For communities that have welcomed recreational sales, this newly created industry and the sales associated with it have been a boon for their municipal budgets.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

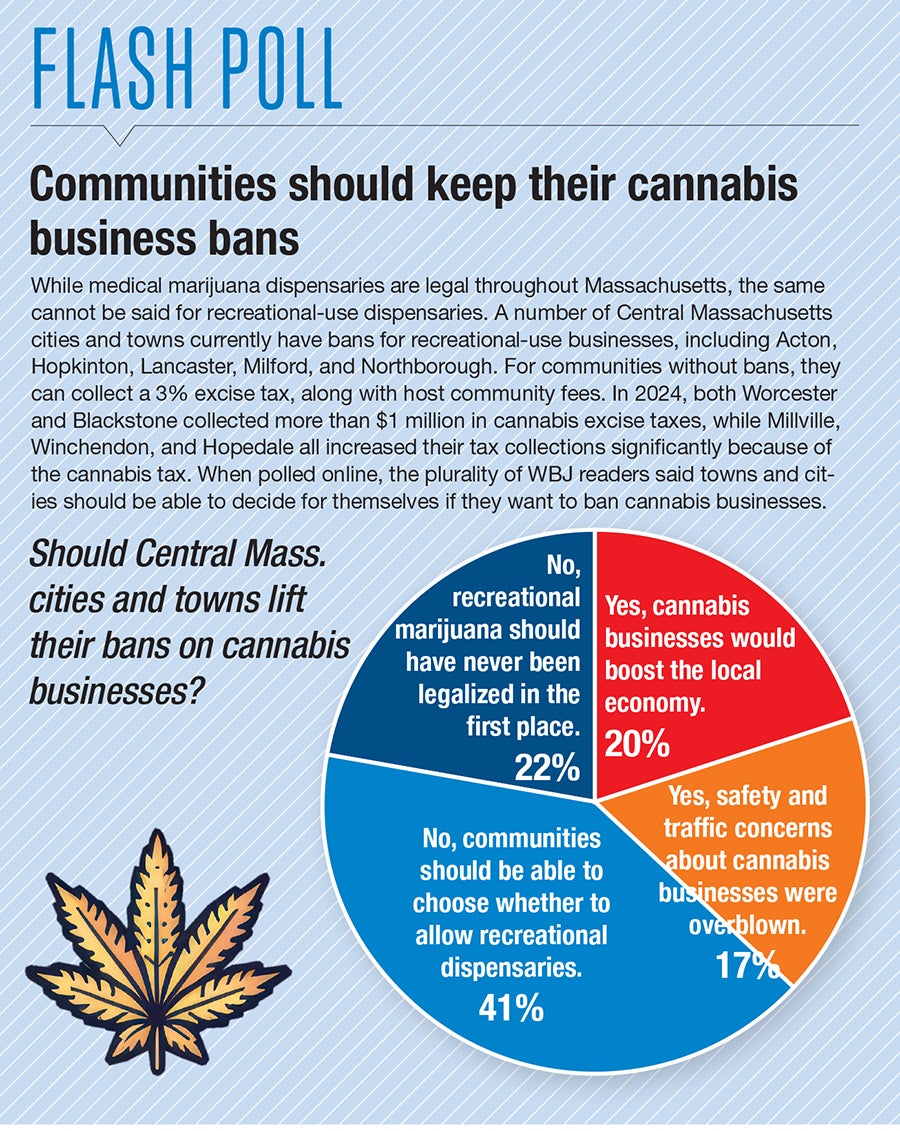

In November 2016, the majority of residents in 48 of the 60 municipalities in Worcester County cast votes in favor of legalizing cannabis for recreational use at the state level, as a successful ballot initiative eventually led to the state’s first legal adult-use cannabis sale almost exactly two years later.

Some communities, from the county’s largest communities like Worcester to smaller towns like Blackstone and Winchendon, decided to pass local ordinances allowing for adult-use sales to take place in their communities. Others, including Acton, Southborough, and Westborough, decided to prohibit adult-use dispensaries from setting up shop within their borders.

