News that Fidelity Investments is closing its 1,100-person Marlborough campus and moving jobs mostly to New Hampshire and Rhode Island did not come as a surprise to Steve Poftak, director of research for the Boston-based Pioneer Institute.

Four years ago Poftak co-authored a study that created a fictional company and analyzed its earnings in seven states including Massachusetts, Rhode Island and New Hampshire. Given all other equal factors — same workforce size and building dimensions — the Pioneer Institute found that when operating in Massachusetts, the firm had costs that were 20 to 30 percent higher than when it was located in New Hampshire, Texas or North Carolina. As a result, average after-tax-profits for the fictional company were twice as much outside of Massachusetts than in those three states and 25 percent higher in Rhode Island.

That was four years ago, but Poftak said little has changed. The underlying issues that create a high-cost-of-business environment in Massachusetts remain.

And that, he said, could be one of the reasons Fidelity is moving out of Central Massachusetts.

Officials with the Boston-based investment bank giant cited the company’s shrunken workforce over the past few years as a reason for consolidating its New England locations. The company’s three locations outside of Marlborough, in Smithfield, R.I., Merrimack, N.H. and Boston, each have at least three times as many employees, according to Vincent Loporchio, a spokesperson for the company.

There were “a number of factors” the company considered when deciding to close the Marlborough campus — which he said has served the company well — by the end of next year, Loporchio said.

The cost of doing business was surely one of those factors, Poftak said and there are numerous culprits that could be putting Massachusetts at a competitive disadvantage compared to neighboring states.

New Hampshire, for example, has no personal property tax, income tax, sales tax or capital gains taxes.

“Simply put, we don’t take your taxes and we don’t give out as many tax breaks,” said Michael Bergeron, business development manager for the New Hampshire Division of Economic Development.

Rhode Island, through its economic development office, has been pumping tens of millions of dollars into Fidelity’s Rhode Island campus for the last 15 years, according to state officials there.

Massachusetts did create a tax credit in 1996 specifically designed for mutual fund companies that is still available today.

But Poftak said it’s about more than these individual standards. It’s about an overall business climate.

Take property taxes, for example. Fidelity owns close to 700,000 square feet of office space in Marlborough, which has a split tax rate. Marlborough businesses are taxed $27.55 per $1,000 of assessed value, compared to the $13.94 per $1,000 of assessed value for homeowners.

In Smithfield, R.I., Fidelity pays $19.90 per $1,000 of assessed value for its more than three-building campus in town, according to the local assessor’s office.

Merrimack, N.H.’s rate is $19.53 per $1,000 of assessed value, a 30 percent discount on property taxes compared to the Fidelity’s MetroWest campus.

So, is Massachusetts better described as “Taxachusetts?”

“I don’t think so,” said Michael Widmer, president of the Massachusetts Taxpayers Foundation, another Boston-based public policy research group.

The original label, he said, may have been deserving in the 1980s when the state was a high-tax environment, but he said that’s not as much the issue today.

“Broadly speaking, we’re in the middle of the pack” compared to national standards, he said.

One area where the Bay State is definitely more costly is when it comes to unemployment benefits, which are handed out longer in Massachusetts for 30 weeks, more than any other state in the country, according to the Associated Industries of Massachusetts.

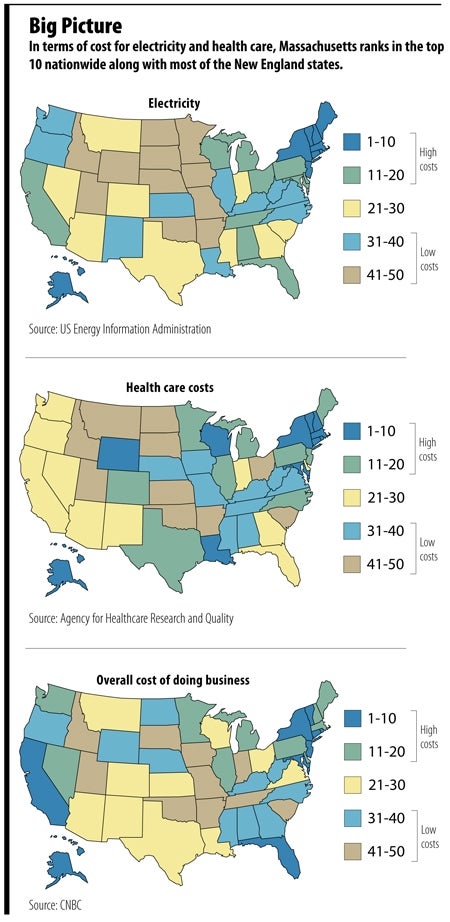

Electricity is another high-cost area. Only three states — Connecticut, New York and Hawaii — have higher commercial electricity costs, according to the U.S. Energy Information Administration’s monthly price report.

But the state does outperform in other areas.

Massachusetts actually has some of the most reasonable worker’s compensation rates in the country, according to the state of Oregon’s department of consumer and business services, which annually ranks average worker’s compensation costs of all 50 states, plus the District of Columbia. Massachusetts has the seventh most competitive rates in the country, whereas Rhode Island ranks 23 and New Hampshire ranks 41.

Poftak, with the Pioneer Institute, said that’s good, but it’s chump change compared to property taxes and other expenses that are higher in the commonwealth.

However, Massachusetts has some qualities over the rest of the nation.

In a CNBC ranking, the Bay State placed tops in America in terms of education and second in access to capital.

But according to Bergeron, the New Hampshire economic development official, that’s a benefit neighboring states can also take advantage of.

With just a little bit of a longer commute for most employees, businesses can save and still access the human capital in Massachusetts by locating in close-by states.

“New Hampshire’s got the best of both worlds,” he said.