December is a “significant month” for state tax collections, but receipts through the month’s halfway point trailed last December’s pace by more than 8 percent, the Department of Revenue said last week.

Through Dec. 15, DOR had collected $1.544 billion in state tax revenue for the month, $138 million or 8.2 percent less than actual collections during the same period of December 2022. And the mid-month returns showed decreases in all major tax types except withholding, DOR said.

The full month’s revenue report is due from DOR by Jan. 4 and the administration has set the monthly benchmark at $3.914 billion. By mid-month, DOR had collected roughly 39 percent of the benchmark amount, but the department cautions against reading too much into mid-month figures since collections are usually “weighted toward month-end.”

Through November (the first five months of fiscal year 2024), state tax collectors hauled in about $146 million or 1 percent more than they did during the same span of fiscal 2023, but this year’s collections are $627 million or 4.3 percent below the estimates used to craft the record $56 billion annual budget.

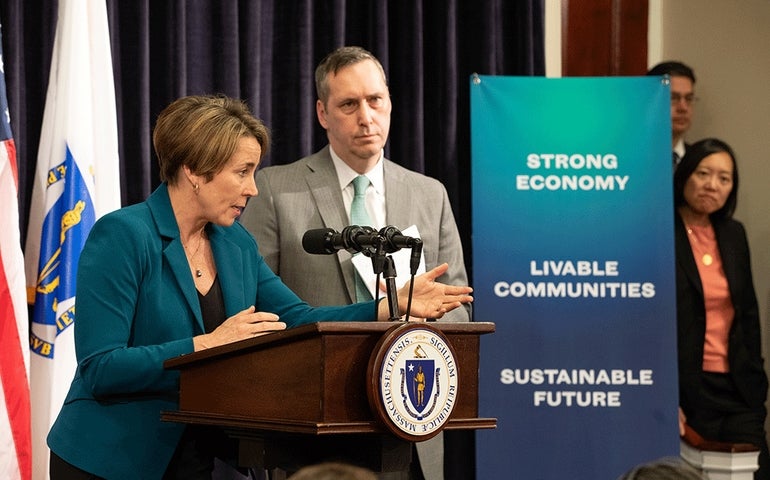

Tax collections have failed to hit benchmarks for five straight months, but Gov. Maura Healey said this month she is not considering using her unilateral power to make budget cuts to better align state revenues with spending as the state budget hits rocky terrain.

“No. No, we’re going to manage the situation,” Healey replied when the News Service asked if she was weighing spending reductions known as 9C cuts. “Revenues are not what they have been the last few years. We recognize that. We’ve seen a dip.”

DOR said that December “is a significant month for revenues because many corporate and business taxpayers are required to make quarterly estimated payments. In addition, some quarterly income estimated payments due by January 15th may be received in December.” The last month of the calendar year generally produces 9.5 percent of the state’s annual tax revenue.