Many factors are impacting Central Massachusetts construction material costs, and when it comes to steel, Amazon’s building activity is one of them.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Amazon built its first two distribution centers in 1997, in Seattle and Delaware.

As any of us know who have ordered – well, almost anything – online, the e-commerce giant grew from there, with its warehouse-building boom really taking off in 2005. According to supply chain and logistics consultancy MWPVL International Inc., there were more than 110 Amazon warehouses in the U.S. by January of 2020, with California a main focus for locations.

And that was before Amazon’s building boom in the wake of the coronavirus pandemic, as online orders skyrocketed. By the end of 2023, Amazon will have 355 large fulfillment centers, according to California equipment rental firm BigRentz Inc.

That expansion includes new Amazon facilities in Worcester, Westborough, Charlton, Littleton, and Bellingham.

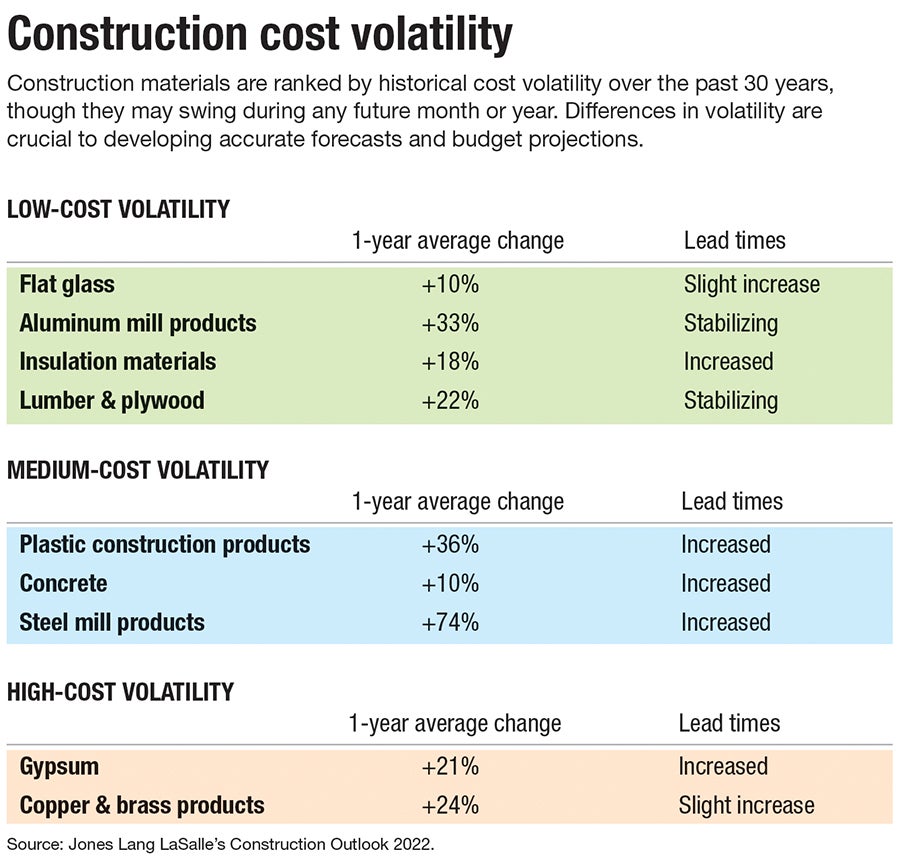

Many factors are impacting Central Massachusetts construction material costs, and when it comes to steel, Amazon’s building activity is one of them.

This warehouse-mania has caused a rush on local materials such as certain roof assemblies, said David Fontaine Jr., vice president of Fontaine Bros. Inc., a Springfield-based builder with offices in Worcester. Construction of the new Shrewsbury Police Station, which would have traditionally involved steel bar joists but now take longer to get, will instead use of alternate steel I-beams.

“We’ve changed the components to source materials that are more readily available,” said Fontaine, about working with architects to involve less manufactured items and more masonry to meet the proposed schedule. “Steel beams may be a bit heavier, but you’ve got to be kind of a student of this and use that knowledge early in the process to set the project up for success.”

