Some of Worcester’s proposed housing projects falling by the wayside isn’t helping the region’s housing crisis.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

At the beginning of the decade, it was reasonable to think Worcester may be heading down a path to slowly build itself out of its housing crunch.

A number of prominent parcels had become available to potential multi-family construction, leaving developers with more options to choose from. With a growing population and the lowest lending rates seen in some time, Worcester seemed ripe for a full-throttle residential housing boom, with developers lining up to get in on the action.

Then, the prevailing winds of the market shifted dramatically. A three-headed monster in the form of difficulties raising capital, larger construction costs, and higher labor expenses struck, interfering with planned developments in the city.

This has brought a consistent trend of developers going back to City of Worcester government officials seeking extensions for permits. Other residential projects have been canceled altogether.

“There were problems that we were having with the supply chain, and for a little while there were some problems with the banking system,” said Joshua Lee Smith, a partner at Worcester law firm Bowditch & Dewey, who represents a number of these projects. “It all kind of went into a very perfect storm.”

However, it hasn’t been doom and gloom for every project. While some have languished, others ranging from affordable projects to luxury buildings have gotten over the finish line. Capital access played a role, as did timing.

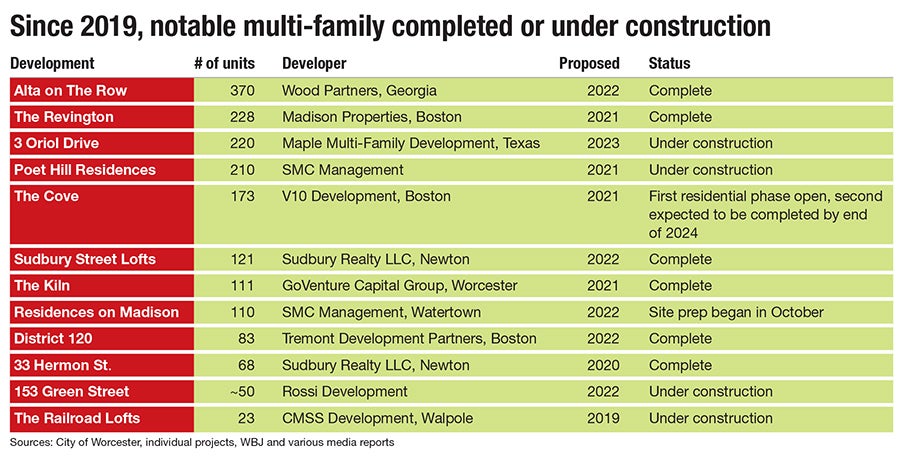

Some of Worcester’s proposed housing projects falling by the wayside isn’t helping the region’s housing crisis, where a lack of available housing is causing prices to climb and housing costs are taking up a larger portion of residents’ incomes. While the city has seen more than 1,300 residential units added to its inventory since 2019, rents continue to increase.

The average asking rent in the city is $1,950, which is 12.2% higher than the national average of $1,726 and a figure which has grown 21.2% since 2020, according to real estate data firm CoStar.

CoStar projects the average asking rent in Worcester to eclipse $2,000 in 2025.

Biding for time

Speaking at a Worcester Regional Chamber of Commerce event in November, Smith said the amount of extensions he’s seeing requested by developers for projects is growing to record numbers.

“I’ve been a land-use attorney with Bowditch for about 20 years, and I’ve never had a period [like] the last two-plus years we’re I’ve had to submit [this many] requests for extensions of permits on behalf of clients,” Smith said. “Developers are having trouble penciling out projects.”

Smith later told WBJ the flood of delayed multi-family projects wasn’t limited to just Worcester, but was boosted by the fact some were rushing to have their projects submitted before the City of Worcester’s new inclusionary zoning rules went into effect.

By doing so, they avoided the requirement that projects either reserve a portion of the building’s units for affordable housing or pay a percentage of the total construction costs to the City’s Affordable Housing Trust Fund.

Since this rush to submit, the financial environment for multi-family projects has changed dramatically.

Developers requesting extensions have consistently cited the same reasons: Difficulties accessing capital due to inflation and interest rates, the instability of the banking system, and an overall slowdown in commercial real estate.

These issues have been persistent, and with some exceptions, have largely driven down new multi-family construction nationally. In the Worcester metropolitan area, apartment units under construction peaked at 1,516 in the third quarter of 2023, falling to 551 so far in the last quarter of 2024, according to CoStar.

