With high-potential inventory in Worcester drying up, investors in smaller multi-family properties are casting a wider net to find parcels with promise.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Coming out of the coronavirus pandemic, Greater Worcester was a hotbed of multifamily property sales, reaching $559.8 million in the second quarter of 2022.

After that flurry of activity raised prices and brought attention from far outside the region, the market has seemingly settled back to pre-COVID levels: The $102.8 million in sales in the third quarter of 2024 was similar to the average sales volume seen in quarters in 2017 and 2018, according to national real estate information provider CoStar.

While the pandemic-era frenzy of activity has subsided, there’s still value to be found for multifamily investors looking for deals in Central Mass., said Chris Collette, founder of the Christopher Group at Compass, which opened an office in Worcester in April.

“In Worcester, Fitchburg, and Southbridge, there’s stuff that you can't get in a lot of bigger cities,” he said. “In Boston, it's hard to find a three-family that needs a lot of work, as most of them have already been renovated.”

With high-potential inventory in Worcester drying up, investors in smaller multi-family properties are casting a wider net to find parcels with promise, eyeing cities like Auburn, Southbridge, Fitchburg, and Grafton with existing multi-family stock.

Worcester cooling

The viability of Worcester’s multi-family market inspired Collette to get in on the action a few years ago, a move that ended up being well-timed.

“I bought a three-family in 2019 and put about $ 100,000 in renovations into it,” he said. “I bought it for $300,000, so I'm into it for $400,000, and I sold it exactly two years later, almost to the day, for $600,000.

“If I had bought something two years ago now, I might have bought it for like $500,000, and it'd be worth like $650,000 now,” he said. “I bought one multi-family in 2019, I wish I bought 12.”

A number of factors are driving down the viability of the city’s current multi-family market, from climbing property taxes to the influence of out-of-market investors, said Brian Allen, owner of the WorcesterMulti real estate firm. He has been involved in 100+ multifamily transactions in the Worcester area since 2021 and has been involved in the local market since 1999.

“Someone from Boston comes out, and everything is so [relatively] cheap, so if they’re doing 1031 [tax] exchanges, they can get more properties or easier-to-manage properties,” Allen said, referencing a process where investors can defer capital gains taxes if they sell a property to buy a property of similar or greater value. “So Worcester has sadly become a bedroom community to Marlborough, Hudson, or even Framingham because you can’t support the rents here with wages you make in Worcester.”

While Worcester’s market is not as lucrative as a few years ago, savvy investors can still find deals that work as property values continue to increase. Allen has had some luck with pursuing off-the-market properties, and Collette is still seeing interest from outside Worcester.

“It’s a lot like inflation,” Collette said. “People say inflation is down, but that just means prices are going up, just not as much as they were. I still get a lot of ... referrals from Boston and other cities.”

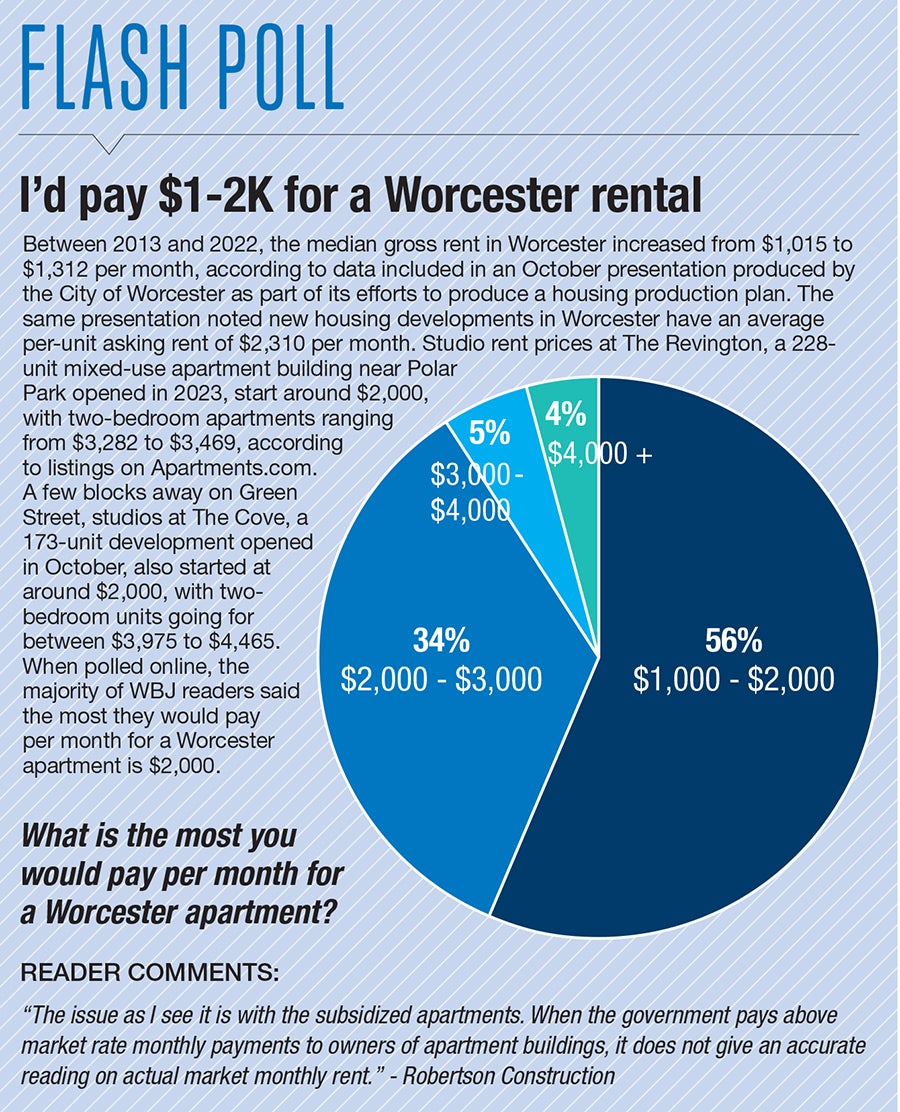

What was good news for existing property owners and well-financed investors can be bad news for budget-strapped renters and longtime Worcester residents, Collette said.

