It had been fairly well known in banking circles that Lowell-based Butler Bank was having trouble.

So, it wasn’t surprising that the bank failed on April 16. But what did come as a shock is that Bridgeport-based People’s United Bank was the winning bidder for Butler’s assets.

The failure of Butler is viewed by many in the industry as an anomaly, but the shakeout promises to change the dynamic in the local and state banking industry in a big way.

Immediately following Butler’s closure April 16 at 6:05 p.m. by federal regulators, it was acquired by People’s United, which has made it clear that the acquisition is one more step in its steady march toward Boston.

People’s United, long a household name in Connecticut, made its first move into the Bay State with the 2007 acquisition of Chittenden Corp., whose portfolio of banks included Worcester’s Flagship Bank. And its stake in the region got bigger after being the winning bidder out of five for Butler’s assets.

Timothy Crimmins, the president for People’s United’s two Massachusetts banks — Flagship and the Bank of Western Massachusetts — now has oversight of Butler. At the time of its closure by the FDIC, Butler had $233 million in deposits and four locations, including two in Marlborogh. Its Marlborough locations were part of Marlborough Co-operative Bank, which merged with Butler under one holding company in 2008, forming what at the time was a $300 million institution.

People’s United acquired all of the assets of Butler. However, it has a loss sharing agreement with FDIC, where the FDIC will assume 80 percent of the losses and People’s United will assume just 20 percent.

Risky Behavior

The trouble for Butler, according to Dave Brown, a consultant who was working with Butler officials since 2009, was one of aggressive construction real estate lending.

Brown, a former CPA with CCR of Westborough and founder of RMPI Consulting, said that when he first was brought in 2009, Butler had 36 percent of its loans in construction. Of that 39 percent, a majority of the loans were in a handful of large, 100-lot subdivisions in various locations in New England, including Maine and New Hampshire.

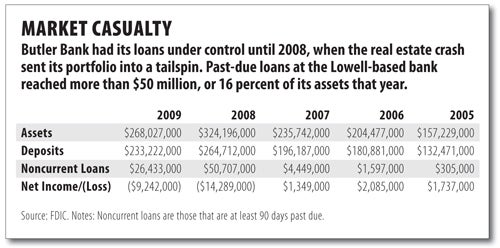

When the housing market collapsed in 2007, those large, speculative projects collapsed right along with it, leaving Butler under-capitalized. The exposure was substantial, according to records with the FDIC. At the end of 2008, Butler had $50.7 million in “noncurrent loans,” or loans that were 90 days past due. Managers were able to chip away at that total slightly, but the bank still had more than $26 million of noncurrent loans at the end of 2009.

Transition

Despite the past troubles, Crimmins and People’s United are hopeful about their acquisition.

Crimmins said that the process to close the bank and execute the acquisition went quickly, but smoothly. Butler’s branches were shut down on a Friday at 6:05 p.m. and reopened the next day with the same staff under the People’s United name.

“It’s really business as usual,” Crimmins said. “All the employees are still in place, and I think the customers were very reassured to see the familiar faces.”

The real change may come now that People’s United, still a relatively unknown entity in the Central Massachusetts market, gains further traction in the region, and particularly in MetroWest.

“It remains to be seen how aggressive People’s United will become in this marketplace,” said Rick Bennett, president and CEO of Marlborough Savings Bank, which is located across the street from one of newly acquired People’s United locations. “I think we’ll probably see a lot of marketing and advertising dollars spent.”

And while the People’s United name has played second fiddle to the Flagship Bank name in Central Massachusetts, it’s not likely to stay that way for long. People’s United has said it plans to gradually transition the Flagship name out of use.

People’s United — with $20.6 billion in assets and 300 branches — has a reputation as a deep-pocketed institution with a relatively conservative risk profile, according to Damon DelMonte, an analyst with Keefe, Bruyette & Woods.

Its expansion in Massachusetts has largely been fueled by its strong capital position. In 2007, the bank went through a conversion from a mutual holding company structure to a fully publicly-owned stock form holding. That process raised $3 billion in capital, and ever since then, its management has been very open about its appetite for acquisitions, including FDIC-assisted transactions like the one involving Butler Bank, according to DelMonte.