Shortly after Massachusetts residents voted to legalize recreational marijuana for adult use, officials at BayCoast Bank realized there could be a problem.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Shortly after Massachusetts residents voted to legalize recreational marijuana for adult use, officials at BayCoast Bank realized there could be a problem.

Cannabis companies were finally allowed to sell their products legally within Massachusetts. The first two recreational marijuana stores, in Leicester and Northampton, generated nearly $24 million in sales in the first three months after opening. But because marijuana is still illegal federally, the new companies didn’t have anywhere to deposit their newly earned currency.

“They were walking around with large bags of cash, paying bills in cash, and creating a security and safety issue for the communities we support,” said Gary Vierra, senior vice president and chief risk officer at BayCoast. “So we decided to fill a void: to provide a service to lower that risk to those communities and help the industry.”

That was how BayCoast, which is based in Swansea and has branches throughout Massachusetts, decided to enter the business of banking to Massachusetts’ legally licensed cannabis companies. Today, it remains one of just a handful of Massachusetts banks and credit unions working directly with marijuana businesses, providing deposit and loan services to local companies, while adhering to strict reporting requirements in order to keep the feds off their doorstep.

The lack of access to financing and banking for the cannabis industry has created a huge amount of inequality, said Shanel Lindsay, an attorney, business owner, and co-founder of Equitable Opportunities Now, which empowers people of color to be active in the Massachusetts marijuana industry. Outside of the few banks that provide services, business owners have limited options when it comes to financing, and the support that does exist usually comes with a huge price tag.

“With a regular business, not only are banks running to you to get your business, but they’re throwing credit at you at the beginning, if you meet certain standards,” Lindsay said. “It’s easy to get money, but that does not exist in cannabis. It’s very difficult.”

