In the midst of five straight weeks of surging unemployment claims, Gov. Charlie Baker asked the federal government for a $1.2 billion loan to help Massachusetts meet unprecedented needs and ensure that people do not suffer through payless paydays.

Baker wrote to U.S. Labor Secretary Eugene Scalia on April 6 requesting the funding, an administration spokesperson confirmed. In his letter, obtained by the News Service, Baker estimated that Massachusetts will need to supplement its coffers with an advance of $900 million from Washington to pay unemployment benefits in May and another $300 million for June.

In need of a cash infusion soon, the state’s unemployment insurance trust fund balance has dropped by more than half, down to about $750 million, since the start of March amid record levels of applications.

Another wave of claims reported Thursday brought the five-week total in Massachusetts to more than 650,000, and that figure does not include the more than 200,000 formerly ineligible workers who are now seeking aid under an expanded program launched Monday to assist the self-employed and independent contractors.

[Related: Mass. unemployment claims fall 22%, but funds are half depleted]

Between April 12 and April 18, about 4.4 million more Americans and 80,000 more Massachusetts residents filed initial unemployment claims, according to weekly data from the U.S. Department of Labor.

Both new figures were the lowest increases since late March — the state’s claims peaked at 181,423 between March 22 and March 28 — but were still several times higher than any pre-pandemic record.

The most recent one-week high in the United States was 665,000 initial claims, reported in late March 2009 at the peak of the Great Recession.

Between March 15 and April 18, almost 26.5 million workers nationwide and about 653,000 in Massachusetts have sought jobless aid, an unprecedented rush with businesses across the country closed to avoid spreading the highly infectious coronavirus that has killed nearly 45,000 people in the United States.

Baker told reporters Thursday that the department is seeing “10 to 15 times” as many applications per week as any previous record.

As massive as those numbers are, they do not reflect the full scale of COVID-19’s economic impact on Massachusetts: in just three days, the state received nearly a third as many claims from newly eligible unemployed workers as it did in the past five weeks from workers who already qualified for jobless aid.

The Pandemic Unemployment Assistance program, outlined by Congress in the so-called CARES Act, extends eligibility to those who previously did not qualify for unemployment benefits such as self-employed, contracted workers and gig employees.

After launching the program Monday to accept those claims, the Executive Office of Labor and Workforce Development announced Thursday that more than 200,000 individuals — none of whom are counted in the federal figures on standard unemployment claims through April 18 — already filed applications.

“Those folks, in many cases, are probably going to start getting their checks next week, which is a great thing,” Baker said during a Thursday press conference.

Continuing claims, which reflect how many workers seek benefits beyond their initial applications and are reported on a one-week lag compared to new claims, are also at high levels. Through the week ending April 11, nearly 16 million people in the United States and 464,000 in Massachusetts applied for ongoing aid, the Department of Labor reported.

If no workers filed initial claims more than once, the 653,000 total applications for standard unemployment assistance filed between March 15 and April 18 would represent about 17.5 percent of the Massachusetts labor force.

The state unemployment rate in March was 2.9 percent.

In a report following the release of Thursday’s numbers, Pioneer Institute Research Director Greg Sullivan estimated that the Massachusetts unemployment rate is now “at least 20.4 percent.”

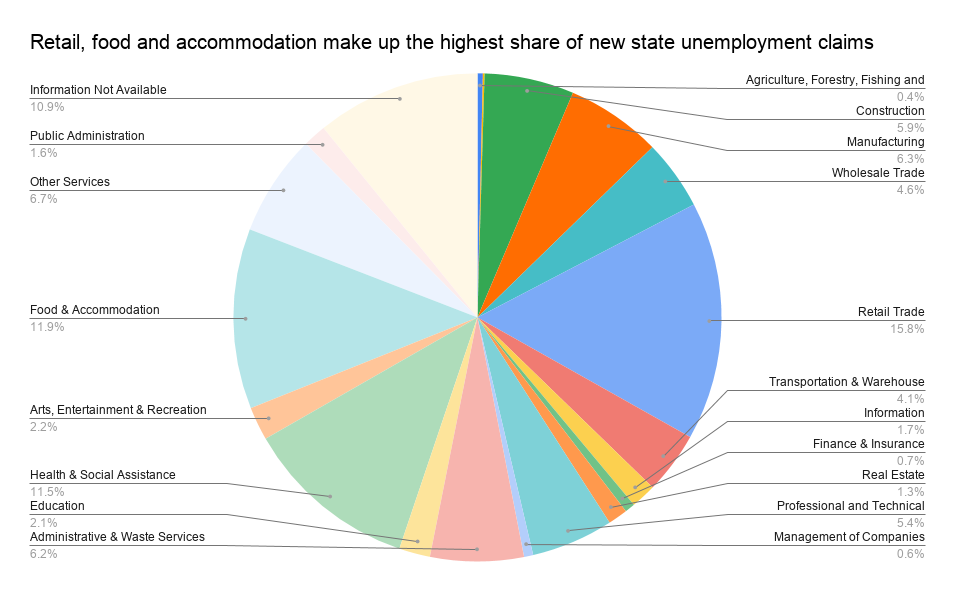

Job losses have been particularly sharp in restaurant, retail and hospitality industries that have seen business evaporate amid stay-at-home advisories.

The Massachusetts Department of Unemployment Assistance is paying benefits to almost 400,000 workers, and a customer service staff that once totaled about 50 employees is now up to almost 1,000 to handle the influx, according to the department’s Thursday press release.

The flood of claims has put significant strain on states. In Massachusetts, the unemployment insurance trust fund’s balance has dropped 54 percent amid the state of emergency, from about $1.63 billion on March 1 to $748 million on April 16, according to data from the U.S. Treasury.

Baker’s request, if fulfilled, would bring $1.2 billion in federal dollars in to help the state fulfill its obligation for unemployment benefits.

Massachusetts is not the first state to make such a request: New York sought a $4 billion no-interest loan to help replenish its own dwindling unemployment insurance reserves, according to a Wall Street Journal report that named Massachusetts as having the largest trust fund balance decline between February and mid-April.

Two recent reports, one from The Tax Foundation and another from the Pioneer Institute, estimated that Massachusetts could deplete its fund some time between May and July.

In addition to prompting requests for federal help, any significant shortfall could also prompt Massachusetts to charge higher unemployment insurance rates on businesses, Pioneer Institute authors Gregory Sullivan and Charles Chieppo wrote.

Costs of paying PUA benefits, which max out at the same $823 per week rate as the standard program, will be reimbursed by the federal government, as will the additional $600 per week all unemployment insurance recipients receive through the CARES Act.

States, through premiums paid by employers, cover the costs of unemployment benefits for all other recipients.