On Tuesday night, the Worcester City Council moved toward approving a fiscal 2022 tax rate to cut commercial and industrial property tax rates lower than they have been in seven years.

According to historical data published for Tuesday’s meeting by City Assessor Samuel Konieczny, CIP tax rates have grown more than $7 per $1,000 in assessed property value since 2012, but that trend will change if council approves the proposed fiscal plan.

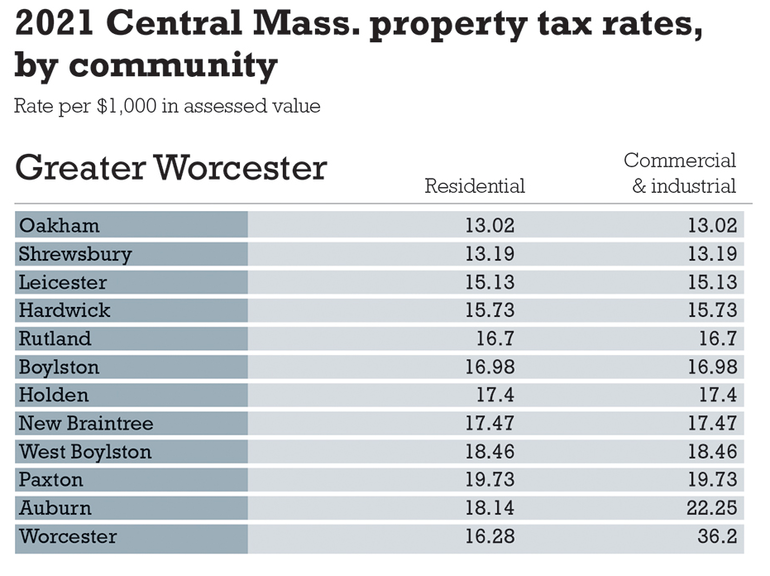

In fiscal 2021, the CIP rate was $36.20 per $1,000, and this fiscal year it is proposed to drop to $33.83, which is the lowest it’s been since 2015, according to the report. Last year, Worcester had the sixth highest CIP tax rate out of 351 Massachusetts communities.

In the past decade, Worcester has kept CIP taxes high in favor of keeping residential property tax rates lower, with the residential rate decreasing steadily since 2014. Last fiscal year, the residential rate was $16.28 per $1,000, and the proposed rate for fiscal 2022 is $15.06.

These proposed rates reflect a split tax rate. If Worcester were to adopt a single tax rate across all property types, it would need to be $19.33 per $1,000 in fiscal 2022, per the report.

The report showed an assessed value for all taxable property in fiscal to be $17.9 billion, a 13.3% increase from last year. This means, for most property owners, their overall tax bill will increase, despite the tax rate being lower.

Councilors on Tuesday spoke positively of the report and voted to continue discussion of the fiscal plan at the next meeting on Dec. 7 after the city assessor made some changes. There is a roughly $818,000 estimated surplus in new growth, which councilors said they would like to see allocated to school facilities and the Worcester Fire Department.