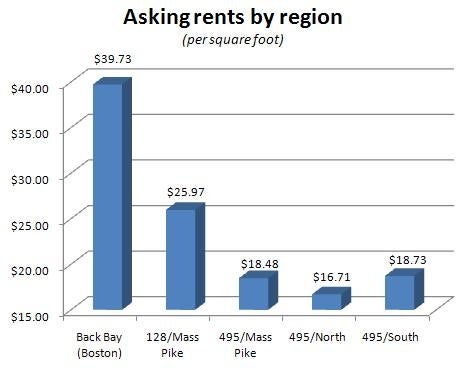

Vacancy rates remain higher and rental prices remain lower in MetroWest and across the Interstate 495 belt compared to other commercial real estate markets closer to Boston, according to the most recent quarterly market report from the Boston-based real estate firm Jones Lang LaSalle.

The commercial real estate market seems to be split into two types of markets, according to Lauren Picariello, vice president of occupier research for JLL in Boston.

There is a large disparity nationwide between areas where there has been economic growth and therefore the office market is robust, versus other markets where there is still economic recovery and “right-sizing,” she said.

“We really still have a two-tiered market,” she said.

That theme seems to be playing out in the MetroWest suburbs where vacancy are above 25 percent in some communities, well below the rates in Boston.

Signs Of Optimism

One other theme Picariello said she’s noticed is a “flight to quality” among tenants.

In a market slowdown, businesses recognize they have an opportunity to take advantage of lower rents at equal or better quality spaces. Some businesses look to upgrade the location or the quality of their spaces.

Therefore, in the top segments of the market, “conditions are pretty tight,” she said. The result is also that some “holes” can be left in the market for lower-quality office space.

That too seems to be happening in MetroWest, she noted.

Take the 495/Massachusetts Turnpike market, which includes the heart of MetroWest in Natick and Framingham. While the overall vacancy rate is 26.9 percent, the rate is only 21.6 percent for Class A office space, the highest-quality lease space. Meanwhile, in the rate for Class B space is more than 40 percent.

It’s also a tenant’s market, noted Picariello. Landlords, she said, are offering incentives to keep tenants in spaces or to get a deal done. These include rent abatement incentives or tenant improvement allowances.

“It’s all about leverage, and right now the tenants have it,” she said.

There is reason for hope. While the Boston market seems to be robust, Picariello said as the market recovers she expects decreasing vacancy rates and higher asking prices to eventually work their way into the MetroWest suburbs. There will likely always be a disparity between the two markets, but there is room for improvement in MetroWest, she said.

The 495/North region posted a 24-percent vacancy rate in the first quarter of the year, while 495/South area had a 28.6-percent rate. Meanwhile, that compares to a 26.9 percent rate for the 495/Mass Pike region and a 19.7-percent rate for 128/Mass Pike.