Since the stock market crashed in the fourth quarter of 2008, we have seen six consecutive quarters of negative absorption, that is, more space going vacant than becoming occupied, with some quarters more dramatic than others.

The greater Boston sub-markets have been floundering ever since.

But with a strong third quarter the markets for office, flex and industrial properties are finally and officially flat.

Though there will always be some soft spots and some hot spots, this is precisely where we turn the corner.

In review of the metropolitan commercial real estate market this year, we find sales volume is high and leasing on the mend with office, flex and industrial buildings.

After only three quarters in 2010, sales of office, flex and industrial buildings in Boston’s western suburbs have already exceeded the previous year.

With results still being reported for the third quarter, sales have already increased $157 million since the end of 2009. This represents 20 percent more volume than last year.

Surprisingly, CoStar group, a commercial real estate tracking firm, also reports that these sales numbers were reached in less than half as many transactions as 2009.

This may not mean the market is in full recovery. What it does indicate is that some prudent, bottom feeding investors with cash or borrowing power are getting back into real estate acquisition mode.

Tenants have also been active this year.

Back In The Game

Behind these trends is the fact that big banks are getting back in the market with a full head of steam. Bank of America is out aggressively soliciting business and advertising long-term rates, low down payments and SBA assistance options.

Some of these programs, such as only 5- or 10-percent down and 25-year amortizations with points being negotiable, represent the first time major commercial lenders have made offers like these in 40 years.

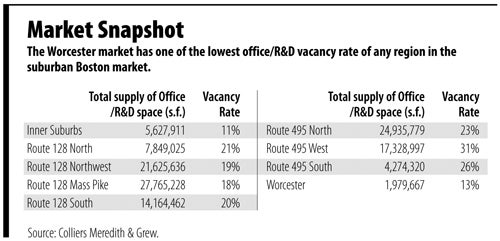

On the leasing front, there is finally a glimmer of hope. In certain areas, vacancy rates are coming down as more space is leased than is vacated.

While some companies are still downsizing or going out of business and vacating buildings, other more fortunate companies are actually growing or moving into the greater Boston real estate market and leasing or buying.

Some major brokerage firms are actually saying that the office market is starting to come back this year.

Office space is usually the sector hit the hardest when layoffs are rampant and it is indeed the sector that requires job creation to recover.

When jobs go away, empty cubicles and dark office space is left behind. There is not such a direct cause and effect relationship between job loss and the increased industrial and flex building vacancies.

To solidify this recovery, the market needs the fourth quarter to finish on a positive note.

Many commercial real estate brokers expect this to happen now that the market has turned the corner.

With the amount of activity we are seeing in the market today, it could still take two or three years for vacancy to reach a safe level. When occupancy reaches 90 percent, most properties are performing at an acceptable level.

Eric O’Brien is president of O’Brien Commercial Properties in Marlborough. He can be reached at eric@obriencommercial.com.