“I want people to have a place to live, and I think everybody should have a place to live,” he said. “Sometimes the city grows up around you.”

What made Worcester an ideal place to invest just a few years ago, said Collette and Allen, was the fact investors could see immediate returns with immediate cash flow via high rents and appreciation. Those days are over.

“Now in Worcester, you don't get cash flow. You're probably not going to get much appreciation, and … if you don't buy a good building, you have maintenance problems and you have tenant problems,” said Allen.

High-profile multifamily projects like The Revington and The Cove have sapped the market for tenants willing to pay higher rents in the city’s nicer triple-deckers, he said.

Old stock

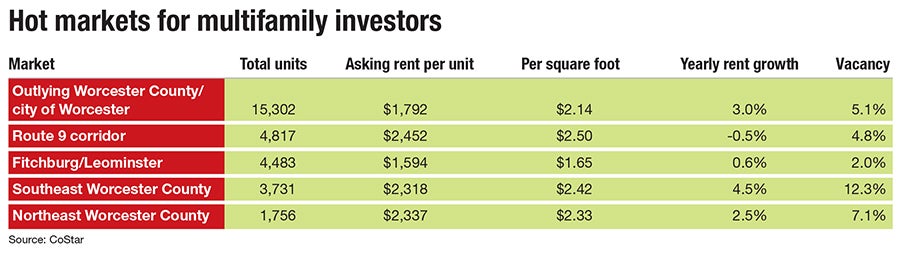

Despite a cooling off, Worcester and its immediate suburbs still account for a large majority of Worcester County transactions, according to CoStar.

Much of the city’s existing multi-family stock is of the one-star or two-star variety, defined as buildings needing renovation work or functionally obsolete.

About 56.9% of Worcester’s rental units are in buildings built before 1960, according to the U.S. Census Bureau.

Still, property owners are finding value in these types of properties; the average one-to-two-star apartment in Worcester draws an asking rent of $1,590, a 51.1% increase from 10 years ago and the same amount drawn by three-star apartment across the country.

Worcester’s colleges and universities have long supplied local property owners with a consistent supply of shorter-term renters. This remains true, although some degree of change may be on the horizon as more schools like Worcester Polytechnic Institute look to expand the amount of university-operated student housing, said Worcester-based RE/MAX Partners owner Jimmy Kalogeropoulos.

“A saving grace for Worcester is you can go to areas that are a little bit higher price point by Worcester State [University] or WPI, although I don't even know if that's true anymore,” he said.

East and west

Collette has seen demand for single-family and owner-occupant multi-family properties to the east of Worcester, where young professionals working closer to Boston can still enjoy the amenities of the city without having to navigate through the city on their morning commutes.

“Most of those folks say to me they don't care as much about being in downtown Worcester, because they're commuting east.” he said. “The Worcester area works for them, so they almost all buy in Holden, West Boylston, Shrewsbury, and Grafton.”

Communities to the west of Worcester have less existing multifamily stock, with only 24.4% of Leicester’s 4,371 being in multi-family buildings. When a property can be found, buying in these areas can have its advantages, said Collette.

“You buy an old Victorian that was turned into a four family in a place like Leicester, and you buy it for like $450,000, you can have cash flow on day one, pretty good money,” he said. “The rents are almost as good as Worcester, but the building is cheaper.”

The drawback to that strategy is less financial appreciation than you would see in a place like Worcester, he said.

North and south

Kalogeropoulos sees potential in Worcester's immediate south.

“I really like Auburn a lot. It has a decent multi-family stock, not big multi-families, but two- and three- [bedroom units]. I think it’s a hidden gem. It’s got everything you need: excellent school system, great highway access, restaurants,” he said. “It’s a great place to buy.”

Further south, Southbridge has seen at least two dozen multi-family transactions in 2024, with investors taking interest in its existing stock of smaller multi-family units, which once housed the area’s mill and factory workers. About 44% of Southbridge’s 7,478 housing units are in two- to four-family buildings, according to data from the Metropolitan Area Planning Council.

Sales have ranged from two-unit houses to large complexes to a 116-unit housing development sold for $7.1 million, a deal where Kalogeropoulos represented the seller.

However, Kalogeropoulos doesn’t see it as a strong market, particularly due to the local school system’s eight-year-long state receivership and flat population.

Southbridge is about equidistant from Hartford, Providence, Worcester, and Springfield, but census data doesn’t indicate out-of-town renters are moving there in significant numbers yet.

“The sales we’ve seen in Southbridge were high-water points,” he said.

Sales in Southbridge have been inflated by one landlord, Michael Kline of Needham, who has sold at least 19 properties in the last 12 months.

If Southbridge’s school system can escape receivership, the market might have more long-term potential, said Allen, with Fitchburg also showing promise.

“Southbridge is an up-and-coming market because, you know, it has all the infrastructure,” he said. “Same with Fitchburg, those markets do okay. There's just not the number of units.”

Collette sees promise to the north, where Devens is attracting potential tenants with high-paying jobs.

“The multifamily market in particular in Fitchburg is getting hotter,” he said.

Eric Casey is the managing editor at Worcester Business Journal, who primarily covers the manufacturing and real estate industries.