There have been some bright spots, but vacancies and empty pad sites remain.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Five years ago, Central Massachusetts seemed destined for a life science real estate boom, as developers across the region rushed to gain approvals for new construction in an attempt to keep up with growth.

From Devens to Worcester, life science pad sites were being prepared with haste on speculation, as the region’s business and political leaders expressed hope the growing local industry could play a role in defeating the COVID-19 pandemic and developing breakthrough cures for diseases.

Fueled by new construction, which was attempting to catch up to unprecedented demand and investment in the midst of the pandemic, vacant life science space has now become a common sight in Massachusetts. External headwinds of higher interest rates, a slowing economy, and simmering geopolitical tensions have impacted expected growth of the space, according to the 2024 U.S. Life Sciences Outlook produced by Texas-based commercial real estate firm CBRE.

This is particularly true in Boston and Cambridge, where the life science vacancy rate sits at 30% and 18.8%, according to Colliers. Overall, the state’s life sciences vacancy rate sits at 24.5%, a stark contrast from the third quarter of 2021 where the rate was hovering just about zero.

While both the presence of the industry and vacancy rates are smaller in Central Massachusetts when compared to the global hub of Greater Boston, the region’s prospects haven't been able to escape these trends.

There have been some bright spots, and industry experts still feel the region is well-positioned to capitalize on the eventual recovery of the sector, but a sizable chunk of allocated life science space created during the boom remains unutilized.

Real estate slowdown

In 2020, Boston-based King Street Properties purchased 45 acres of land for a biolife-focused advanced manufacturing facility in Devens. It invested more than $1 billion in the five-building site, hoping to entice potential tenants with lower cost than those seen closer to Boston and the ability for the quasi state agency MassDevelopment to streamline project approvals.

Of the five buildings, three are leased, with Azzur Cleanrooms on Demand being the first to ink a lease in May 2022, according to a press release from Boston-based commercial real estate advisory firm The Stevens Group.

Filling the 311,000 square feet of space in phase two of the development has been proven a larger challenge in the years since, with two of the sites remaining unleased, according to King Street’s website.

King Street declined to comment for this story.

A similar slowdown has happened with new life science construction in Worcester, with projects near Polar Park and at The Reactory biomanufacturing campus frozen in time.

The Reactory is a 46-acre campus comprising former Worcester State Hospital land, which was first earmarked for biolife uses in 2016 after the then Gov. Charlie Baker Administration formed a task force to revitalize the hospital campus.

One of the anchors of The Reactory is supposed to be a 90,000-square-foot building from Webster-based developer Galaxy Life Sciences. Today, the site still sits as it did in January 2021, with a concrete slab poured and a small portion of the building’s steel structure erected.

Galaxy told WBJ in early 2023 it would wait until it finalized tenants before building out The Reactory. Galaxy directed a WBJ inquiry to Andrew Sherman and Phil DeSimone of Worcester real estate firm Kelleher & Sadowky, who said they continue to field calls from firms interested in the parcels. The Reactory is not exclusively earmarked for biomanufacturing, allowing for potential pivots if clients don't end up materializing.

Waiting on WuXi

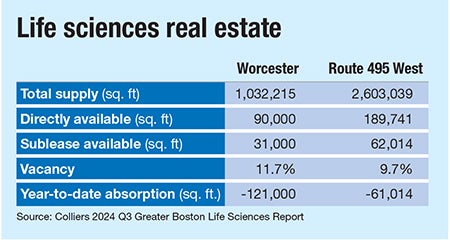

Despite some new construction and pad sites that have gone unused, Central Massachusetts is in a better position than the Greater Boston area, said Jeffery Meyers, a research director at the Boston office of Canada-based investment management company Colliers.

“If you are comparing it to other parts of the Greater Boston area on the supply side, if you're in Worcester, around [Interstate 495], and a lot of those submarkets, the construction pipeline just isn't as scary as it is in places like Somerville or the Seaport,” he said. “Vacancies in the 495 market went from zero-ish to 1% back in 2021 or 2020 to up to about 10% now. So they’re up, but compared to the 24.5% we’re seeing across the entire market, that’s actually pretty healthy.”

While other nearby Reactory pads are still idle, one parcel has seen activity: The site of WuXi Biologic’s $300-million, 189,500-square-foot biomanufacturing facility.

The China-based company’s first manufacturing facility in the U.S., WuXi’s plans for the site have expanded since it was first proposed for The Reactory in 2018, fueled by what the company said was increasing demand from its global clients.

After announcing further expansion plans in January, WuXi paused work at the facility around June. The company did not disclose a rationale for the decision, but the pause coincided with Congress’ consideration of the BIOSECURE Act, a bill which sought to block foreign life science firms from accessing federal funds or working with American firms as manufacturing or trial service providers. The bill, which specifically cited WuXi as one of the firms it was targeting, passed the House of Representatives in September.

Construction resumed sometime around the beginning of December, as the legislation has since been languishing in the Senate, where it faces an increasingly dismissing chance of passage before the end of the session.

First expected to become operational in 2022, WuXi’s latest update on the facility indicated the company plans for it to come online in 2025.

