Back in the early 1980s, the administration of then-Gov. Edward King launched a multimedia advertising campaign, urging businesses to “Make it in Massachusetts.” The television spots highlighted some of the commonwealth’s key business, cultural and entertainment assets, all touting the Bay State as a place to grow, thrive and get richer.

Right around the same time, the state’s cities and towns were struggling to get used to a 1980 voter-approved referendum, Proposition 2½, which reined in their ability to spend by capping the amount of revenue they could raise through the property tax every year. It was a dose of bitter medicine, but was necessary at the time because a lack of fiscal discipline led to spiraling spending. It forced many communities to ramp up their efforts to attract business. That, in turn, would provide extra revenue for many key services, especially the schools, since the property tax revenue generated by a new home with two school-age children is more than negated by the cost to educate them.

Since then, some cities and towns have enacted separate property tax rates, one for homeowners and a higher rate for business property owners. Sixteen Central Massachusetts communities have “dual rate” structures, in part to ease the burden on homeowners.

But officials in many of those communities are starting to realize — if they haven’t already — that such a strategy benefits no one in the long run.

As communities ramp up their economic development efforts to bring in more business, many are realizing that narrowing the gap between those rates makes for sound fiscal policy and provides more incentive to attract and grow the business base. Sturbridge eliminated its dual tax rate in September when selectmen there voted to close the gap and go with a single rate. And in October, city councilors voted to narrow the gap in Fitchburg.

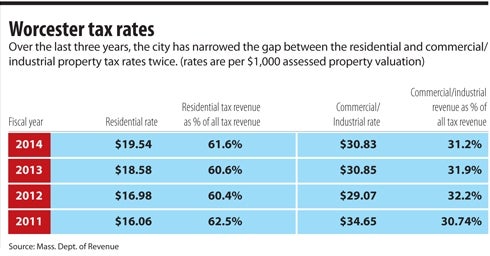

Next week, Worcester city councilors are expected to hold their annual tax classification hearing, and the business community is again lobbying to shrink the gap between the residential rate ($19.54 for every $1,000 assessed property valuation) and the commercial/industrial rate ($30.83). The council, in very close votes, narrowed the rate in two of the last three years and it should do so again.

The Worcester Regional Chamber of Commerce, in a letter to its roughly 2,300 members, urged them to lobby councilors to vote for “equality and fairness.” Chamber President and CEO Tim Murray said his organization will push for an increase in the residential rate to $20.29 and a smaller jump in the commercial/residential levy to $31.20, which would mean median property tax increases of $145 for homeowners and $154 for business property owners for the current fiscal year. A narrowing of the rate gap is especially important in a community such as Worcester, since most of the business base is made up of small and mid-size firms, Murray said.

As more people begin to rediscover urban living, cities become more attractive sites for businesses. With Worcester making strides as part of that sociological shift, especially in the downtown area, it needs to continue to act in a way that will draw more business rather than repel it.

We hope more communities take similar action across the commonwealth. Here’s a bit of evidence that they should: In Forbes’ recent ranking of the best states for business, Massachusetts ranked a solid 13th. But it ranked 49th — ahead of only Hawaii — in business costs. While municipal taxes are only one part of that equation, a return to a more fair and equitable distribution of the tax burden can lead to the kind of economic growth that will increase the overall tax base, a goal on which we can all agree.