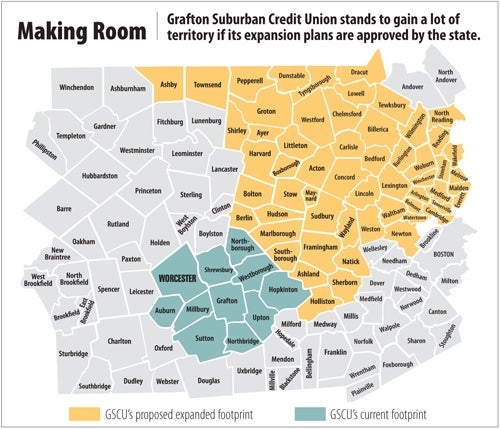

Grafton Suburban Credit Union, an institution with about $114 million in assets and more than 11,000 members, is asking the state Division of Banks to allow it to draw members from all of Middlesex County, instead of the small 11-town region surrounding Grafton.

Specifically, GSCU is limited by its charter to serve people who live, work or conduct business in the following communities: Grafton, Auburn, Hopkinton, Millbury, Northbridge, Northborough, Shrewsbury, Sutton, Upton, Westborough and Worcester. An expansion to all of Middlesex County would allow the credit union to market itself to people in 53 new communities.

However, don’t expect to see a bunch of GSCU signs popping up along communities along Interstate 495. The credit union has “absolutely no branching plans for Middlesex County,” according to CEO Edward Lopes.

Instead, it wants to overcome the geographical restriction placed upon it by its state charter in order to do business online with folks from Middlesex County.

The public comment period on Grafton Suburban’s application closed in late January, and Lopes expects a final decision in the next two weeks or so.

“We’re trying to get a little more contemporary,” Lopes said.

Geography Matters

Grafton is very close to the western border of Middlesex County near Hopkinton, Holliston and Ashland. Increasingly, credit union members and bank customers are banking online and rarely setting foot inside a branch office.

And credit unions are “marketing to consumers online, and once you do that, it’s difficult to tell the guy who’s eight miles away that you can’t serve him,” Lopes said.

Grafton Suburban has also asked the DOB for permission to close its South Grafton branch office.

Lopes said the concentration on online efforts didn’t necessarily have anything to do with the branch’s closure, but it wasn’t going to help that branch, either.

The South Grafton branch claims about $9.5 million in deposits, but a branch of that size that’s part of a credit union the size of Grafton Suburban ought to be holding about twice that in order to cover its costs, Lopes said.

Capital investments, South Grafton-specific promotions and incentives for employees didn’t work. Somehow, members just didn’t think that branch was “relevant,” Lopes said. Grafton Suburban’s main office is just three miles from the South Grafton branch. So, the decision was made that it should close.

And with its move online, the situation for the South Grafton branch would’ve become worse.

“All of your online business comes into where the technology resides, which is the main office,” Lopes said. “And we didn’t think we could build South Grafton if we were changing the business model.”

There could be a day in the not-too-distant future when credit unions and banks cut down on the number of branches they operate in favor of online operations.

Kristen Carvalho, president and CEO of Milford National Bank & Trust Co., isn’t ready to tear down seven of the bank’s eight offices, but agreed that “the climate now is really a challenge to deliver goods and products and services, and that’s what everybody’s doing, that’s what the whole industry is moving toward.

“Mortgages, car loans, you get instant approval. It’s taken leaps on the technology side, and previously, banking wasn’t really tech savvy,” Carvalho said.