Congress enacted the Opportunity Zone program three years ago to provide tax incentives for investment in low-income communities. But will investors seize the opportunity?

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

If you zone it, will they come?

U.S. Congress posed this question in 2017 when the Opportunity Zone program was created to provide tax incentives for investment in low-income communities.

Under the initiative, companies who reinvest unrealized capital gains into high-impact, long-term projects in high-poverty communities can defer taxes on capital gains, receive a basis step-up of previously earned capital gains invested, or get a permanent exclusion of taxable income on new gains.

These zones represent low-income areas where the rate of educational attainment is below the state average. They provide favorable tax treatment if investors use their capital gains to boost economic activity in specific regions.

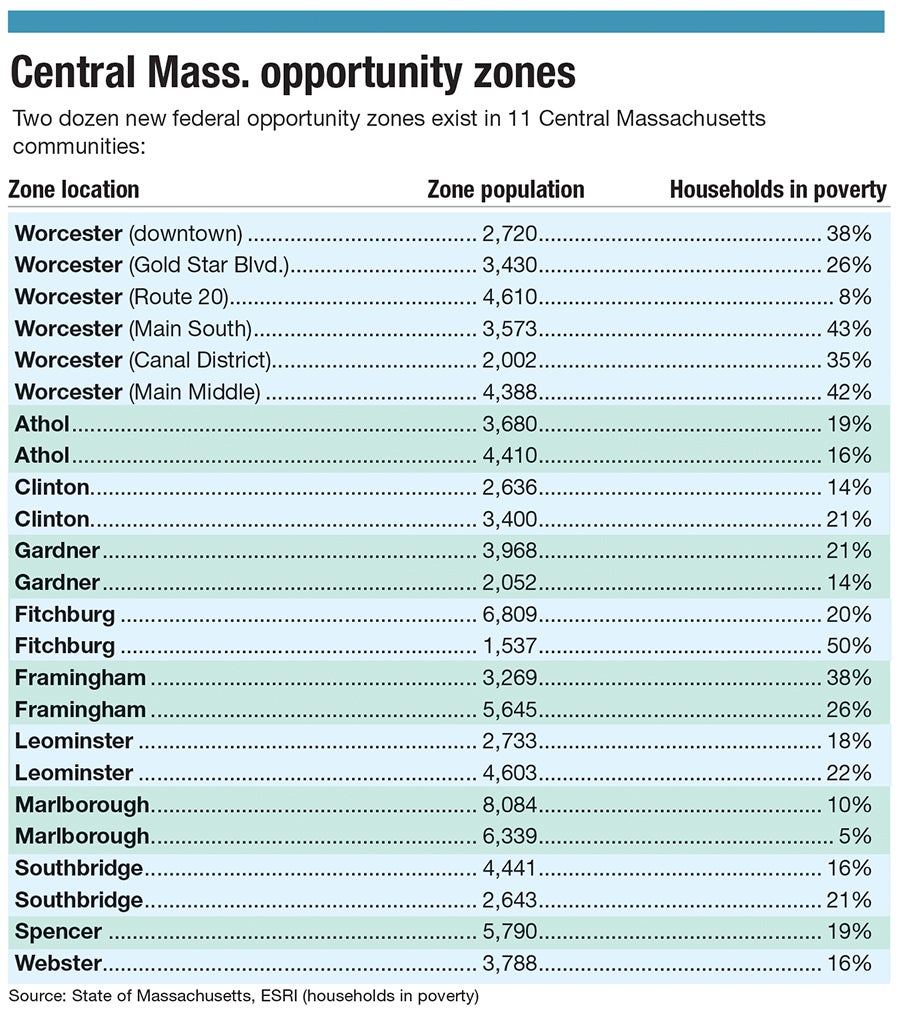

Of the 138 districts in Mass. designated by the Gov. Charlie Baker Administration and certified by the U.S. Treasury, 24 are in Central Mass. from Athol to Worcester, including Clinton, Fitchburg, Framingham, Gardner, Leominster, Marlborough, Southbridge, Spencer, and Webster.

But nearly three years into the federal tax relief program, it’s unclear whether the legislation crafted by U.S. Senator Cory Booker (D-NJ) and Tim Scott (R-SC) is working.

“Opportunity zones are not a game changer in terms of helping make an investor’s bottom line work,” said Thomas Skwierawski, executive director of Fitchburg’s Community Development office. “It won’t make a bad project good … It’s just a piece of the puzzle.”

Gateway Village

In Fitchburg, there are two Opportunity Zones, including Main Street and the downtown, and project areas south of the Nashua River.

“The city has seen an uptick of investment in the downtown and all of the corridors included in the Opportunity Zone,” Skwierawski said. “But I don't know how much it has to do with the Opportunity Zone legislation.”

The city has approved a 112-unit project by Fitchburg developer William Krikorian on a vacant parcel at Main and Day streets. Dubbed as Gateway Village, it features two levels of parking, with five stories of market rate apartments above. Krikorian has said the investment was the direct result of Opportunity Zone incentives, Skwierawski said.

In addition, in Moran Square, the adaptive re-use of two historic buildings and the construction of a new five-story building will offer 44 new mixed-income apartments with ground-floor retail.

But Skwierawski said it’s unclear whether that project came as a result of an Opportunity Zone.

Peter Dunn, Worcester’s assistant chief development officer, said the biggest criticisms of the program are the lacks of a formal community approval process and reporting requirements.

To capture the tax credits, investors file with the U.S. Internal Revenue Service. As a result, investors are not required to seek the city’s approval, and communities do not know which investors are using it.

“Communities don't have control over the flow of capital that’s coming into their cities and towns, and the projects that might be resulting from the program,” Dunn said.

Worcester’s Opportunity Zone project

Worcester has six such zones: downtown, Canal District and Green Island, from the east side of Indian Lake to Belmont Hill, two in the Main South neighborhood, and one near Route 20 in the southeast corner of the city.

Dunn only knows of one confirmed Opportunity Zone candidate.

In October, Worcester Plaza, a glass office tower in downtown and the tallest building in Worcester, was purchased by Synergy Investments of Boston for $16.5 million.

Ryan Chamberlain, Synergy's business development director, said they created a $100 million fund to invest in Greater Boston properties.

"Worcester Plaza is not the only building we will buy," he said at a round table discussion about Opportunity Zones on Thursday sponsored by the Greater Worcester Chamber of Commerce. "We expect to invest in two or three more Worcester properties."

Chamberlain noted the firm plans to spend $12 million to renovate the 24-story building at 446 Main St. over the next two years.

Dunn noted Synergy was very transparent in their desire to own the office tower and said a handful of other investors are probably looking at or have already invested in Worcester’s Opportunity Zones, but the city can’t verify.

“It’s difficult to measure success without data,” he said. “If there were some level of reporting, we would have better handle on it.”

Even Booker has been critical of the program, but for a different reason. In November, the senator and other Democrats wrote to the chairman and ranking members of the tax-writing committees of the House and Senate to urge swift enactment of legislation to enable the Opportunity Zone tax incentives to more successfully achieve their purpose.

The letter came amid reports from the Associated Press of wealthy developers, including Jared Kushner, President Donald Trump’s senior adviser and son-in-law, who are pursuing business opportunities in areas not truly needing investments.

“If a policy is intended to benefit low-income Americans by incenting development in economically disadvantaged communities, then such a policy must prevent manipulation of investments to benefit only investors or high-income prospective residents to the exclusion of low-income current residents,” Booker wrote.