Initial unemployment claims in Massachusetts remained at crisis levels last week but fell 22%, the third straight weekly drop.

The unprecedented surge in claims has already forced the state to use most of its unemployment insurance fund, which stood at more than $1.6 billion at the start of March.

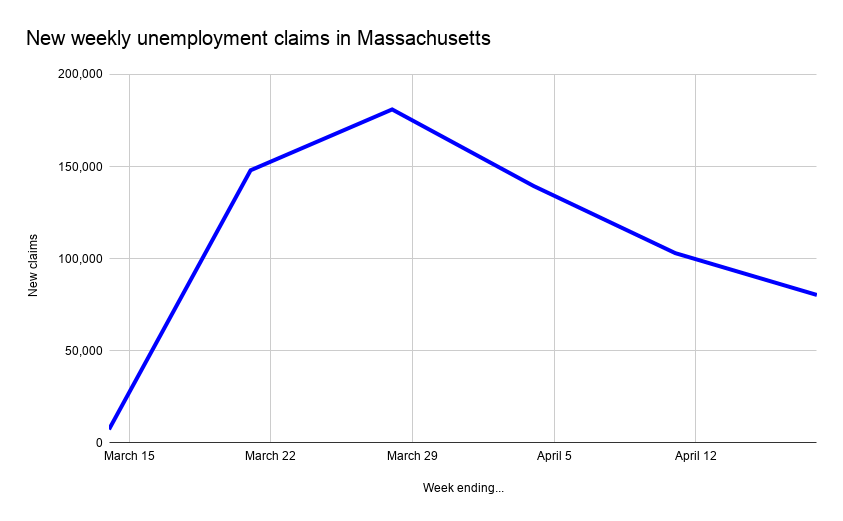

The new data from the U.S. Department of Labor on Thursday indicates many who’ve been left without work, at least temporarily, because of the coronavirus outbreak, may have already been laid off. The peak for new unemployment claims for Massachusetts was the week ending March 28 with 181,032 claims.

[Related: Baker seeks $1.2B loan to pay jobless benefits]

For the week ending April 18, there were 80,345 new claims made. That was a drop of roughly 23,000 from the prior week.

