Small businesses created 64 percent of the net new jobs added to the country’s economy over the past 15 years, according to the U.S. Small Business Administration. And, since the 2008 financial meltdown, community banks have earned a reputation for responsible lending that contrasts with the more “creative” practices of larger financial institutions.

So President Barack Obama’s recent proposal to generate jobs by handing community banks low-interest loans that they could pass along to small businesses might sound like a no-brainer. But some local banks say the idea doesn’t make much sense for them.

Cash Rich

Martin Connors, president and CEO of Rollstone Bank & Trust in Fitchburg, said banks like his are already flush.

“Providing the cash to the banks is really not critical at this point,” he said. “We’re trying to find ways of using our liquidity.”

One problem, Connors and other bankers said, is that many businesses have seen both their sales and the value of their real estate drop over the last few years, making them less credit worthy than they once were. Just as important, they said, many established businesses aren’t using as much of their existing credit lines as they used to.

“Those companies that are well managed and have strong capital, they’ve hunkered down over the last couple years,” said Brian Thompson, president and CEO of Commerce Bank in Worcester. “Those that were weak to begin with, unfortunately some of them got weaker over this time.”

The president’s proposal would create a $30 billion Small Business Lending Fund to channel TARP funds that have been returned to the government to community banks, and as the banks do more lending to small businesses, the interest they pay on the government loans would drop. That could encourage more liberal lending practices. But Connors said he fears government regulators won’t be on the same page as the president.

“We’re going to be encouraged to make loans we wouldn’t normally make, and then we’re going to be criticized afterward for making them,” he said.

Daniel Forte, president of the Massachusetts Bankers Association, said agencies like the Federal Reserve, the Office of the Comptroller of the Currency and the FDIC already seem to be tightening the standards that they hold banks to. For instance, he said, regulators may suggest reducing credit lines to companies that are showing a loss because of the economy even if they’re current on their payments. Forte said there’s a “human element” to the equation since people have a natural tendency to become more conservative with money when the economy is slow.

“There’s the overzealousness,” he said. “You’re dealing with people. Regulators will get tougher at exactly the wrong time.”

Yea For SBA

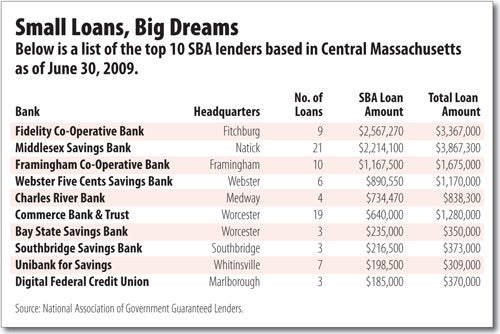

Forte and other bankers said the part of Obama’s proposals on bank lending that seem most useful is not offering new funds but improving the terms of existing SBA guarantees. In March, the federal government made some changes to SBA loans, increasing the amount of bank loans it would guarantee to 90 percent in some cases and waiving some fees.

Larry Marsh, director of the Small Business Development Center at Clark University in Worcester, said those changes have helped the startup businesses he works with get financing.

“That’s been really helpful,” he said. “Particularly in situations that have been tight.”

But some of those changes are now expiring, and Connors said Rollstone has had a couple of cases where the return of SBA fees has made it impossible to make a loan.

“When they realized the cost of the deal, the customer declined,” he said.

Obama’s new proposals would keep the SBA changes going and expand some of them, Marsh said.

Meanwhile, though, Marsh said the financial climate for the fledgling businesses he works with are not as difficult as many think.

“There seems to be a disparity to some extent between what we’re seeing and what we see on TV,” he said.

Local banks say their ability to keep healthy loan portfolios isn’t suffering too much either. Thompson said Commerce has had record years in terms of both deposits and loans since the start of the recession.

“It’s been a good time for us, as some of our major competitors have been focused elsewhere,” he said.

Connors said that while he’s seeing fewer start-up companies coming to Rollstone for money, he’s finding commercial customers migrating to the bank from larger institutions. He said some businesses have gone to community banks after large banks reduced their loan limits. Many are more comfortable somewhere where they can know someone in the local area is hearing their case.

“The decisions are not made in North Carolina, or in some foreign country,” Connors said.

Forte said he expects Congress hasn’t jumped on Obama’s proposals in part because of delays caused by February’s snow storms. But he said he expects the government to move something forward, possibly sometime this month.