When the economy hit the skids, many publicly traded companies pulled back on dividends, particularly financial services companies.

But today, some companies are bringing their dividends back, or even increasing them, in order lure investors back to the market.

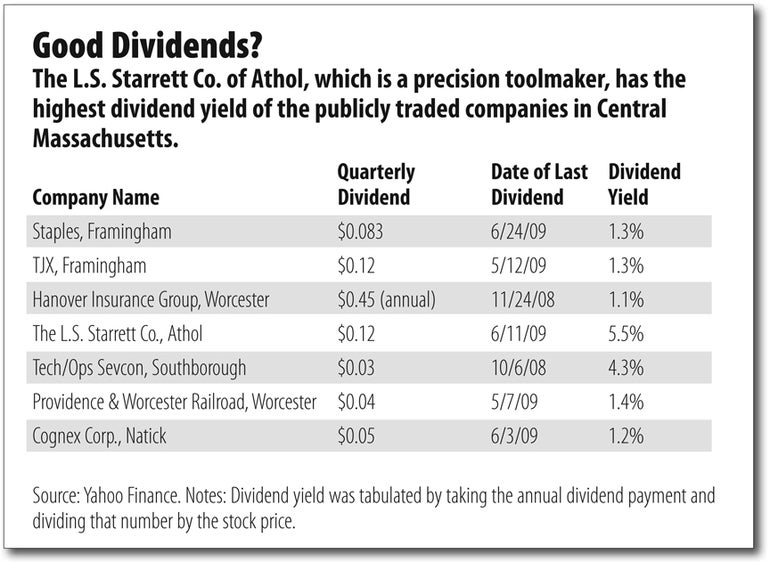

Locally, the publicly traded companies are all over the map. But if dividends are at all an indication of a company’s performance, the good news is that Central Massachusetts publically traded companies are sticking with what they know. According to a review by the Worcester Business Journal, the majority of firms in the region have maintained their dividends and two, Framingham-based TJX Cos. and the Hanover Insurance Group of Worcester, have seen small upticks in dividend payments in the last year.

However, there are also a couple of companies in the area that have scaled dividend payments back or cut them entirely.

Why Give Back?

Most publicly traded firms in Central Massachusetts do not issue dividends. And those that do, aren’t big dividend payers, according to Michael Grenon, a vice president and principal with Grimes & Go. Inc., a financial advisory firm based in Westborough.

“Historically, some of the biggest dividend payers out there have been the financial services companies,” Grenon said, adding that those same firms, like JP Morgan Chase, have been cutting dividends to either maintain their capital ratios or pay back TARP funds to the federal government.

Dividends are measured by the value of the payment per share as a percentage of the stock price. A hefty dividend yield is around 3 or 4 percent, according to Grenon. The dividends issued by Central Massachusetts stock companies tend to be much smaller, in the 1 to 2 percent range. The exceptions are The L.S. Starrett Co. in Athol, which has a dividend yield of 5.5 percent, according to Yahoo Finance, and Tech/Ops Sevcon of Southborough, which had a dividend yield of 4.3 percent. But Tech/Ops’ last dividend payment was in October 2008.

Tech/Ops makes motor control systems. Earlier this year, the company’s board issued a statement saying it was suspending the dividend for the first quarter in an effort “to conserve cash” due to “worldwide economic conditions.”

Tech/Ops has been hurt by the recession. The company reported a net loss of $300,000 for the most recent quarter after a 59 percent drop in revenues.

Natick-based Cognex Corp. hasn’t had to suspend its dividend, but the maker of machine vision systems has scaled back. It announced a September dividend payment of $0.05 per share. That’s down from the $0.15 per share dividend the company issued in March of this year. Cognex, like Tech/Ops, has been hurt by the recession. The company reported a $6.4 million loss for the most recent quarter.

On the opposite side of the scale are Hanover Insurance and TJX. Hanover, unlike many in the insurance industry, has weathered the financial storm relatively safely and upped its annual dividend from $0.40 per share to $0.45 per share in November 2008. The company has not made any announcements about its 2009 dividend.

The increase in the dividend payment is in contrast the overall trend for insurers last year.

For example, The Hartford Financial Services Group of Connecticut, which is a property and casualty insurer like Hanover, began cutting its quarterly dividend in November of last year.

Capital Gains

A company’s decision to hold onto cash, rather than issue the dividend, is all about capital, according to David Grenier, president of the Worcester-based hedge fund, Cutler Capital Management.

“Not only do we have an environment where the economy is tough, but capital is tough to come by as not everyone can go and get loans on the same terms they were expecting prior to this occurring,” Grenier said.

Grenon said that dividends hit their most recent high in June 2008, but since that time, they’ve been on a steep downward slide.

“Companies, in general, are just being more cautious with their capital again,” Grenon said.

But at the same time, Grenier said cutting a dividend is a very difficult decision for a board to make.

“It’s a serious decision… and while everyone understands it might be the right thing to do, you do alienate a set of investors,” he said.

The Central Massachusetts companies that don’t issue dividends include many tech companies, such as Hopkinton-based EMC Corp. and Acton-based Seachange International.

The reason that tech firms tend to stay away from dividends is because they tend to focus on fast growth, and need the capital to fuel that growth, according to Grenier.

“An investor in a tech company doesn’t typically invest because of a dividend,” he said.

“They invest because they think the stock price is going to go from $10 to $100 based on new technology.”