A week ahead of the House’s expected fiscal year 2022 budget reveal, the Baker administration said it has worked up new spending projections for the single largest budget item to account for a federal-level change that could drive up costs by more than $1.4 billion while providing additional revenue to offset most or all of the extra spending.

Gov. Charlie Baker’s fiscal 2022 budget (H 1) was filed Jan. 27 proposing to trim state spending by about $300 million. That reduction in overall state spending was to be made possible largely thanks to slower-than-expected growth in MassHealth enrollment, Baker budget officials said at the time.

But during a Ways and Means Committee hearing on Baker’s budget, Health and Human Services Secretary Marylou Sudders explained that the MassHealth picture had changed since January and that lawmakers will have to account for the changes when they draft their own fiscal 2022 spending plans. The House is expected to unveil its budget next Wednesday, April 14.

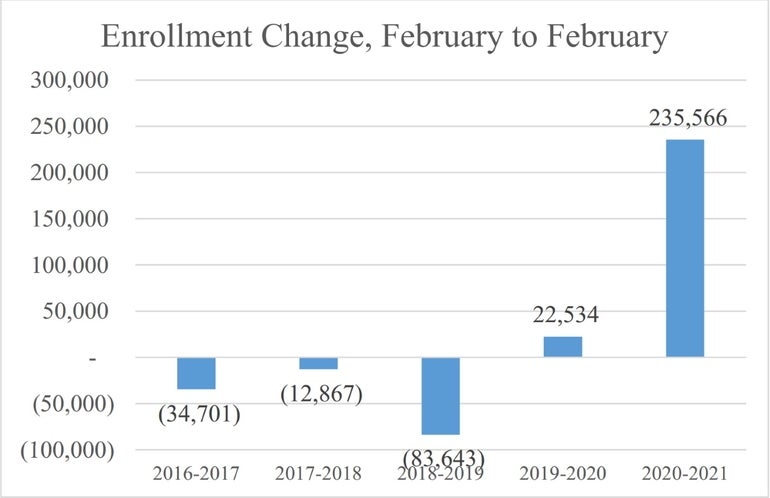

“Of course, MassHealth represents about 40 percent of the state budget. Over the past year, the MassHealth caseload has increased to over two million individuals — a growth of more than 230,000 individuals since about a year ago, last February,” she said Tuesday.

Sudders said Baker’s budget was predicated on the federal public health emergency declaration being lifted at the end of April — meaning the state could again conduct Medicaid eligibility redeterminations starting in May to reduce enrollment — and that the increased Medicaid reimbursements the federal government has provided through the pandemic would end after June.

But almost a week before Baker unveiled his budget publicly, the Biden-Harris administration informed governors in a letter dated Jan. 21 that the public health emergency was likely to remain in effect through 2021 — which keeps the redetermination prohibition in place and means MassHealth enrollment (and cost) is likely to continue to grow through the year.

When Baker filed his budget Jan. 27, gross MassHealth spending was budgeted to fall from $18.2 billion this year to $17.6 billion in fiscal 2022, a 3.4 percent reduction. Instead, Sudders said during Tuesday’s budget hearing, gross MassHealth spending is now projected to increase 4 percent. That would mean an appropriation of roughly $19 billion, according to Amanda Cassel Kraft, the state’s deputy Medicaid director.

“We have reprojected MassHealth costs to account for increased spending due to continued caseload growth, resumption of redeterminations not until January of 2022, and enhanced FMAP [Medicaid Federal Medical Assistance Percentage] extending to December of 2021 with the extension of the public health emergency,” Sudders said.

In flagging the MassHealth issue in its preview of next week’s House budget rollout, the Massachusetts Taxpayers Foundation pegged the fiscal 2022 MassHealth gross spending increase at about $1.45 billion over what the governor included in his initial budget recommendation.

Though MassHealth costs could see an increase in the neighborhood of $1.4 billion, the administration and MTF said the additional costs could be mostly or entirely offset by the extension of enhanced Medicaid reimbursements that come with the public health emergency. Sudders said the MassHealth “increased caseload is somewhat offset by increased federal funding in FY 22 on a net basis.”

Whereas Baker’s initial H 1 budget filing represented spending growth of 7.2 percent net for MassHealth, Sudders said the new projection is that state spending on MassHealth will increase 6.8 percent net over fiscal 2021. On a net basis — meaning only the state’s portion of the cost and not including the sizeable portion of MassHealth spending that is reimbursed by the federal government — the MassHealth appropriation would be roughly $6.9 billion, Cassel Kraft said.

MTF’s analysis suggested that much of MassHealth’s enrollment growth has been driven by members with a higher federal reimbursement under the Affordable Care Act, “which would offset cost increases by about $1 billion, before accounting for enhanced reimbursements.”

Based on the reimbursement levels from the first six months of the pandemic, MTF projected $546 million in additional revenue during the first half of fiscal year 2022 — enough to more than offset the additional costs, leaving House budget managers with about $100 million in additional revenue.

“Assuming MassHealth spending maintains a similar pace during the first 6 months of FY 2022, it means that Medicaid revenue will exceed additional costs by approximately $100 million,” the organization wrote.

The state budget ramifications of the extension of the federal public health emergency was one issue that MTF highlighted in its House budget preview, which focused on the ways the budget dynamics had changed in the roughly 10 weeks since Baker filed his recommendation.

“The combination of action at the federal level, changing assumptions on the state’s Medicaid program and the public health and economic response to COVID-19 all have altered the fiscal landscape for budget writers,” MTF wrote in its brief released Tuesday.

Two other issues highlighted by MTF — that detailed rules around the use of roughly $4.5 billion in federal aid to Massachusetts won’t be known until mid-May and that state tax collections are on pace to come in $1.45 billion higher than current projections and $419 million higher than the fiscal year 2022 assumption — suggest that the six-person conference committee that will inevitably be tasked with reconciling the House and Senate budget bills in late May or June will hold even more power than during a typical year.

“The challenges that face budget-makers in FY 2022 are certainly preferable to the fiscal challenges of a year ago, when the likelihood of catastrophic revenue loss and the potential of major budget cuts loomed, but no less monumental,” MTF wrote in its brief. “The House and the Senate will need to chart a fiscal course that uses significant, but temporary, federal funds in a manner that fosters a public health and economic recovery without creating a fiscal cliff down the road.”

MTF said it is “highly unlikely” that the House would next week adjust the underlying fiscal 2022 tax revenue assumption of $30.12 billion that Baker’s budget office and lawmakers agreed to in January. That would mean sticking with a revenue estimate for the next budget year that is less than the $30.539 billion the state is on pace to collect by the end of the current budget year. It would also assume a decline in revenue during a time that many economists are forecasting to be a high-growth period.

“An upgrade to FY 2022 tax revenues may ultimately be warranted, but any such adjustment should be delayed until income tax payments, now due in May, are known,” MTF said.

If lawmakers take MTF’s advice and wait until after May revenues are known to upgrade the fiscal 2022 revenue projection, it would mean the revenue base that the fiscal 2022 budget is to be built upon — and the revenue base that underpinned the budgets that representatives and senators voted on — would be changed, likely by a group of six lawmakers meeting privately, less than a month before the fiscal year is to begin July 1.

Even without changing the revenue base late in the game, lawmakers have struggled in recent years to have a budget in place by July 1, often opting for at least one month’s worth of a temporary budget instead.