With April 15 just behind us, we all know how easy it is to complain about taxes. But for businesses in Massachusetts, there’s a real question about whether such complaints are justified.

One recent report on the subject shows that, despite having the reputation of a tax-and-spend sort of state, Massachusetts actually keeps taxes on both individuals and businesses relatively low. But another study faults the state for the way in which it calculates taxes, arguing that having a complex system with different rates for different sorts of companies contributes to a bad business climate.

Market Perceptions

It’s been a long time since the label “Taxachusetts” could rightfully be applied to the Bay State. Sure, in the late 1970s, the state had the third-highest tax burden in the nation, with taxes representing 13.7 percent of personal income compared with 11.2 percent for the country as a whole. But these days the state ranks 38th on the same scale, with taxes equaling 10.5 percent of income.

“There’s been a certain amount of misunderstanding out there about overall business tax levels in Massachusetts,” said Noah Berger, executive director of the Massachusetts Budget and Policy Center, which compiled the numbers. “I think once reputations happen they tend to stick.”

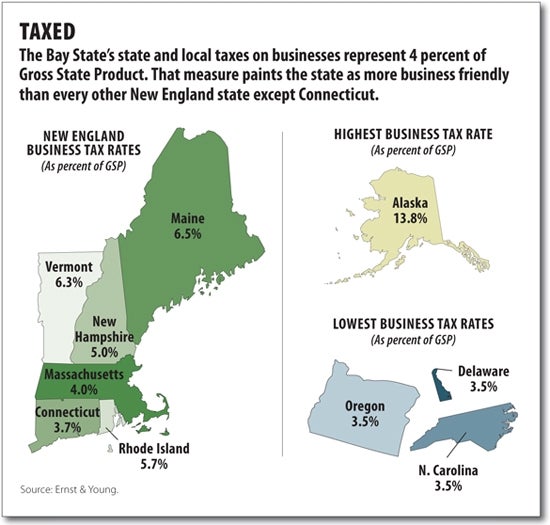

MassBudget cites a study conducted by Ernst & Young for the Council on State Taxation for fiscal 2009 that shows business taxes making up 4 percent of gross state product. That compares favorably to the U.S. average of 4.7 percent and leaves just eight states taxing less than Massachusetts.

But another study, the 2010 State Business Tax Climate Index released by the Tax Foundation, ranks Massachusetts at Number 36, well below the middle of the pack. Rather than measuring total tax burdens, the index is based mostly on how simple and evenly applied a state’s system of taxes is.

Spokeswoman Natasha Altamirano said the foundation opposes the use of tax policy to encourage particular behavior or favor specific types of businesses.

“We view it as, a state’s tax code should serve as a welcome mat for all industries,” she said. “If you have to give special treatment to certain industries to lure them, then that’s a sign that the tax system as it is isn’t luring them.”

The foundation’s rankings are based on five subindexes, and Massachusetts fares particularly poorly on the way unemployment insurance taxes, corporate taxes and property taxes are levied.

Richard Kennedy, president and CEO of the Worcester Regional Chamber of Commerce, said he’s been disappointed to see Massachusetts and local governments within the state add new types of taxes to handle budget shortfalls.

“As the economic crisis has really taken hold … everyone’s looking for sources of revenue,” he said.

Incentivized

Kennedy said focusing on certain industries, or businesses in certain stages of development, can seem unfair to companies that don’t fall within the targeted group.

But he said there can be value to tax incentives. He noted that Worcester has remained an economic center despite the loss of the bulk of its manufacturing jobs because the city and state supported growth in the education and biomedical fields.

“Had we not helped those industries along, I don’t know what the City of Worcester would look like today,” he said. “There’s a lot to be said for picking industries that have a future potential.”

Berger said he generally agrees with the Tax Foundation that the government shouldn’t give breaks to particular companies. But unlike that group, he said MassBudget favors using extra funds raised by eliminating incentives to support business-building public services like education rather than to give across-the-board tax cuts.

Berger said Massachusetts’ land, energy and labor costs will always keep it from being a cheap state to do business in, so it needs to compensate with high quality workers.

“The jobs we are going to be able to attract are high-value-added jobs,” he said.

Kennedy also said he believes the significance of taxes to a business climate can be overstated. In one study, he said, North Dakota came out as the lowest tax state.

“I’m not sure you’d find a lot of people moving to North Dakota,” he said.