Compliance Management Group (CMG) found itself in a pinch last year when Hewlett Packard announced that it was shuttering its Marlborough campus, where the company had been renting space for its product-testing business.

CMG’s revenues were coming in below expectations following the purchase of a smaller, similar Marlborough business in 2009, according to Eric Wilbur, CMG’s president. At the time, CMG did not have the capital to cover up to a month of delays caused by a move to a new facility.

Wilbur needed money to get his company and its 16 employees over the hump, but he said the bank couldn’t help.

“Our revenue numbers weren’t coming in as good as they should have for a bank to consider giving us the money,” Wilbur said.

Financial Savior

Enter the Massachusetts Growth Capital Corp. (MGCC), which issued CMG $245,000 in credit.

Wilbur said the money helped him avert staffing cuts during the company’s transition to its new facility on Simarano Drive in Marlborough. And despite a month-long blip in production, the company still hit its first-quarter projections.

“They were our white knight,” he said.

And CMG isn’t the only firm to get help in Central Massachusetts.

Uxbridge-based EMX Controls and Worcester-based Acclaim Home Health Care received $750,000 and $100,000, respectively, from MGCC to help with expansions.

The MGCC has issued a total of $7 million to 28 companies since it was created last year, said Charles Grigsby, interim president at the MGCC.

Grigsby said that bank regulators have tightened lending requirements and the effects are starting to show in the wake of the recession. Companies that have received credit in the past but then lost money in the previous year may not receive a loan, he said.

Grigsby said that the fund can help businesses like CMG as well as companies in other situations.

“Sometimes getting over that hump is the issue, sometimes because the company had losses last year the bank can’t extend the credit, or sometimes the owner has a bad FICA score,” Grigsby said.

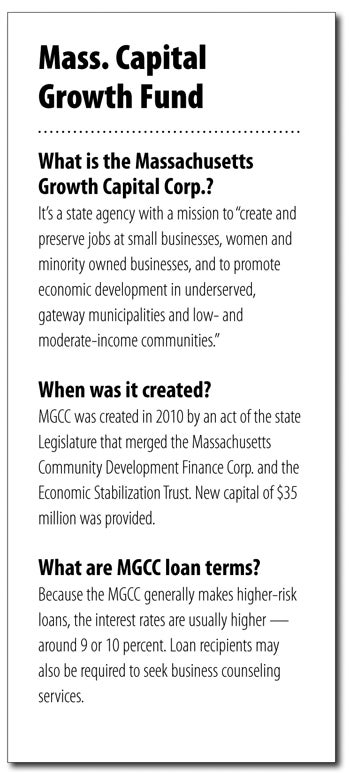

The growth fund was created last year after the Legislature voted to merge two similar quasi-public funds.

Since the exposure is higher for the MGCC than for other business lending programs, such as the Small Business Administration, the interest rates are higher, usually between 9 and 10 percent, Grigsby said.

Unlike a bank, the MGCC offers — and in some cases requires — business counseling to accompany a loan. He said banks cannot legally give such advice.

“Not all entrepreneurs are good managers,” he explained.

The fund started last year with $35 million but could hit the $92-million mark by 2013, he said, thanks to state and federal contributions.

Grigsby said that the state will issue a $20- million bond for further funding. The MGCC is also applying for a federal small business credit initiative worth $22 million.

Grigsby said that the fund will likely make money from its annual operations, but predicted that the fund will likely break even over the next eight years.