The 2,300-square-foot location at Government Center in Boston features interactive challenges to bring financial concepts to life in a fun and free way for the public.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

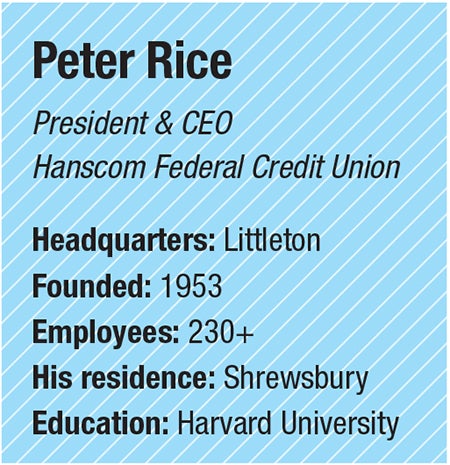

Based in Littleton, Hanscom Federal Credit Union traces its roots to Hanscom Air Force Base, where eight volunteers united to support the financial goals of their peers. Today, the credit union serves more than 95,000 members and holds $1.9 billion in assets. Innovation is one of the core values of HFCU and is demonstrated by the March opening of WealthTrek in Boston. The 2,300-square-foot location at Government Center features interactive challenges to bring financial concepts to life in a fun and free way for the public.

What inspired the WealthTrek questing rooms?

Banking has become very transactional and very focused on convenience, and that's great. Having better mobile apps so you can bank whenever has been game changing. But we still have this dearth in our society of: Where do I get financial acumen from? Who can I learn from? If you look at how people learn across cultures, they learn through play. I began to get fascinated by that, and we figured we could introduce gamification to our members and give them a beneficial experience, because games break down shame and stigma. Our prototype opened in our Burlington location last year and focused on car loans. After great success there, we opened our second WealthTrek location in Boston, which focuses on the theme of fraud. It's amazing how pervasive fraud is within our society. So, we decided to do something about it. We built a four-room game based on a questing model where members or non-members could go for a fun, team-building experience and learn what to do when you receive these fraudulent emails or texts. It's about getting people out of their homes and into a comfortable environment to learn about a big, scary topic in a safe way.

What is the benefit of gamifying financial lessons?

Gamification is in everything else we do; it is the way we learn. So, we figured, let's introduce gamification into finances. Imagine being able to go down to your credit union and actually have fun there. It also makes financial institutions less intimidating because we are breaking down barriers. We have been working with Regis College in Weston to study this concept and have had great success. We have businesses book rooms for their team building and families looking for a free activity. Everybody can go in. It's universal, and that's the whole point behind it. This is a universal problem in our society, and it's just a great way to take people through that process. It builds confidence and camaraderie, and they walk out having real knowledge instead of being lectured. This concept then opens the door to financial wellness and coaching and is a great introduction to who we are at HFCU. I've never heard of another financial institution where groups of people are coming out laughing, back slapping, and having a good time.

Why is financial wellness important?

According to the American Psychological Association’s report, 77% of Americans over the last 20-25 years say financial stress is the biggest worry in their lives, outweighing even their physical health. Modernization has made transactions more convenient, which is a good thing, but who is now teaching financial wellness, especially since financial wellness is linked to your physical and mental health. Most Americans do not have enough money put away for any kind of retirement. In fact, 60% of Americans do not even have $400 for an emergency regardless of their income.

Will you expand WealthTrek?

We're selecting the location of Worcester and one other location, soon to be announced. We piloted Burlington in July last year with one room, and we studied it for six to nine months. The feedback we received from that location was outstanding, and we are working on a mobile version.

We improved our current rooms because we noticed when working with some folks, for example, my son is autistic, we had to be aware of the environment within a room, particularly with occupational therapy. So, we must be very careful with things such as flashing lights. As a result, we built these rooms where we can change the environment to match the groups or individuals who are going into the game.

We see the tremendous success it has on folks who were on the margins of society who are just looking to get back in right. People who are looking to heal. And we're delighted by those results. I don't know any other financial institution that maybe can boast programs like that, and they are missing out on a great opportunity to engage people in a new and exciting way.

CORRECTION: A previous version of this story incorrectly said Hanscom Federal Credit Union piloted a WealthTrek room in Worcester last year. That pilot program was actually held in Burlington.

This interview was conducted and edited for length and clarity by WBJ Correspondent Sloane M. Perron.