The rise of smartphones has given companies the opportunity to connect with customers anywhere and at any time. And banking is one of the industries taking notice of the convenience that smartphones and their applications can give customers through mobile technology.

“We think that it’s the wave of the future,” said Bruce Spitzer, director of communications for the Massachusetts Bankers Association. “We know that more and more smartphones are being sold every year, and as people adjust to managing their lives on their phones, it’s only natural that they’re going to want to do more banking in that space as well.”

According to a Federal Reserve survey, one out of five Americans used their cell phone to access a financial account in 2011. That’s expected to jump to one in three by 2013.

After initially allowing customers to receive their account balances via text messages, banking leaders have responded to customer demand by offering more detailed access to accounts through websites adapted for mobile phone use and apps for their systems. Major banks often lead the way with new technologies, and community banks follow.

Worcester-based Commerce Bank launched apps for both iPhone and Android systems this year after offering a mobile site.

“We all do a tremendous amount of research,” said JoAnn Morency, senior vice president of retail banking. “What it’s really come down to is you have to have everything, because it really depends how the customer wants to interact with you, and it all comes down to when they want to do it.”

According to a recent study by Cambridge-based Forrester Research, the most popular uses of mobile banking are checking balances and transaction histories, and transferring money between accounts.

Morency said that’s true at Commerce, as most customers check their balances when they’re about to buy something and want to know if the money is available.

“Those are everyday things that I think people just use,” she said. “No one’s carrying around checkbooks anymore.”

But “no one” may be an overstatement. According to the Federal Reserve, 18- to- 29-year-olds account for 44 percent of mobile banking users. And currently, less than half of the 40 largest banks in Central Massachusetts offer mobile banking, according to their websites. But as customers demand it more and the technology continues to trickle down from bigger banks, more banks want to jump in.

“The community banks take a little more time for implementation … just time and resources are a little more strained on the community level,” said Kristin T. Carvalho, president and CEO of Milford National Bank & Trust Co., which plans to launch a mobile website in 2013.

“Our customers are definitely asking for it,” she said. “We definitely want to do it because it obviously attracts the younger customer base and people who are more tech savvy.”

Security has been one factor in the bank’s slower move into the mobile world, and is another concern that may be more easily addressed by larger banks with more resources. But Spitzer said it’s why the industry as a whole has been slower than many others to implement mobile technology.

Security Vs. Convenience

The Federal Reserve said most people who don’t use mobile banking say it’s because they either see no need or have security concerns.

“I think security is always an issue,” said Peter Donohue, e-products manager for Commerce. “That’s always foremost in a lot of people’s minds … (but) on a day-to-day basis, convenience is always what wins out.”

Morency agreed, but noted that banks are in the business of mitigating risk.

“I think people get nervous because there are breaches out there, but it’s never been on the bank’s end. Those are from stores or processors out there,” she said, adding that because banks deal with people’s money, they need to be especially trustworthy.

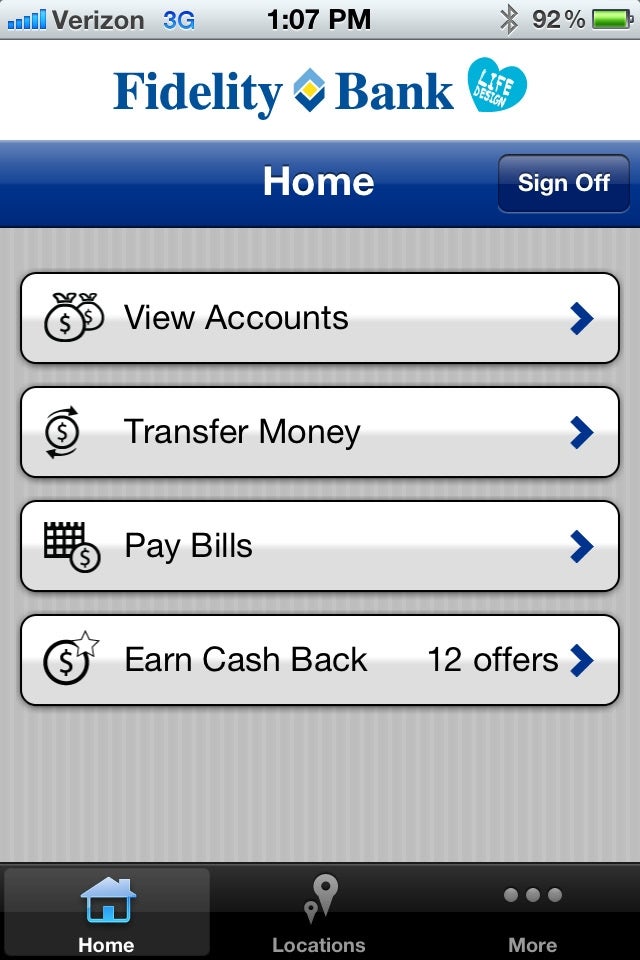

While many banks are not even in the mobile arena yet, others are looking beyond the basics. Commerce is planning to roll out a bill-pay option through its apps next quarter. And in October, Leominster-based Fidelity Bank will start offering remote deposit, which will allow customers to take a picture of a check, upload it to the bank’s app and have the funds deposited.

“We’re a pretty early adopter,” said Catherine Dillon, Fidelity’s senior vice president and director of marketing and retail sales. “We’re just trying to keep up with the needs of the customer.”

Effect On Branch Traffic?

As customers become more able to handle bank tasks, branch traffic is shrinking. But some say that doesn’t mean the demise of branches.

“(If) customers have a real issue or problem, they really like to come into the branch for resolution,” Morency said. “It depends sometimes on the complexity of what they want to do. Are we worried about our branches? No, but the branches will be changing. Five years from now … you really won’t have to come into the banks as much as you did. There’s going to be a lot of specialists there.”

Dillon said banks are concerned with the shrinking branch traffic, but that Fidelity is offering new products and working to build relationships with customers.

“Anything that makes it more convenient for them, I think that just gives them a stronger reason to bank with us,” Dillon said of the mobile technology. “They don’t have time to come to the branch every day, but when they get to the big decisions, they’ll still come for that advice.”

Read more