(A correction has been made to Debbie Taverna’s quote at the end of this story, changing “our financial goals” to “their financial goals” to reflect her original statement.)

Through the long, hard years of the Great Recession, replacing an old car looked to a lot of people like an untenable extravagance. But today, the market has rebounded.

“People that, a few years ago, were potentially sort of trying to make that vehicle last are feeling a little better,” said Debbie Taverna, vice president of consumer lending for Marlborough-based Digital Federal Credit Union.

With growing car sales has come a greater need for financing. In the second quarter of 2015, lenders originated $119 billion in U.S. auto loans, the highest quarterly total in 10 years, according to the Federal Reserve Bank of New York.

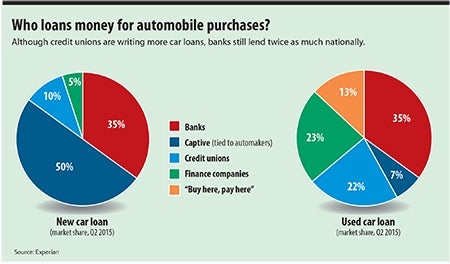

Credit unions are taking an increasingly large piece of the growing market. In the first quarter of 2015, credit unions provided almost 17 percent of auto loans in the U.S., and their share of the market grew 7.6 percent year over year, according to credit information services provider Experian. Banks — mainly huge national brands — gave out 34 percent of car loans, while 28 percent were “captive” finance, provided by financial subsidiaries of car companies, such as Ford Motor Credit.

Taverna said DCU, the largest credit union in Central Massachusetts, made $1.3 billion in loans for 72,000 vehicles last year. This year, it’s on pace to finance 80,000 vehicles.

Car loans are also a big deal for smaller credit unions. Fitchburg-based IC Federal Credit Union did about $100 million in auto-lending business last year, according to Bruce Mathieu, senior vice president for retail and consumer lending.

Mathieu said part of IC’s success comes from its relationships with local car dealers. He said the credit union can offer same-day funding in a market where some lenders take several days. Communication with the dealers is a big deal too, he said.

“We don’t have voice mail,” he said. “We answer every phone call.”

Credit unions are especially likely to be the ones financing used car sales, according to the Experian numbers, and Taverna and Mathieu both said they do most of their business in used-car loans. It doesn’t always pay to try to compete with captive finance in the new car markets since dealers are often able to offer zero-percent financing or cash-back deals through carmakers, they said.

Taverna said DCU sees offering good deals for used car buyers as part of its mission and business plan.

“One of the things that we’re proud of is how we offer the same rates for new and used” vehicles, she said. “That does differentiate us in the market some.”

DCU also offers distinctive loan products such as “second chance” refinancing of existing loans, Taverna said.

Meanwhile, Matthieu said another niche for IC is working with customers who might otherwise end up paying “ridiculous rates” on a subprime car loan.

“A credit union is more willing to work with someone with a lower credit score,” he said.

That might mean having the customer put 15 or 20 percent down, but it’s a way to save them a lot of money over the life of the loan.

Banks sitting in back seat?

While Central Massachusetts credit unions and community banks are competitors in many areas, the local banks typically don’t seek out auto loan business the way the credit unions do.

Alan Jenne, senior vice president and director of consumer lending at Commerce Bank in Worcester, said it’s generally not worth it to the bank to try to compete with the low rates offered by captive finance shops. He said the bank makes only around half a dozen auto loans a month, mainly as a courtesy to people who like doing all their financial business in one place.

“They’re very dedicated Commerce Bank customers, and rate may not be as important to them as the comfort of dealing with Commerce Bank,” he said.

Michael Allard, a spokesman for Hudson-based Avidia Bank, said the bank doesn’t seek out auto loan customers and only does around 150 of them each year.

He said the difference between community banks and credit unions centers largely about their historical missions. Banks have tended to focus most of their energy on mortgages and commercial loans.

“For credit unions, it’s been a lot of the consumer lending, and they put a lot of resources into that,” he said.

Taverna said it’s true that working with customers, particularly locals who might not have many other good options, is a key mission for credit unions.

“Our vision is that all our members achieve their financial goals,” she said. “We want to help the borrower. That’s why we’re here.”