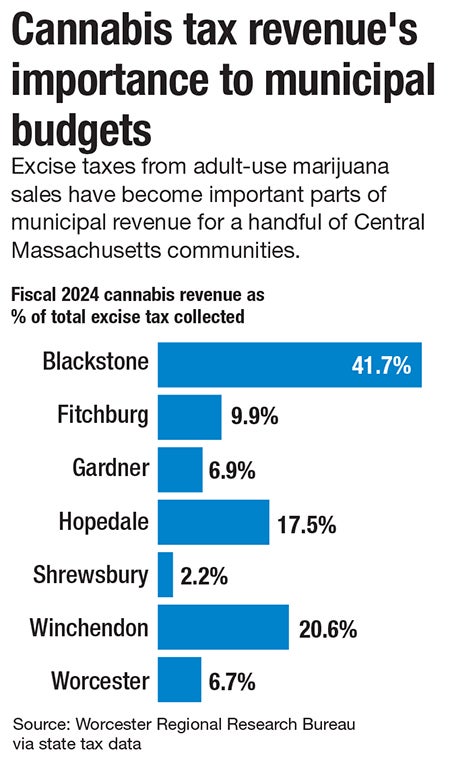

For communities that have welcomed recreational sales, this newly created industry and the sales associated with it have been a boon for their municipal budgets, as state law allows for municipalities to collect up to 3% in local taxes on cannabis sales.

“Having a few hundred thousand dollars from cannabis is a help to us,” said Bill McKinney, town manager for the Town of Winchendon.

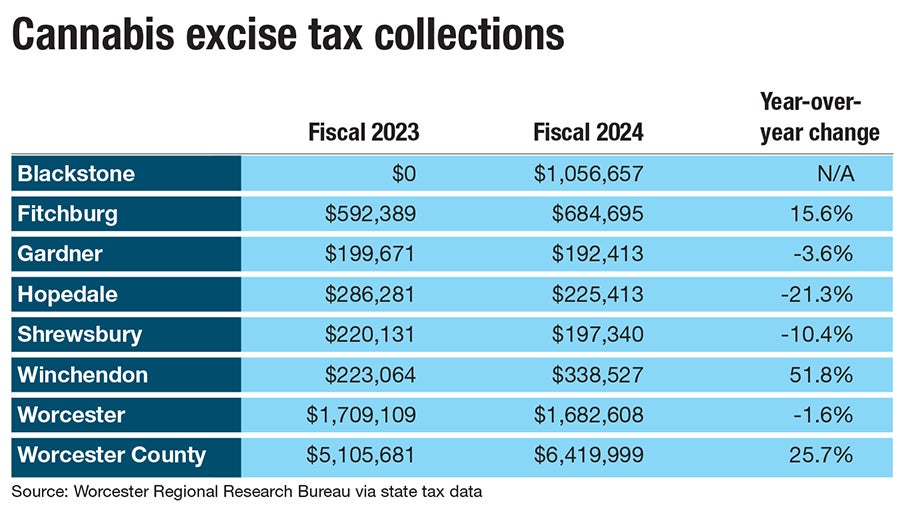

The 22 Worcester County municipalities that hosted recreational marijuana dispensaries in fiscal 2024 brought in a combined $6.42 million in local cannabis taxes, up 25.7% percent from fiscal 2023. This data was compiled by the Worcester Regional Research Bureau using state revenue data as part of a joint project with Worcester Business Journal examining the impacts of the legal cannabis industry.

“Our overall picture of ourselves as an industry is that we’ve had a positive impact on local communities without any of the negative impacts that were perceived when we first started getting these licenses,” said Ryan Dominguez, executive director of the Massachusetts Cannabis Coalition.

Large communities with lots of dispensaries like Worcester and smaller towns near the state’s borders are bringing in solid chunks of cannabis tax money, but some municipalities have seen declines in the overall amount of cannabis tax revenue coming in.

With increased industry consolidation and competition from neighboring states, there’s a chance some cities and towns have already seen the high-water mark of revenue to be extracted from legal cannabis sales.

Brought to you by Worcester Regional Research Bureau

Just over the border

Even as the industry is struggling throughout Massachusetts, cannabis businesses near state borders have been thrown a lifeline: Out-of-state shoppers.

Cannabis remains illegal for recreational use in New Hampshire, as the state’s legislature shot down an attempt by then governor Chris Sununu to legalize sales through government-run stores in 2024. Legal weed in New Hampshire seems less likely under the new Gov. Kelly Ayotte, who has spoken out against legalization and frequently enjoys using the more liberal Massachusetts as a proverbial punching bag.

Connecticut and Rhode Island legalized recreational cannabis in 2021 and 2022 respectively, but a mix of more stringent regulations and a less robust marketplace has led some consumers in those states to make the trek north to make their purchases.

