The Massachusetts Restaurant Association wants to give restaurants and other small businesses the opportunity to push some of the credit card costs for restaurants onto consumers.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

The waiter drops off the check. The drinks and food are listed in a nice list with the price of each in the same row. At the bottom, the total includes the cost of the meal and drinks with all the taxes, and maybe the gratuity is already included too. Someone grabs the check, looks it over, reaches to grab their wallet and pulls out their credit card. They lean back in the chair a bit and put the card on top of the check, placing it out on the edge of the table. When the waiter picks it up and runs the card through the point of sale system, they bring it back and the exchange ends with a signature.

The customer never thinks about how the money moves from that plastic card to the restaurant. There’s no thought of the process or the costs associated with it. The Massachusetts Restaurant Association wants to change that. Or, at the very least, make people aware of how much their spending creates credit card fees for businesses. MRA wants to give restaurants and other small businesses the opportunity to push some of the credit card costs onto consumers.

“We would like restaurants or businesses to be able to add a fee, if they chose, for folks who use a credit card,” said Jessica Muradian, MRA director of government affairs.

While MRA is working on the state level to enable businesses, especially those with small margins like restaurants, to pass credit card fees onto consumers, the U.S. Congress is working on its own legislation designed to decrease the fees credit cards charge businesses when customers use them, especially as credit cards becoming an increasingly popular form of payment.

Still, even though businesses may pay more when customers use their credit cards, the tradeoff in allowing people the flexibility to choose from multiple forms of payment is worth it, said Dani Babineau, CEO and co-founder of Redemption Rock Brewing Co. in Worcester.

“The cost of doing business,” Babineau said.

The cost of credit cards

Each time a credit card is run, fees attached to that transaction are put on to the business, which is already paying for the system to run those cards. Modern point of sales systems can do more than just run credit cards, but the fees associated with the cards is significant, MRA wants to try and curb those fees for its members by changing a law in Massachusetts preventing businesses from floating the bill for charges onto the customer.

Swipe fees can cost anywhere between 2 to 4% of the whole bill per transaction, according to the National Retail Association.

Doug Bacon owns Red Paint Hospitality Group, which operates seven neighborhood restaurants in Greater Boston. They’re local spots catering to regulars in the neighborhood. They’re not destination spots bringing in people from around the globe, who rack up huge tabs. From July 2021 to July 2022, one of Bacon’s restaurants in Allston paid out $58,000 to the credit card companies in fees, which cost more than insurance and maintenance at the restaurant.

“That’s three weeks of payroll,” Bacon said.

Those fees have started to creep their way into the menus. Bacon said he has to take into account how much will be taken out and try to make that up. The credit card fees he pays come out in percentage of the entire bill – including tip – so Bacon has to calculate how much money he will have to pay out at the end of the year and find a way to wrap that cost on the menu.

Not that long ago, credit card fees weren’t an issue for Bacon because his clientele usually paid with cash and those cash payments over time would cover the fees he paid for credit card users. He said prices on menus reflect the cost of fees overall and cash customers pay a higher price so restaurants can afford credit-using customers. Now, the numbers have flipped. Ten years ago, the roughly 30% of customers paying with cards has risen to 90% at Bacon’s restaurants.

Dealing with fees

What MRA wants to do is make it legal in the commonwealth for restaurants and other businesses to charge customers a percentage of the swipe fee they’re on the hook for. A bill was introduced by former State Sen. Joseph Boncore (D-Boston) in 2021, but it has not moved out of committee yet. Another bill was introduced in the same year by State Rep. David Muradian (R-Northbridge) and is also stuck in committee. The charges would be labeled on menus, and customers would have the chance to choose how they want to pay. It’s similar to how gas stations can charge two prices for credit or cash.

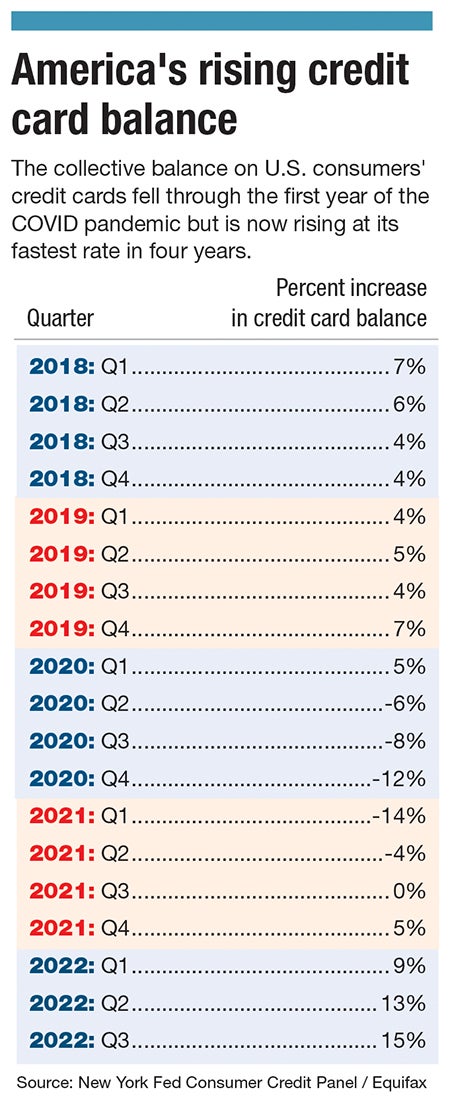

A CNBC report from August showed more than 500 million credit card accounts are active in the United States for the first time ever. According to a Liberty Street Economics report from November, 191 million Americans have at least one credit card account, half of all American adults have at least two cards, and a 13% have five or more cards.

At Redemption Rock in Worcester, the universal appeal and ubiquity of credit card use among its customers is more important than trying to save money on fees, which they pay every few months, said Babineau.

The brewery pays roughly $2,000 once a month in fees, but Babineau said she doesn’t lose sleep about it.

Instead, she’s more interested in spending her time trying to find other ways to make money rather than worrying about passing on fees to the customer.

MRA’s effort is a small part of a larger effort to address the fees businesses incur by accepting credit card payments.

In U.S. Congress, the proposed Credit Card Competition Act of 2022 seeks to curb such fees by creating more competition among credit card companies to offer better pricing. It follows in the footsteps of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, which curbed debit card fees.

The credit card bill enjoys bipartisan support in Washington, D.C., having been introduced by Sen. Roger Marshall (R-KS) and Sen. Richard Durbin (D-IL), the chairman of the judiciary committee, and nearly 2,000 businesses and trade associations from around the country sent letters to Congress urging them to pass the bill into law.

With Congress now in a lame duck session following November’s midterm elections, the credit card bill appears unlikely to become law this year.