Murky legality

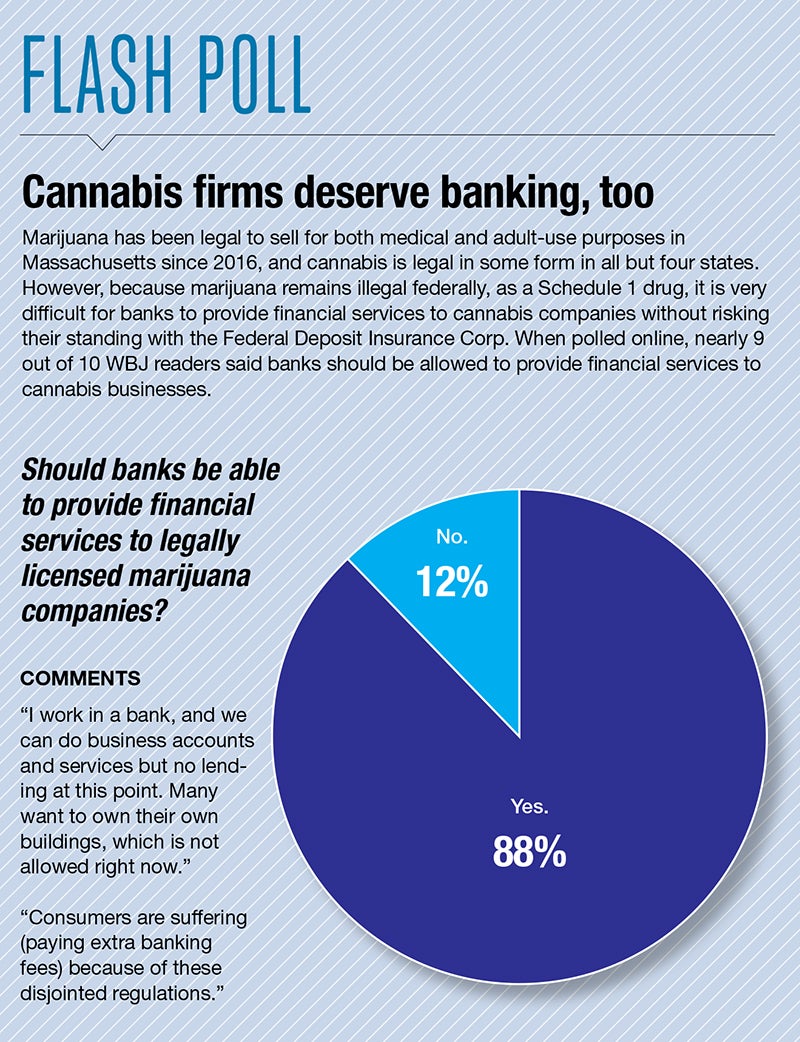

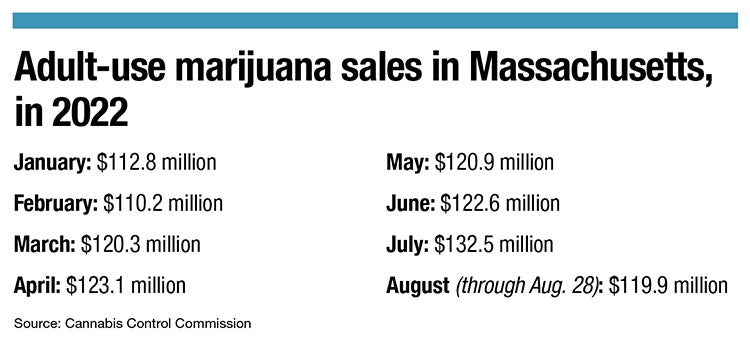

Adult-use marijuana establishments have generated about $3.4 billion in sales since the first stores opened in 2018, according to the Massachusetts Cannabis Control Commission, which regulates the industry. Year-to-date sales for 2022 have reached $962.4 million.

Despite the law in Massachusetts, marijuana remains illegal at the federal level. This, the American Bankers Association said, has left banks in a tricky position: trapped between their mission to serve the financial needs of their local communities and the threat of federal enforcement action, the group said on its website.

ABA called on Congress and federal regulators to provide greater legal clarity to banks operating in states where medical or adult-use marijuana is legal.

“Those banks, including institutions that have no interest in directly banking marijuana-related businesses, face rising legal and regulatory risks as the marijuana industry grows,” ABA said on its website.

The Cole Memorandum, a U.S. Department of Justice memo issued in August 2013, is a guideline for the federal government’s position on marijuana law enforcement. The memo stated the federal government wouldn’t use its resources to enforce marijuana prohibition in states that allowed it and regulated it responsibly. The memo was rescinded in 2018 by then-Attorney General Jeff Sessions.

Vierra hopes for the passage of the so-called SAFE Banking Act, a bill to prohibit federal regulators from punishing banks that provide banking services to legitimate cannabis companies and any ancillary businesses – like plumbers or electricians – that work with them. The bill has been passed by the U.S. House of Representatives, but not the Senate.

When it comes to its marijuana clients, BayCoast follows strict guidelines, including filing certain reports every three months, showing all activity of the businesses, and monitoring the flow of cash in and out to make sure it’s not being diverted for illicit purposes, Vierra said.

Needham Bank, which got into the marijuana banking business earlier this year, also adheres to stringent rules when it comes to its pot clients, said James Daley, senior vice president and director of structured finance.

The bank spent the better part of two years figuring out how to enter the cannabis financing space, on the legal, operations, and marketing side, Daley said. But today, Needham Bank provides both deposit services and financing for cannabis companies.

The bank has a staff of more than 30 devoted to cannabis banking, including professionals who have knowledge of how it works in other states with longer records of adult use. The bank consults with outside law firms to stay up to date on regulations and restrictions.

The client base is a combination of startup level businesses and others with multiple years of success behind them, Daley said. Needham Bank has more than $3 billion in assets, so on the lending side, it competes with larger national players like Santander Bank, TD Bank, and Bank of America, which is an advantage, he said.

“It’s certainly not for everybody,” Daley said of banking with marijuana businesses. “We’re definitely seeing more banks in space, throwing their hat in the ring. I think they’re jumping to conclusions on how easy they think it is. The barriers for entry are pretty high because of the level of complexity.”

It goes beyond directly working with pot purveyors. For example, some banks won’t open accounts for employees of marijuana companies because of the risk, and other companies working with cannabis retailers – like landlords who want to lease space to one – can sometimes run into issues.

“There was a CEO we closed on a deal with, and a week before closing, he called me and said, ‘I’m walking into Wells Fargo; they said I have 30 days to leave. Can you get me a mortgage?’” Daley said. “He was high up in the business and had that safety net, but for the people like processing workers and manufacturing workers that don’t have a couple of million lying around trying to provide for their family, we do what we can to respond and get a referral to the right people.”

Equal access

Mass. law requires CCC to structure the industry so it benefits communities impacted by the War on Drugs the most. A new law signed in August by Gov. Charlie Baker includes language to move that initiative forward.

The 2022 cannabis reform bill establishes a trust fund for disenfranchised entrepreneurs, funded by 15% of tax revenue generated through adult-use sales. The fund, according to CCC, lowers one of the primary barriers to entry into the cannabis industry: money.

This fund is going to be a huge help for marijuana entrepreneurs from communities who were most harmed by the War on Drugs, Lindsay said.

It’s also an important extension of financing options in a shallow market, she said. Funding from private investors usually comes with a huge amount of interest, and some small companies will sometimes look to larger, multi-state operators as a survival tactic; but that gives the bigger company a lot of the power while pushing the small business owner out, she said.

“It’s very difficult for people to wade through what is good and what is bad. They take on money that is detrimental to them and business,” Lindsay said.

The fund is an important step towards creating strong futures in the marijuana industry for families of color, she said.

“We wanted this money from the beginning, as we were trying and fighting for and building an equity program,” she said. “If they don't have the money, they won't move forward.”