For Caliper Life Sciences in Hopkinton, it meant a 3 percent boost in the fourth quarter.

Framingham retailer TJX Cos. reported a 2 percent loss because of it last year.

Waters Corp. in Milford saw lower sales revenues in 2009 because of it, but a positive impact during the fourth quarter of 2009.

Companies deal with fluctuations in currency exchange rates every year. But the high volatility in the dollar’s position relative to other currencies in the last 18 months has meant exchanges rates are impacting the top and bottom lines of many locally based companies’ financial earnings from last year.

“This has definitely been a very volatile time period for currency exchanges,” said Brian Dolan, chief currency strategist for Gain Capital, which runs the exchange site FOREX.com in New Jersey.

Highs And Lows

On a general basis, if a U.S. company has overseas sales, the company will do better when the dollar is weak. Sales outside the United States will translate into more dollars when converted.

Alternatively, a strengthening dollar can negatively impact companies with large overseas operations. A strong dollar can make the prices of products more expensive.

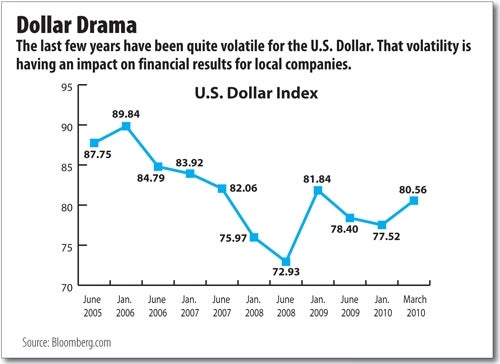

The last few years and have been full of ups and downs the dollar.

Major fluctuations began in 2005 when the dollar’s strength hit a high of 92 on the U.S. Dollar Index, which weighs the dollar against six other foreign currencies. For three and a half years after 2005 the dollar began a slow downward spiral, culminating to a low-point in March 2008 when the federal government bailed out financial giant Bear Sterns. The dollar dropped almost 23 percent during that time to 71 on the index.

The global financial meltdown, however, meant that international investors flocked to the dollar, giving it some strength.

“When things are bad and looking worse on a global level, the dollar benefits because of a safe-haven mentality,” Dolan said.

However much uncertainty there is in the world, the U.S. dollar is still seen as a strong international currency.

By late 2008 the dollar rebounded strongly and gained almost back to the point of its 2005 high.

In 2009 the international economy improved and investors began moving away from the dollar. Now, just recently in 2010 the dollar has begun to improve once again on fears in the international community about the strength of the Euro with monetary issues facing Greece.

All these fluctuations have been watched closely by companies with international operations.

Hopkington’s Caliper Life Sciences, which produces medical devices, reported that for a full-year basis currency exchanges had a 1 percent negative impact on profits. During the fourth quarter of the year, however, currency exchanges had a 3 percent positive impact.

That runs inversely to the Index Rate, which showed the dollar weakening toward the end of 2009.

Caliper is headquartered in MetroWest but has offices in England, Belgium, France, Germany, Switzerland and Japan, as well as dozens of distributors around the world.

It was a similar story for Framingham retailer TJX, operator the TJ Maxx stores, as well as Home Goods and Marshalls. For the full year, currency fluctuations had an estimated 2 percent negative impact on revenues, according to the company’s year-end financial report. In the fourth quarter, when the dollar weakened, there was a 3 percent gain directly attributable to currency exchange rates.

Many companies take steps to minimize the impact of volatile currency exchange rates by hedging their investments.

Hedging Their Bets

For example, companies can buy an insurance policy on losses from currency exchange rates.

Other companies use derivative trades, or futures trading to hedge the market. These allow a company to lock in the price of a transaction at the current day’s currency rate even though the sale may not take place for weeks to months.

That’s what EMC Corp., the Hopkinton computer storage giant does, according to the company’s annual earnings release.

“We enter into derivative contracts with the sole objective of decreasing the volatility of the impact of currency fluctuations. These exposures may change over time and could have a material adverse impact on our financial results,” the company reports in its year-end results for last year.

Other companies have their own internal hedging mechanisms.

“As an international company, we’re naturally hedging against currency fluctuations just by having operations in different parts of the world,” said Gene Cassis, corporate vice president of worldwide business development for Milford laboratory equipment manufacturer Waters Corp.

The company reported last month that currency fluctuations, like other companies in the area, would have a small negative impact on sales for all of fiscal year 2009, but would provide a benefit during the fourth quarter by about 3 percent.

Al Cotton, spokesman for Nypro, the Clinton plastics manufacturer, said the company has operations in 14 countries and sales around the world. Revenues are managed in each home country’s currency, he said, insulating the company from volatility in currency exchange rates. He said it’s too early to say if exchange rates would have a substantial impact when the year-end financial are calculated this summer.

“It’s just part of doing business,” he said.