The silver lining

Despite all not going exactly as planned with projects like The Reactory, the region is well-positioned to benefit from the recovery of the life science sector, said Jon Weaver, president and CEO of Massachusetts Biomedical Initiatives in Worcester.

The longest-running life sciences incubator in Massachusetts, Weaver said MBI continues to be impressed by the resilience of the market for startups in Central Massachusetts, with its available space still being a hot commodity. The nonprofit’s Pilot Biomanufacturing Center opened in October 2023 and is 90% full.

There’s been a slight slowdown in demand for early-stage space, but that might actually be a good thing for MBI, said Weaver.

“We were in a place where we were filling [early-stage] labs after 14 days,” he said. “One company would move out, and then the next company would move in two weeks later. It was red hot. Now it’s normalized to somewhere around 60 to 90 days, which is probably a healthier place to be.”

Over the long term, Central Massachusetts still offers life science firms with the access to future employees from the region’s many higher education institutions and cheaper costs than those seen closer to Boston. The region has 10 municipalities, including Worcester, which have been given a platinum rating from the Massachusetts Biotechnology Council, indicating a large amount of shovel-ready sites and active efforts by local regulators to woo biotech uses.

One of these platinum municipalities is Framingham, which in July successfully convinced Cambridge-based KalVista Pharmaceuticals to move into a space at 200 Crossing Blvd., which is three times as large as its former headquarters.

Another platinum-ranked community is Marlborough, which has largely weathered current market conditions well, said Meredith Harris, executive director of the Marlborough Economic Development Corp.

The former bedroom community has had success in attracting and retaining life science firms, from massive figures in the sector like Moderna and Sartorius to first-stage newcomers like LoopCO2, a company seeking to turn carbon dioxide emissions into a number of eco-conscious products. The company from MBI’s incubator moved to Marlborough in August.

A lot of that success comes down to being a welcoming municipality able to supply the basics, said Harris.

“A lot of it has to do with access to, you know, the unfun stuff, but water, sewer, that type of infrastructure is really important for those companies; and we have that,” she said. “Marlborough is a business-friendly community. We are able to go out and talk to the companies and offer incentives and try to work with them to get things like expedited permitting, or answers to questions that they might have at a state level.”

In late November, Sartorius opened a $90-million, 63,000-square-foot Center for BioProcess Innovation in Marlborough. The center aims to provide space for customer demonstrations and training with the goal of increasing collaboration with customers and other external partners, a fact which could draw even more life science attention to Marlborough.

Harris said the success of larger firms in the city has helped encourage startups like LoopCO2 to locate there.

Smaller firms “want to be near those larger companies that are making the larger investments,” she said. “Obviously, if Boston Scientific or Moderna can find the workforce and find the talent that they need, I think that gives confidence to the smaller companies that they'll be able to survive here.”

Worcester versus the world

Looking through the long-term lens, it’s hard to imagine global demand for life science services will diminish anytime soon. Fears of the next pandemic, from the lingering threat of bird flu to the mysterious Disease X outbreak in Central Africa, serve as reminders for the need for the life science industry to have the capacity to respond quickly to new health hazards.

There’s some indication venture capital is returning, as the industry saw a nearly 30% increase in funding in the first half of 2024 compared to the same period in 2023, according to a report from Washington D.C.-based real estate services firm Gallagher & Mohan.

In addition to medical-related innovations, life science companies like LoopCO2 have been putting more focus on other bio-derived materials, which addresses global issues, including cleaner fuels and agricultural-focused products.

While the industry’s recovery won’t be uniform across the country’s various hubs, Central Massachusetts is in a good position to take advantage of domestic biomanufacturing opportunities, said Meyers of Colliers.

“If you're looking at some of the biomanufacturing opportunities that's going to be the exclusive domain of areas where you have the land, where you have those pad-ready sites, and the ability to actually accommodate that demand,” Meyers said. “The structural location of those places still in reasonable proximity to the research that may be taking place in Boston is still very much a benefit.”

The biomanufacturing angle here in Central Massachusetts is already playing out. The Massachusetts Biotechnology Council’s 2024 Industry Snapshot showed Worcester County as the only county in the state where biomanufacturing employment grew between 2022 and 2023.

While beating Boston in that regard is good news, Weaver said the region must realize it’s competing against a much wider playing field for future biomanufacturing jobs.

“This is really Worcester against the world,” he said. “We are competing on a global stage against other countries and states that are trying to get into this biomanufacturing market. So we as a region and community need to come together and put as competitive of a package together as we can, so that when a company is looking at North Carolina or Pennsylvania or any of our competing geographies, they look at Worcester and they say, ‘Wow, that's the place you want to be.’”

Despite the global slowdown, Weaver said the region’s affordability and access to talent still makes it a top place for firms to locate when activity picks back up.

“We're focused on preparing the cities in the region, so that when this next cycle does pick up, we are as ready as we can be to really launch and take off,” he said.

Eric Casey is the managing editor at Worcester Business Journal, who primarily covers the manufacturing and real estate industries.