The federal government will begin accepting applications again to the Payroll Protection Program on Monday morning, about a week and a half after the program was halted because it ran out of money.

The initial $349-billion program, part of the federal $2-trillion CARES Act meant to help businesses and governments through the coronavirus pandemic, started April 3, the program gave loans of up to $10 million to small businesses, nonprofits and those who are self-employed but ended when it ran out of money April 15.

Congress appropriated another $320 billion this week, and the U.S. Small Business Administration will resume accepting applications for the program at 10:30 a.m. Monday, the SBA announced late Friday afternoon.

Nearly 47,000 small Massachusetts businesses have received or were approved for $10.4 billion through the first PPP phase. Massachusetts ranked ninth nationally in both the number of businesses awarded and the amount its businesses received.

Nationally, nearly 1.7 small businesses received aid, with more than 30 million jobs protected, according to the SBA.

The largest share of funds, nearly 24%, were for loans between $350,000 and $1 million, according to the SBA. Another 17% are loans of less than $150,000, and 9% are for loans of more than $5 million. The program provides loans of up to $10 million to businesses and nonprofits with fewer than 500 employees with a portion eligible for forgiveness if businesses use the money to keep people employed.

Construction companies were the largest recipient nationally at more than 13% of funding awards. That’s followed by professional, scientific and technical services at nearly 13%, manufacturing at 12%, health care and social assistance at nearly 12%, accommodation and food services at less than 9% and retail with less than 9%.

In another component of help for businesses hurting during the coronavirus pandemic, called Economic Injury Disaster Loans, 509 Massachusetts businesses were approved for loans and 16,538 approved for advances. The loans combined totaled $103.8 million and advances combined for $76 million.

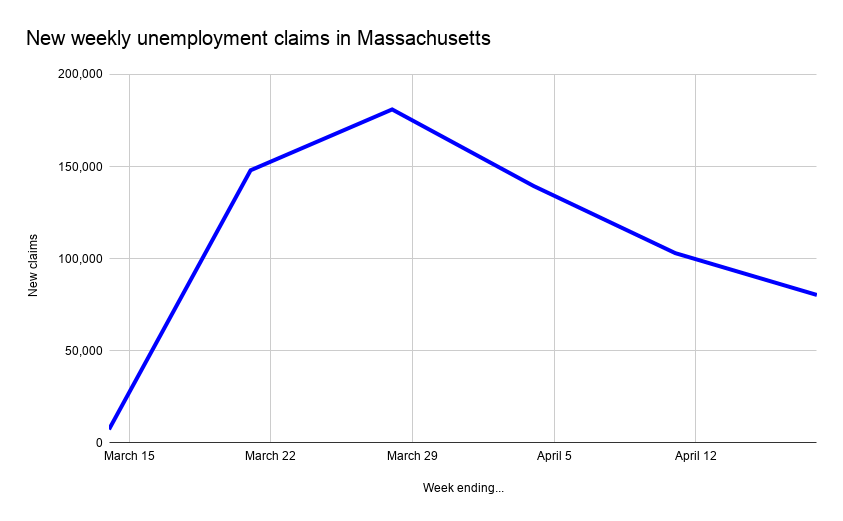

Unemployment in Massachusetts and nationally has spiked despite the federal action, particularly in food service and retail.

For the week ending April 18, Massachusetts residents made 80,345 new unemployment claims, bringing a five-week total to nearly 652,000, or roughly 18% of the state’s workforce, according to the U.S. Department of Labor. Across the United States, more than 4.4 million new claims were filed last week, bringing the national five-week total to more than 26 million.