When it comes to job creation, the good has outweighed the bad in the state’s manufacturing sector since June.

The sector gained nearly 3,000 jobs in July, according to the state Office of Labor and Workforce Development, after losing 300 in June and adding 400 in May.

Overall, manufacturing employment grew by about 3,000 in the first three quarters of the year, according to IHS Global Insight, a Lexington-based economic research firm.

But while statistics indicate that the sector is ahead of the curve when it comes to emerging from the recession, experts warn that its position is tenuous and a return to employment levels of even 10 years ago is highly unlikely.

“For both the state and the U.S., a lot of the pick-up in hiring we attribute to the inventory cycle,” said Michael Lynch, an economist at IHS. “When manufacturers anticipate good business conditions, they’re more inclined to have stuff on hand. When things are bad, they have a very lean supply. If they’re overly pessimistic, they get very, very lean and at any hint of a pick-up, they respond very quickly and hire just to get inventories back up,” Lynch said.

That may be what’s been happening in the last few months in Massachusetts, and Lynch said it’s certainly not enough to reverse the generations-long decline in the state’s manufacturing sector.

Rust Belt

In the short term, “we still have a relatively weak underlying economy that’s just going to drag on the sector through the end of the year,” Lynch said. Hiring will pick up as the economy gets better and demand increases, but many companies that are hiring “are responding to overly excessive cutbacks” made in the throes of the recession.

Overall, Massachusetts is part of a larger New England manufacturing phenomenon in which manufacturing jobs that are lost simply don’t come back.

Andre Mayer, a senior vice president at Associated Industries of Massachusetts, noted that many Massachusetts manufacturers aren’t simply behind the times, “they’re here because this was a good place to do business in 1890.”

As each economic cycle hits its bottom, the tendency is for advanced manufacturers to survive while the old and inert “have more trouble,” Mayer said.

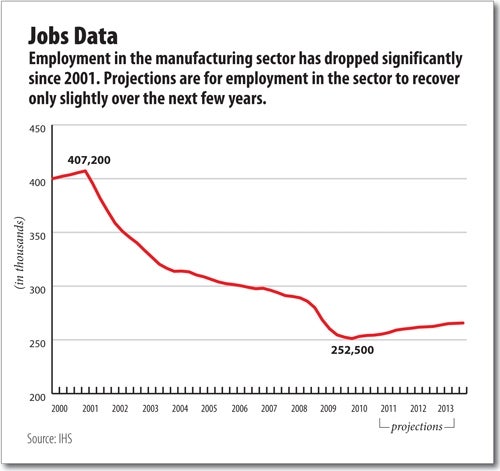

“Manufacturing got hammered in 2001, and the recovery was just a slowing of the pace of losses,” Lynch said.

In 2001, Massachusetts went from 407,000 people employed in manufacturing to 370,000, and the sector continued declining. By the third quarter of 2006, the sector employed fewer than 300,000 and today it employs about 250,000, according to IHS.

IHS predicts that manufacturing employment in Massachusetts will struggle back up to about 265,000 by the end of 2013.

Mayer said despite the overall downward trend, the manufacturing sector in Massachusetts is lately “seeing some employee growth, which is unusual,” especially considering the ongoing trend of companies wringing productivity gains out of fewer and fewer employees.

Mayer said the sector’s health varies from business to business. Manufacturers of computer chips and other high-tech equipment have been doing very well, even though “some were concerned a year ago that they were just going to go out of business,” Mayer said.

The dollar is relatively weak and Massachusetts manufacturers are strong exporters, but Europe, one of the state’s key export markets, has been very weak.

“So we’re seeing business investment not because the economy is great, but because (manufacturers) need to catch up to a year or two years ago when companies stopped hiring because it was just too uncertain.”

“The recession may be technically over because we’re growing,” Mayer said. “But we’re certainly digging our way out of a big hole.”