Don’t want to buy in Worcester? That’s just fine by Salvatore Mula, a Hudson-based developer who plans to add three Worcester rental properties to his real estate portfolio by mid-July.

Mula said that he never considered investing in property in Worcester in the past, a result of the city’s hard-to-shake reputation, he admits.

But Mula changed his mind when he realized he could make a solid profit.

“You get a good return in Worcester compared to other towns going closer to Boston,” Mula said, explaining that real estate prices in Worcester are relatively low, while average rents are decent.

Mula, who owns more than 30 units in Central Massachusetts communities, is far from the largest landlord in the city. But he is seizing an opportunity provided by increased demand for rental dwellings.

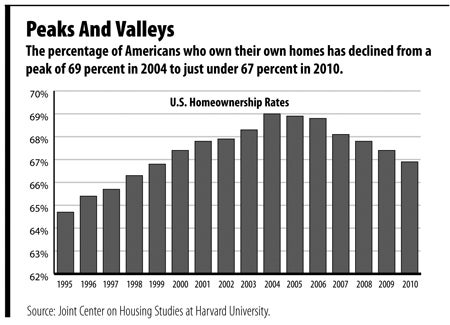

Renter households across the country increased by 3.4 million from 2006 to 2010 while the number of owner households fell by 1 million, according to a recent report from the Joint Center on Housing Studies at Harvard University. Rent prices also started to trend upward during 2010 and vacancy rates started to decline.

Young people are not entering the ownership class like they were in the past and older owners are selling in favor of renting, the study says. And though tenants’ income levels have not kept pace, demand for rental property has driven up rents.

Ed Murphy, CEO of WeRentCentralMass, a Worcester-based listing and rental company, said he has certainly seen those trends here.

Murphy said that a three-bedroom apartment in Worcester was renting for around $800 per month three years ago. That rent has now risen to around $1,100.

And an influx of newcomers to the rental market has created a demand for higher-end apartments, Murphy said, which is something Worcester has historically not had.

“There’s no inventory,” Murphy said. “The city is filled with triple deckers.”

The newcomers are former owners who have lost their homes to bankruptcy, downgraded to a smaller home to rent out their old house or people with good incomes that would normally become buyers, but are holding off because of concerns about the economy or their jobs, he said.

“The influx of people who are losing homes and renting instead are really taking the middle to high-end rentals off the market,” Murphy said.

And there are plenty of those people, according to the Harvard University report, which analyzed the state of the housing market.

Renter households across the country increased by 3.4 million from 2006 to 2010, according to the report, while the number of owner households fell by 1 million. That is the complete opposite of the prior decade’s trend.

Indeed, the report states that the rental market may be “one bright sign” in an otherwise bleak housing market that is showing “no convincing signs of a broad turnaround.”

Multifamily Rebound?

The Harvard report predicts that the high level of demand for rental property could help to spur a rebound in multifamily housing construction starts.

The report notes that the Federal Housing Administration has nearly quadrupled its multifamily mortgage volume over the past two years, to $3.8 billion.

Carl Foley, president of Worcester-based Botany Bay Construction, said that his company is optimistic about the future of multi-family housing. The company’s apartment vacancies are lower than ever and it is expecting final approvals soon for a 32-unit apartment complex on June Street in Worcester.

And whether it is larger apartment communities or multifamily homes, Mula, the Worcester newcomer, thinks other investors are starting to the get the idea.

He said he recently made an offer on a foreclosed property that was $7,000 over the asking price.

Other contractors and developers were also interested in the property.

“I didn’t get it,” Mula said, of having his offer rejected. “Somebody else paid more.”