That’s not to say that materials have never seen cost spikes before.

Fontaine remembers dramatic price increases in 2009–2011 for materials like gypsum board and steel, but commodities have stabilized. But now, he said, constant increases in things like steel, copper, and PVC conduit have been underway for 18 months or so, with no sign of cooling.

“This one is just is very persistent,” he said.

Perfect storm

Speaking for the trade group Associated General Contractors of Massachusetts, Jim Madigan, president and CEO of Worcester’s F.W. Madigan Co. Inc., said builders around the state are using timber to avoid the delays and cost of ordering steel.

But heavy timber is also expensive.

“It really is like a perfect storm,” Madigan said. “There are not always easy substitutions, and when there are, they are expensive, with long lead times.”

Builders have seen lumber costs spike up and down for a year and half or so, with steel rising and staying there, Madigan said. These rises have made project estimating difficult for contractors, who need to order materials immediately before prices rise again.

High petroleum costs are more pervasive, said Madigan, as they don’t just affect the construction industry in terms of transporting materials, but also the price of materials made with petroleum, such as rubber roofing, PVC pipe, or anything made with resin. He said it touches nearly everything in the industry.

All this pulls on project budgets and completion schedules.

“Time and money are both being stretched,” he said, not just client deadlines, but subcontractors’ schedules as well. “The biggest constant is the unknown.”

Forecasting 101

Climbing costs make it decidedly more difficult to create estimates. Quotes used to be valid for 90 days but are now only good for seven to 14, Fontaine said.

In-house resources have been allocated to track costs and lead times at Fontaine Bros., involving compiling of information on material pricing, labor pricing from 50 to 60 subcontractors, and vendors and suppliers in the U.S. and across the globe.

“These are the most important pieces of the puzzle,” Fontaine said. “We lean in and use that information to get ahead of issues.”

His company is building the new Shrewsbury Police Station and the new Doherty Memorial High School in Worcester.

Not getting ahead of issues means a lot of profit potentially left on the table.

At the same time these materials costs are up, the volume of work is right up there with it.

“Here in Worcester, we see it downtown,” Madigan said. “Construction is still pretty robust; it’s the same across the state and in Boston. Companies that have been sitting on capital are now just getting projects started.”

These busy times bring challenges all their own, like a lack of subcontractors, said Brandon Purrington, project manager and head of pre-construction for Green Leaf Construction in Leominster.

“Everyone is looking for people. Costs are booming, but then there’s a labor shortage on the other side. It’s harder to get people there,” he said.

The subcontractor shortage incentivizes general contractors to organize their jobs and materials well in advance to have subcontractors look favorably on pricing their jobs, Purrington said. It goes beyond efficient planning only for the client, but for the firm’s future projects and labor.

“The more organized we are, the more subcontractors will want to work with us and the more money they will make,” he said.

Purrington sees the long wait times on materials other general contractors are experiencing: steel, lumber, PVC, copper, but added another one to the list as well, rooftop units, which hold HVAC mechanical equipment. Previously, he could order them two weeks ahead of time. Now, 18 to 20 weeks is needed, he said.

“It’s even longer than that if it’s something custom,” he said. “I just gave one submitted price to a customer, and I gave them what is realistic and told them the unit can’t deliver until Q3 of 2023.”

Rise to the occasion

Fontaine and Purrington both see benefit in their firms finding ways to succeed despite the challenges of high construction costs. Both have ramped up communication with clients, their teams, vendors and subcontractors as a result.

“Our relationships are stronger with our clients,” said Fontaine. “They see our value in looking out for their projects.”

The start of those projects now needs to be earlier than ever before.

The design-build model is now one more clients see as beneficial, where it was 50/50 before, said Liz Mason of Green Leaf, director of client services. Landlords are understanding more that tenant relationships are affected when they are waiting for a heating system while space sits empty.

“They see how busy the market is and want to mitigate their risk,” Mason said. “It’s important for them to plan their projects earlier out.”

Good advice, considering building material costs don’t appear to headed in a downward spiral anytime soon.

This means only one thing to Fontaine, who has this strategy: “We plan to continue to plan ahead.”