The business community received a couple of well-timed gifts from the Worcester City Council in time for Christmas: the first, a 10-year tax increment financing agreement for the developer of two downtown-area hotels, including a much-desired, higher-end facility for the CitySquare project, and narrowing the gap in the residential and commercial/industrial property tax rates.

Both actions were significant. But it’s the further narrowing of the tax gap that sends a more important long-term message that the city continues to move in the right direction to create greater equity in its two-tiered system. In the broader picture of factors that drive economic growth, some argue that property taxes are relatively low priority when they’re measured against the overall appeal of the location, proximity to markets, accessibility to transportation routes or the availability of skilled workers. But make no mistake: how a city or town taxes its businesses is a simple, first-impression measure that can sway an entrepreneur or executive in the early stages of a decision to either locate or expand there.

Over the last several years, Central Massachusetts has come to realize that there needs to be a stronger link between businesses and the communities in which they reside. Especially with the increased importance placed on public education and the tax dollars needed to pay for it, that link becomes more critical for the Bay State’s cities and towns, which must continually examine their assets and liabilities in attracting and fostering business, given the relatively high cost associated with running a business here.

Other communities, especially the larger ones, have gotten that message. Like Worcester, Boston has narrowed the gap between its residential and commercial/industrial rates. Closer to home, Marlborough, another town with dual tax rates that has enjoyed key additions to its business base the last couple of years, has done the same.

Business growth is also important to cities with larger percentages of tax-exempt property in their tax base. That’s the case with Worcester, which has the highest percentage of tax-exempt property — nearly 29 percent — in Central Massachusetts.

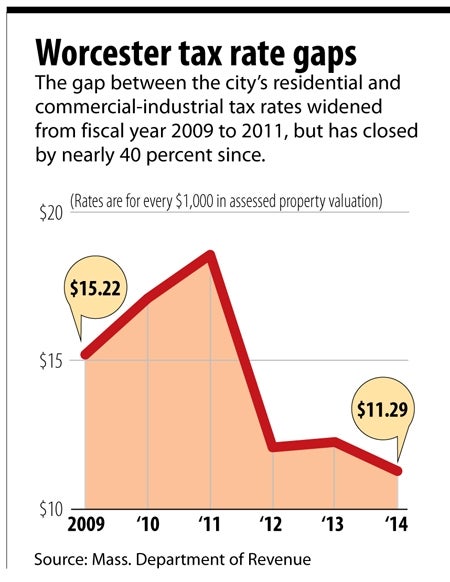

Business interests led by the Worcester Regional Chamber of Commerce have been arguing for greater tax-rate equity for some time now, and rightfully so. Returning to a single tax rate, as it was in 1984, will take many more years given the baby-step pace that is being taken toward parity. Do it too quickly and the city’s elected officials risk raising taxes disproportionately on homeowners, which would invite a backlash that no politician looking to stay in office is willing to absorb. The city council’s vote last month narrowed the gap between commercial/industrial and residential rates from $12.27 per $1,000 assessed valuation to $11.29. That translates to an average property tax increase of 4 percent both for homeowners and businesses. That’s fair for both sides, and keeps the momentum going in the right direction.

It’s critical that this narrowing trend continue for business-growth advocates to continue to market the city aggressively as a great place to do business. It might take another 10 years, but closing the gap remains critical to expanding the city’s economy.