After demand for its services led to almost unreasonable wait times at its two Worcester branches, Digital Federal Credit Union opened a third location in the city in November, where the staff has been busy educating people out of bad financial messes.

This uptick in demand at all three DCU locations – on Tobias Boland Way, Shrewsbury Street and Gold Star Boulevard – is a heightened reaction to the financial illiteracy problems Scott McCarthy saw when he was managing the DCU branch in Framingham. People in that town, especially members of the foreign-born population, had a tough time telling the difference between a scam and a good financial deal.

“One person had an auto loan of 300 percent. He had to drive to New Hampshire to make his car payments,” said McCarthy, who manages the new DCU location on Tobias Boland Way. “They had no idea we could give them good credit advice.”

Serious financial knowledge gaps exist in Massachusetts across all age groups, according to a state-sponsored study in December on financial literacy across the commonwealth entitled “A Roadmap to Economic Empowerment.” Massachusetts adults don’t have access to the earning power, information and services they need to save for retirement, and because of this they find themselves juggling saving for their own retirement with supporting older family members and helping their children pay for college.

In Worcester – with its large immigrant population and a median household income 30 percent lower than the state average – those problems are exacerbated, giving businesses like DCU the opportunity to educate those people and attract them to credit union products that will give them good financial health.

Because Worcester is classified as an underserved community by the National Credit Union Association, potential members don’t need to have a business affiliation to join, McCarthy said. DCU established an education center in Worcester because of demand it saw for financial literacy.

“It’s amazing that we can help people in this way,” he said. “We wanted to do this, and Worcester was the logical place to do it.”

Literacy push

Credit unions have always been focused on enhancing financial literacy in the communities they serve, especially since the financial crisis, said Paul Gentile, president and CEO of the Cooperative Credit Union Association, which serves Massachusetts, New Hampshire and Rhode Island.

“This whole consultative approach is becoming more critical for credit unions as we help people with financial wellness,” Gentile said.

Financial challenges disproportionately affect low-income populations, immigrants, senior citizens, veterans and women, according to the state-sponsored study. Immigrants who come from countries with corrupt banking systems are often hesitant to get involved with traditional financing products, especially since information about financial literacy isn’t always readily available in multiple languages.

Senior citizens, on the other hand, face an asset gap due to increases in the cost of living over their lifetime. The study reported that 63 percent of senior citizens can’t meet their basic economic needs, and that number is higher for African-American senior citizen households (81 percent) and for Latin Americans (91 percent).

Worcester has a large immigrant population – 21 percent of the city’s population is foreign born, according to a study from the Seven Hills Foundation, and many of these immigrants, especially those who hail from Latin America, have low English proficiency and are therefore more susceptible to credit-related scams.

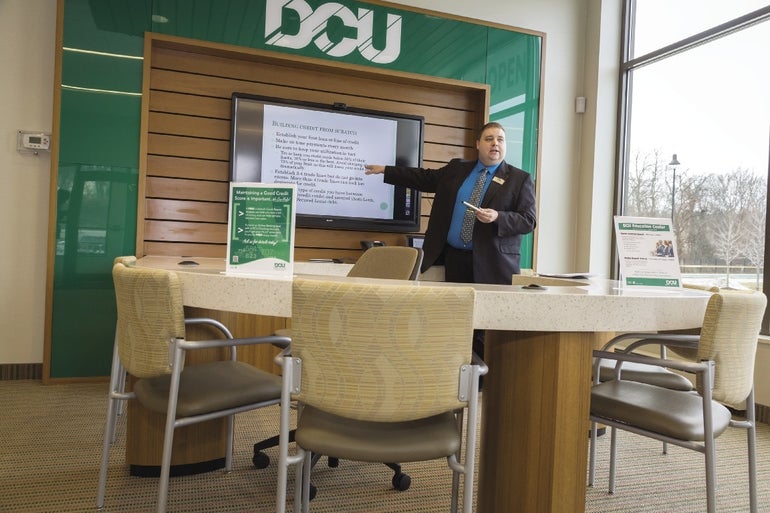

Currently, the new DCU branch in Worcester is holding a seminar on mobile banking, as well as a mobile deposit tutorial. In the front of a seating area, there is a touch-screen television, which allows presenters to make notes on slides as they go. The screen is also compatible with iPads, which can be used to demo services like mobile check deposits. Within the next few months, McCarthy said he hopes to hold an introduction to credit seminar and classes on home buying, basic banking and scam prevention for the elderly.

DCU plans to remodel its Littleton branch in a similar way this summer.

What DCU is doing is a step in the right direction towards people making better informed financial decisions, Gentile said.

“They’re on the lead of an emerging trend, now more and more people are trying to take that community education approach,” Gentile said. “They should really be credited for investing in the community there, it’s an investment in the community. I would hope to see more of that as we move forward – that’s what we need.”

Industry-wide effort

Other credit unions are committed to expanding financial literacy. Seven years ago, Ingrid Adade was the manager of the Clinton High School branch of Leominster Credit Union. After the recession hit, Adade said she was inundated with questions about money management from students.

“They didn’t know what a recession was – they had studied about a depression in history class – the school was small enough … [they would ask], ‘What is a recession?’ ‘What is a foreclosure?’ ‘Is it true that your electricity should get turned off or disconnected every month or every other month?’” Adade said. “It’s just more or less students trusted us to be able to ask those questions.”

Realizing a need for better financial education in the schools, Adade went to the superintendent and drew up a curriculum for an accredited financial literacy class. Today this class is offered at Clinton High School and at Wachusett Regional High School, where Leominster Credit Union also has a branch. Interested students can take the class as a prerequisite to a summer internship at one of the on-campus branches.

Worcester Credit Union has a similar partnership with Worcester Technical High School. Since opening its branch at the high school 10 years ago, the credit union has trained more than 100 students, taken about 25 percent of them as part-timers and hired five students as permanent employees.

Student tellers have become Worcester Credit Union’s primary source of new employee tellers, said Karen Duffy, the credit union’s president and CEO. Duffy said financial literacy should be a high school graduation requirement.

“Financial literacy is a popular topic in banking and in education today, and it really refers to exposing young people and unbanked populations to the benefits of using basic, no-fee bank accounts and services as opposed to using alternatives like check cashing stores, which charge high fees,” she said.

At LCU, Adade is now the de-facto financial literacy specialist, and travels throughout Central Massachusetts to work with everyone from pre-kindergarteners to college students to senior citizens on how to manage their money.

“Financial literacy and education really has become sort of our main cause in working with our community,” said Janet Belsky, vice president of marketing at LCU. “An educated public really has the best opportunity for success. We want to make sure we help people get there.”

Spreading awareness

Even though financial literacy gaps exist, there are a lot of programs in place across Massachusetts, meaning part of the challenge of improving access is letting people know what’s already out there, the state’s study said.

The study recommended expanding awareness of certain existing tools, such as the Massachusetts Community Banking Council’s Basic Banking Tool, which identifies state-chartered banks with low-cost banking products. It also recommended working with the Office of Refugees and Immigrants to make it easier for immigrants to understand the complex banking system in the U.S.

When McCarthy’s new branch opened, he visited the Walmart next door to introduce himself to the management. During his visit, he was surprised to see about 75 percent of people in line for customer service were there to do their banking, he said.

“We need to make sure people can do banking and build credit,” he said. “Our goal is to help people.”