When Boston Scientific Corp. decided to move its headquarters from Natick to Marlborough, the issue was one of logistics, the company said. Previously, the company’s Central Massachusetts operations had been scattered, with various pieces in Marlborough and Natick.

“We were looking at how do we improve the operational efficiency of our headquarter office,” said company spokesman Steven Campanini. “It made a lot of sense for us to consolidate into Marlborough and then build a new headquarters building that would create an integrated headquarters for us in Marlborough.”

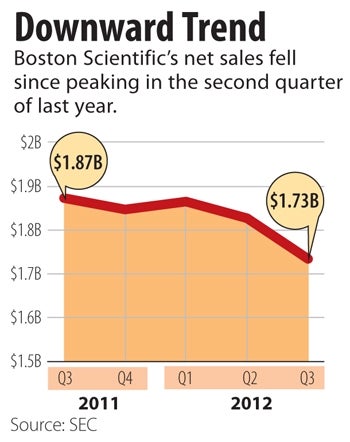

The move isn’t part of a companywide cost-cutting effort that’s been underway since 2010, Campanini said. Still, it’s easy to see it as a microcosm of the company’s overall strategy. The medical device industry as a whole is under pressure these days, and Boston Scientific is struggling even more than many of its competitors. Its revenue for the first nine months of this year was down 6 percent to $5.4 billion, compared with the same period last year. The company is responding by trying to find ways to be more efficient and get more done, even if that involves moving into new spaces.

The space Boston Scientific (BSX) most recently decided to move into is renal denervation, a method of treating hypertension. BSX is buying Vessix Vascular, a California company that has developed a product for that procedure, paying $135 million up front with another $300 million in milestone payments between 2013 and 2017.

Vessix is just the latest acquisition for Boston Scientific, which has bought four other companies this year alone. Vessix will be part of the Peripheral Interventions business, which, not coincidentally, is one of the smaller areas for the company, but one it’s trying to grow.

Campanini said BSX now makes 55 percent of its sales in its largest divisions — interventional cardiology and cardiac rhythm management — but those have been tough areas in recent years. The strategy now involves stabilizing sales in those businesses while investing more in the smaller divisions and implementing overall cost-cutting measures. Those include streamlining manufacturing processes and making some layoffs, with the goal of reducing operating expenses by $200 million to $250 million.

“The totality of all of those initiatives are designed to stabilize the revenue decline,” Campanini said. “Part of the strategy includes focusing on new areas.”

For Marlborough, BSX’s decision to move its headquarters is just the latest in a series of positive corporate announcements for the city. This year, TJX Cos and Quest Diagnostics have both announced plans for new offices in vacant commercial properties, which will bring about 3,000 jobs to Marlborough.

Boston Scientific’s move is even better for the city in one respect: Marlborough didn’t have to promise a tax break to secure the new employer. Michael Berry, executive aide to Mayor Arthur Vigeant, said BSX, which already had a location in the city, decided on the shift without any discussions with the local government. The Marlborough building that the company owns has an existing TIF dating back to former mayor Nancy Stevens, Berry said.

“They just reached out to us and informed us of this move,” he said. “It was actually pretty simple.”

Berry said the city is pleased that more workers will be around to spend money at local businesses, and it’s hopeful about continued partnerships with BSX, which has already supported community initiatives.

“It’s going to be great for the businesses in the area,” he said. “Combined with TJX and Quest, I think it’s going to be a real good boost to the local economy.”

The existing Boston Scientific building in Marlborough, at 100 Boston Scientific Way, is a one-story building with a bit less than 200,000 square feet of space dating from 1986. The company paid $43.5 million for it in 2004.

The old headquarters in Natick, which Boston Scientific is selling to MathWorks, is a 500,000-square-foot campus. Campanini said the company is not releasing details about its plans for a new headquarters building in Marlborough, but it expects to complete it and finish moving employees from Natick in the summer of 2014.

When it comes to what the company will look like by that time, observers say it’s hard to tell. Rajeev Jashnani, an analyst with UBS Securities, said he’s more optimistic than some of his counterparts at other firms. He said if the company could stabilize its market share within its core businesses, it would make a difference, even though those markets aren’t strong overall.

“Their current results still leave something to be desired,” he said. “I don’t think the company would dispute that. I think it’s a work in progress and it remains to be seen how long it’s going to take them to kind of repair the top line. We think they can pull it off; it’s just going to take another five quarters, six quarters.”

Bruce Jackson, an analyst with Northland Securities, which gives BSX stock a neutral rating, said the slow growth in the company’s core markets means it needs to find success elsewhere, through acquisitions like Vessix.

“In that type of situation, you’ve got to go out and find more products to feed your distribution capabilities,” he said.

Jackson said overall pressures on the medical device industry, like greater pushback on pricing from hospitals and a new tax that’s part of the 2010 Affordable Care Act, are making things tougher for many companies in the industry and encouraging consolidation. In fact, he said, particularly given its difficult core markets, he wouldn’t rule out the possibility that Boston Scientific could itself become an acquisition target at some point.

Read more

MathWorks To Add To Natick Presence, Soften BSX Exit