“Our regulators and our elected officials don't like to talk about [out-of-state cannabis shoppers] because it kind of gets into a messy situation around interstate commerce,” said Dominguez, referencing the fact that cannabis is still illegal at the federal level and bringing any amount over a state border is, by the letter of the law, interstate drug trafficking. “But our border towns are highly dependent on those sales.”

This has been beneficial for dispensaries in the northern and southern ends of Worcester County, as relatively small municipalities like Blackstone and Winchendon have brought in sizable amounts of local cannabis taxes.

Blackstone, population 9,208, has two dispensaries in town, both within 2,000 feet of the Rhode Island border.

The Town of Blackstone government brought in $1.06 million in cannabis excise tax revenue in fiscal 2024, a significant part of its overall $33 million municipal budget. Blackstone was second only to Worcester for cannabis excise tax collections among Worcester County communities.

Sharing a border with New Hampshire, the Town of Winchendon government and its population of just over 10,000 brought in $338,527 in fiscal 2024 from its two dispensaries, a 51.8% increase from 2023.

This suggests the town’s two dispensaries, Bud Barn and Toy Town Health Care, brought in about $11.29 million in sales during fiscal 2024, equaling about $1,089 per resident.

As a community with limited business opportunities, which relies heavily on state funds to fund its $35-million municipal budget, the cannabis industry has been a benefit to the Town’s coffers, said McKinney, the town manager.

“That's a significant amount of money that helps, because like a lot of towns, we're going to need an override,” McKinney said of the cannabis revenue, saying it's playing a role in combating increasing municipal expenses like health care.

When the 2016 ballot initiative legalizing recreational marijuana was being debated and later as dispensaries were proposed in specific communities, one of the arguments against them were potential negative impacts on the community. Yet, from McKinney’s perspective, hosting two dispensaries has mostly been smooth sailing for the town.

Aware of some of the industry’s struggles, he’s not taking the additional revenue for granted. For this fiscal year, he projected around $140,000 in cannabis revenue.

“I wouldn't want to bank on $300,000 plus a year and bake it [into the budget], because then if the industry continues to consolidate, or prices continue to drop, or one of [the stores] closes, I don't want to count on that,” McKinney said.

For prospective consumers, either north or south of the border, McKinney’s sales pitch is simple.

“If they’re looking to buy marijuana, they should come to Winchendon,” he said.

Worcester cannabis tax revenues falling

Considering its large population and 13 active recreational dispensaries, perhaps it shouldn’t be a surprise Worcester leads the county in terms of overall local cannabis tax revenue.

However, Worcester’s dispensaries have seen the revenue they are bringing in decline over time, as more retailers have opened in nearby communities and the health of the industry has been called into question; The City of Worcester collected in $1.69 million through local cannabis excise taxes in fiscal 2024, down 11.9% from a peak of $1.91 million two years prior.

The city has already seen one cannabis retailer shut its doors for good, as Florida-based cannabis giant Trulieve closed its dispensary adjacent to George's Coney Island Hot Dogs at 142 Southbridge St. in the summer of 2023.

Since then, no new recreational dispensaries have opened in the city. Corner Emporium, a retailer with a site at 40 Jackson St., is planning to launch sometime in 2025 after a four-year effort to open its doors.

Even with a potential new dispensary, it’s possible Worcester’s cannabis tax revenue will face further decline.

Alex Mazin, president and CEO of Bud’s Goods, a brand of dispensaries with a location at 64 West Boylston St. in Worcester with additional stores in Abington and Watertown, said the industry is facing a wrath of closures if conditions don’t improve.

He cited a combination of strict regulations and lackluster enforcement from the state’s embattled Cannabis Control Commission, creating an environment where some businesses are choosing to prioritize profits over compliance in an effort to keep their lights on.

Compounding the problem is an industry norm of allowing other businesses to buy products on credit, a habit which has allowed some operators to simply avoid paying their bills, causing a knock-on effect as some businesses wait to be paid so they themselves can pay other businesses they owe money to.

All of this has created an environment where the most ethical businesses are often the ones who suffer the most, Mazin said.

“Most operators are really trying their best, and that's what's upsetting,” he said. “People who follow the rules can't compete.”

Eric Casey is the managing editor at Worcester Business Journal, who primarily covers the manufacturing and real estate industries.