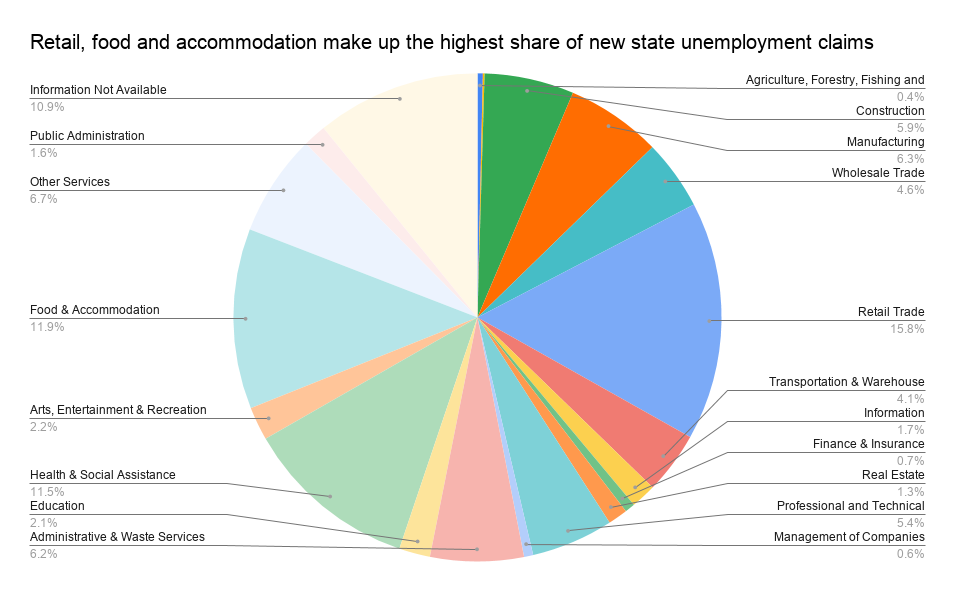

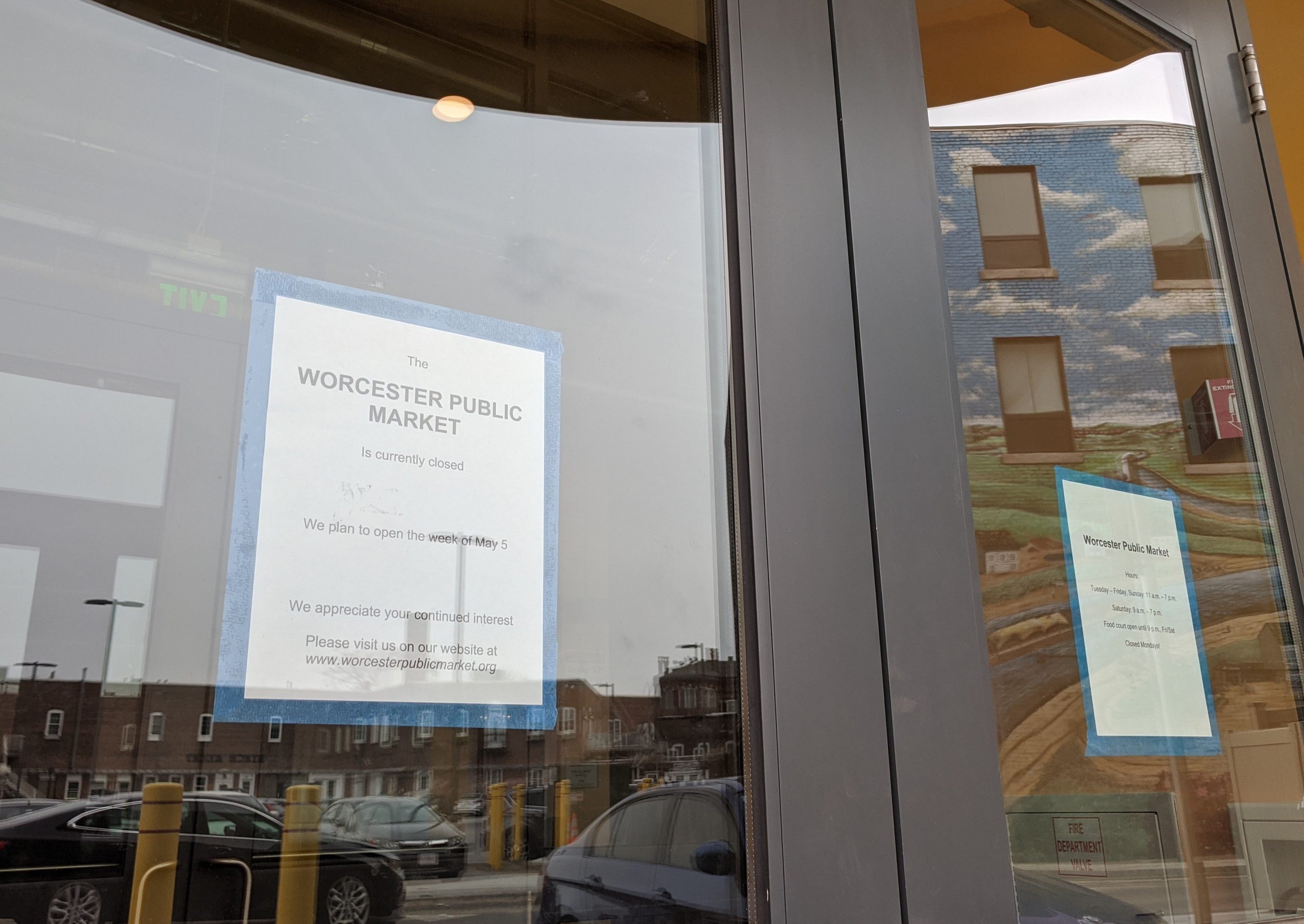

Still, Massachusetts and the rest of the nation have seen an unprecedented surge in unemployment claims as the pandemic has forced many businesses to close or dramatically reduce their hours, especially in retail, food and hospitality. A Massachusetts Restaurant Association survey showed four out of five restaurants in the state have closed at least temporarily.

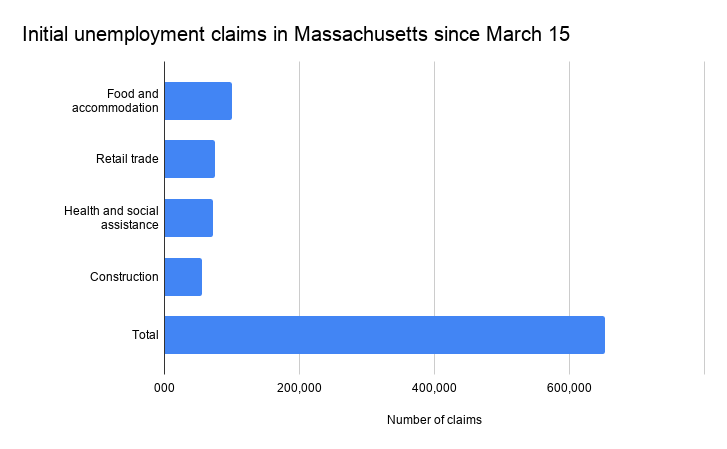

In the week ending April 18, claims in Massachusetts were highest in retail (12,669), food and accommodation (9,564), and health and social assistance (9,249), according to the Massachusetts Executive Office of Labor and Workforce Development.

In the last five weeks, 651,862 Massachusetts workers have filed unemployment claims — equal to about 18% of the state’s workforce.

In the span of just a month and a half, Massachusetts has burned through more than half of its unemployment insurance fund, a result of both economic turmoil brought by the coronavirus pandemic and relatively generous benefits to unemployed workers.

At the start of March, the state’s fund had more than $1.6 billion, up from $640 million from five years ago, thanks to a long period of economic growth where the state’s unemployment rate dropped to 2.9% in March. That figure, which doesn’t account for the job losses that soon followed, was sixth best nationally, according to the U.S. Bureau of Labor Statistics.

In a flash, more than half of the state’s unemployment funds are now gone.

The fund was down to $748 million through April 16, according to the U.S. Treasury, which tracks states’ unemployment insurance funds. That’s a drop of 54%.

Massachusetts appears to have burned through its fund faster than any state, which also factors how much the state has already paid out to unemployed workers unlike states with far fewer claims approved. A Wall Street Journal report that tracked states’ funds since February said Massachusetts had used the largest share, followed by New York, California and Illinois.

The nonprofit Tax Foundation ranked Massachusetts among the worst nationally in terms of how long states can continue paying benefits. The state was tied for 46th, with just six weeks of payments available, according to the agency’s report April 9.

The state has been hit with a flood of unemployed workers, especially in food service and retail, as many have been forced to close or dramatically cut back their operations. Gov. Charlie Baker has required non-essential businesses to close through May 4.

Nationally, claims also remained exceptionally high last week, even after falling from previous weeks.

The U.S. Department of Labor reported more than 4.4 million new claims on a seasonally adjusted basis, down 810,000, or about 18%, from the prior week. Weekly national claims exceeded 6.6 million for two consecutive weeks ending April 4, setting new records.

More than 26 million unemployment claims have been filed in the past five weeks.