The changing face of retail is having a profound impact on Massachusetts’ real estate and development landscape.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

The changing face of retail is having a profound impact on Massachusetts’ real estate and development landscape.

Online shopping has been on the up-and-up ever since retail giants like Amazon burst onto the scene, taking a larger bite out of retail sales every year.

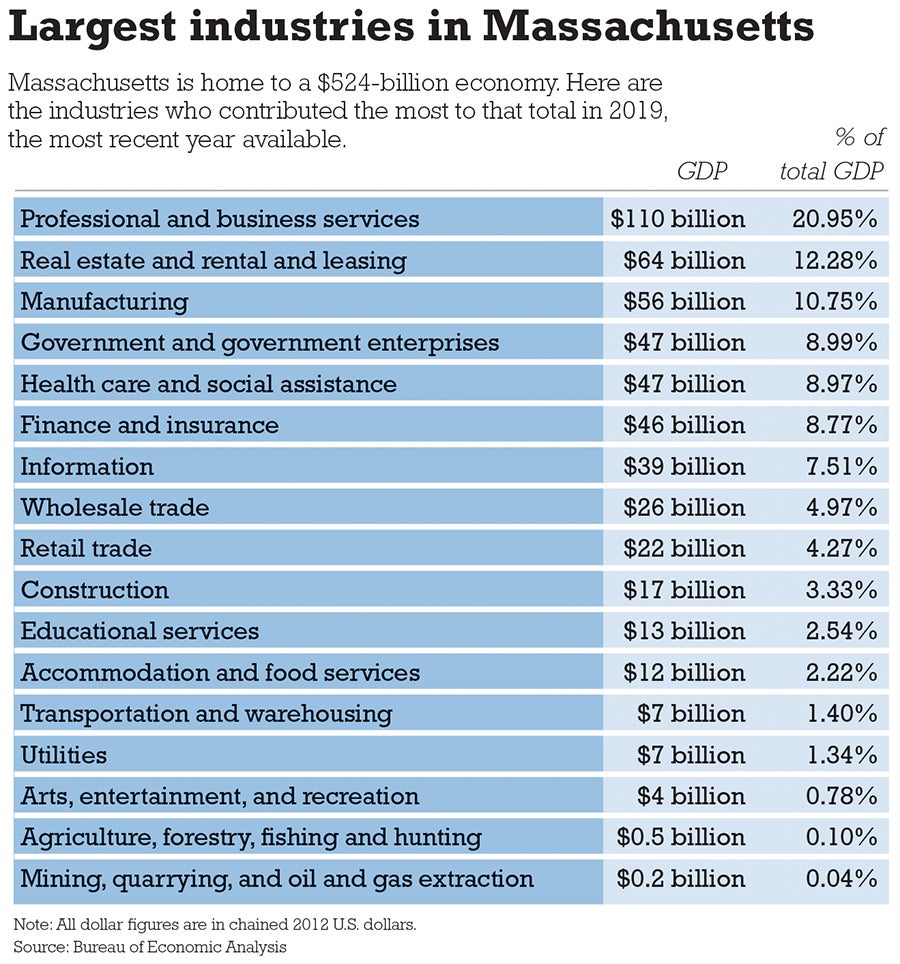

The coronavirus pandemic accelerated e-commerce sales across Massachusetts, with a 34% jump during the first nine months of the pandemic, according to a report from the Boston-based Metropolitan Area Planning Council. By February 2021, online shopping made up 14% of total retail sales in the state.

Yet, these shifts don’t seem to spell out a death sentence for brick-and-mortar retailers, rather a resounding message to adapt to changing consumer demands.

The omnichannel

Compared with other countries, the United States has an exorbitant amount of retail space with an estimated 25 square feet of retail per person, said Todd Alexander, an executive vice president specializing in retail at Worcester commercial real estate agency Kelleher & Sadowsky Associates.

“We’ve over-built over the years, so we’ve seen repositioning going on and retail evolving much more over the last few years,” he said.

Almost 14 million square feet of retail space has been converted to industrial space over the past three years nationwide, according to a 2020 report from Dallas real estate firm CBRE Group.

This change is evidenced in local development projects like Reliant Medical Group’s move to a shopping center in Westborough in 2017, and this year’s redevelopment of Worcester’s Greendale Mall, which is set to become an Amazon distribution center.

Of the 34 Amazon facilities in operation or planned in the state, 11 are located in Central Massachusetts, and all of them have cropped up within the last seven years, according to the MAPC report.

“It’s a great opportunity for retail conversion because most of these retail centers were really conveniently located,” said Alexander. “When you convert them to commerce distribution centers and you’ve got that network of roadways that are already in place, it makes it easy to convert.”

The increase in such developments has blurred the line between online and in-person retail, as well. While brick-and-mortar businesses built out online presences during the pandemic, online retailers have been moving in the other direction.

This reflects a surge in omnichannel shopping, which means all types of customer interactions including online shopping and in-person methods, like curbside pick-up. Nearly 22% of online orders in the U.S. were filled using omnichannel methods in 2020, a 14-percentage point increase from five years ago, according to a report from Canadian real estate company Colliers International.

Amazon announced plans in August to open a 4-star retail store in the Shoppes at Blackstone Valley in Millbury and is set to open an Amazon Fresh grocery store in Westborough.

A new look for in-person shopping

While consumers are still looking to buy in-person, they aren’t looking for the same experience they were 10 years ago.

“A lot of new retailers don’t want to be inside the mall anymore, they want to be outside,” said Leominster Mayor Dean Mazzarella, who emphasized a demand for more free-standing retail locations. “It’s also given a whole new look to retail space: landscaping, lighting, making it so people feel safe.”

He said most of Leominster’s retail space is filled at the moment, with the exception of some large vacancies left by Macy’s and Kmart. These thousand-square-foot spaces are less appealing to small businesses, which Mazzarella said tend to be more successful these days, but the mayor is optimistic about exploring alternatives.

“There’s plenty of re-uses for malls, whether they be entertainment or food or a marketplace setting where you’re offering to smaller tenants that can share space,” he said.

The marketplace blueprint was adopted by Allen Fletcher, a Worcester businessman who founded Worcester Public Market on Kelley Square in 2020. The market acts as an incubator for small restaurants and retailers who may not be ready or able to invest in a brick-and-mortar storefront.

Fletcher said his customer base, although still not fully rebounded, has been steadily climbing over the past few months.

“The two things we have going for us are, one, uniqueness, and, two, human congregation,” he said. “We’re completely founded [on] the joy of human congregation.”

Fletcher has been a long-time proponent of retail in Worcester’s downtown, vying for ground-floor stores in the new 400-apartment Table Talk Lofts development, which neighbors his market in the Canal District neighborhood.

“My holy grail is a district that is alive, that has people on the street,” he said. “People on the street are sort of the indicator species of a successful ecosystem and the kind of city people love to be in.”

At the same time, he said standalone shops along Green Street have faced greater challenges than his indoor businesses, which he attributed to a lack of walkability in the area. While retail enlivens a street, he said, it can be challenging for solo businesses to succeed when they aren’t surrounded by other shops.

Residential developments are key to retail’s success, as it keeps the streets pumping with life after work hours, said Alexander.

“If all [Worcester’s proposed] developments come through and we start to get that density in the residential population, we’ll see many more retail opportunities for different types of businesses, not just restaurants,” he said.