payments. Instead, the balance is due when the borrower dies, moves, or sells the home.

As home prices surged, average salaries have been anemic over the last 10 years, according to the Pew Research Center, a Washington D.C. think tank.

Year-over-year income growth has mostly ranged between 2% and 3% nationally since 2013, according to Pew.

But in the years before the 2007-2008 financial collapse, average hourly earnings often increased by 4% year-over-year, Pew found. Contrast that to the high-inflation years of the 1970s and early 1980s, when average wages jumped 7%, 8% or even 9% year-over-year.

More home repairs needed

Albert LaValley, president of Sustainable Comfort Inc., a 50-person Worcester firm which renovates three-family homes, said anyone who wanted to sell during the last real estate crash, learned they were under water when the bottom fell out.

“Those people have had to wait 10 years to get back to where they were and that shut off many sales,” he said.

Another shocking figure, LaValley said, is how few Worcester homes are sold.

Of the estimated 48,382 multi-family homes in the city, 441 (less than 1%) changed hands last year, according to MLS.

In the single-family home market, 1,219 homes (4%) sold of the 29,654 in the city in 2019.

“It’s clear lots of people are hanging on to their homes,” he said.

When his firm buys a triple-decker, there’s lots of repairs needing to be completed before it can be flipped, he said.

“When we do buy one that’s been in someone’s family for a long time, they need plenty of work,” LaValley said.