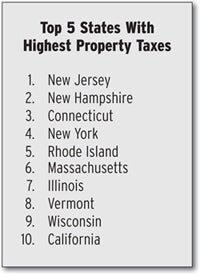

Massachusetts ranks 6th on a new list of property tax burdens ranked by the Washington, D.C.-based Tax Foundation using U.S. Census data.

In 2007, the state’s median annual property tax bill for owner-occupied homes was $3,328. That accounted for slightly less than 1 percent of the median home’s value and a little more than 4 percent of the state’s median income.

Regional Problem

Massachusetts has plenty of neighbors near the top of the list. New Hampshire ranked No. 2 on the list with a median tax bill of $4,390.

Connecticut has the third-highest property tax burden for homeowners. Its $4,332 median tax bill represents 5.2 percent of its residents’ median income. Rhode Island ranked 5th and Vermont was 8th. Maine came in at 21.

The state with the heaviest property tax burden for homeowners was New Jersey. The median annual property tax bill for owner-occupied homes in that state is $6,082, a whopping 7 percent of the state’s median income.

The state with the lowest tax rate is Alabama, which had a medain tax bill of just $352.

The Tax Foundation also broke out taxes by county. Middlesex County has the highest burden in the Bay State with a median property tax of $4,235. The priciest county, according to the Tax Foundation, is Passaic County in New Jersey where homeowners pay an average of $6,928.

In Worcester County the median property tax bill is $2,942.

The Tax Foundation compiled its report based upon the 2007 American Community Survey (ACS), which includes real estate taxes paid on owner-occupied housing units.

The Tax Foundation is a nonpartisan, nonprofit organization that has monitored fiscal policy at the federal, state and local levels since 1937.