Delays and cancellations

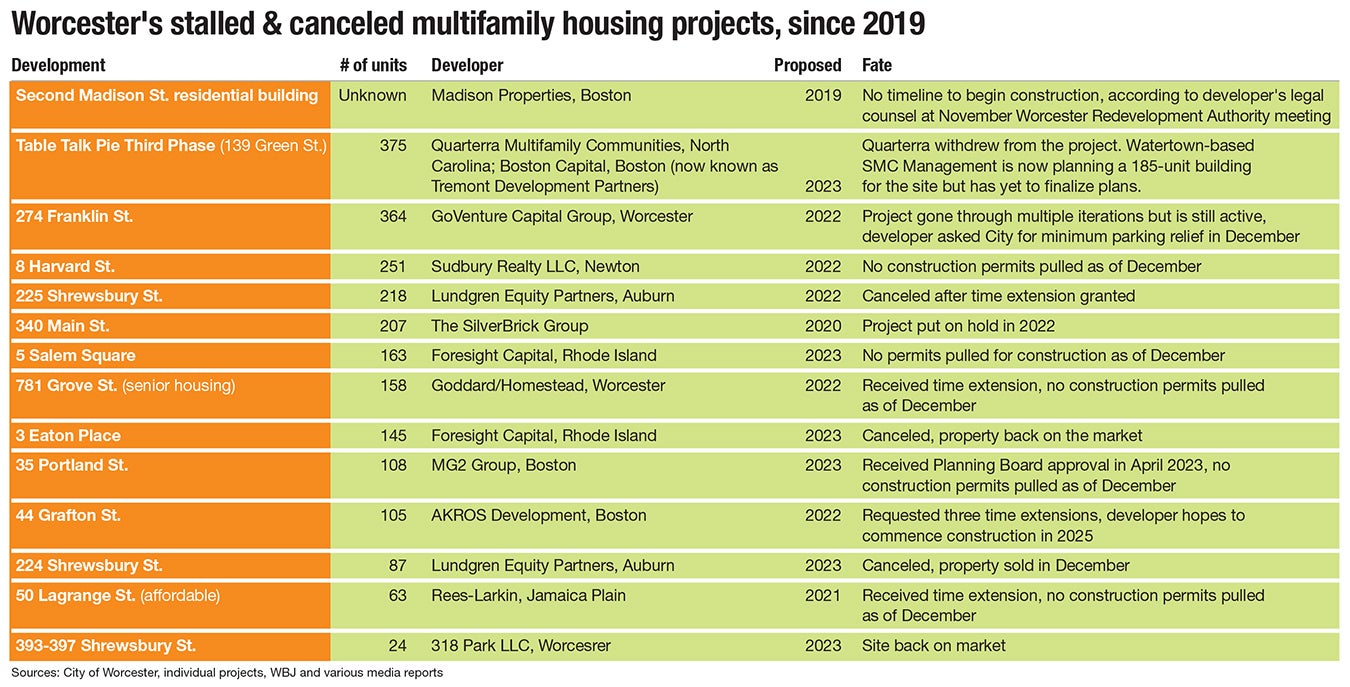

The number of total residential units in Worcester proposed since 2019 but not yet built eclipses 600, while at least 825 units have been outright canceled. Hopes for more residences on Shrewsbury Street in particular have been hurt by the cancellation of two projects set to be led by Auburn-based Lundgren Equity Partners, which saw a combined 305 units axed.

It doesn’t just come down to the developer, as some firms have success getting one project over the finish line only to see others delayed.

Perhaps the most prominent example of a developer with a mixed record of success is Boston-based Madison Properties, the developer behind The Revington, a 228-unit building in the Canal District, across the street from the Polar Park baseball stadium.

The Revington has had some success in attracting tenants since opening in late 2023, even with an average asking rent of $2,608, about 29% higher than the city average. The building has a vacancy rate of about 23%, according to CoStar, consistently shrinking since opening at a rate relatively consistent with other newly built apartments in the area.

Still, Madison Properties’ priority is focusing on stabilizing The Revington, rather than moving forward with a second residential building or other properties it had planned for the Ballpark District, which were supposed to contribute to the City’s efforts to pay for Polar Park.

Longtime Worcester attorney Mark Donahue, serving as counsel for Madison Properties President Denis Dowdle, declined to get into the nuances of Madison’s capital-raising struggles, despite a vigorous line of questioning from Chair Michael Angelini during a Worcester Redevelopment Authority meeting.

Donahue said Madison Properties was still committed to constructing the building but would only do so when it had felt it was ready and had financing in place, alluding to the same issues cited by other developers seeking time extensions from the Zoning Board of Appeals.

Referring to the broader issue of developers pausing or abandoning projects, Michael Jacobs, principal at NAI Glickman Kovago & Jacobs in Worcester, said it mostly comes down to economics.

“It’s primarily due to financing terms,” he wrote in an email to WBJ. “Lenders from the institutional arena, to private investment, to regional banks, tightened their terms for multi-family developments over a year ago [for projects] that had not commenced.”

Navigating the headwinds

The Revington wasn’t alone in its ability to get open despite tough market conditions.

District 120, an 83-unit affordable housing building located next to Polar Park, opened in May, with a lottery for units drawing 750 applicants. The project benefited from a $19.6-million tax-exempt bond from MassDevelopment.

Alta on The Row, a 370-unit project from Georgia-based Wood Partners on the former site of the Our Lady of Mount Carmel church, opened in May as well.

One of the largest multi-family developers in the country, Wood Partners owns more than 20,000 apartment units in 20+ cities across the country, according to its website, with more than 50 construction projects slated for completion in 2024 and 2025. The firm has developed 65.48 million square feet of residential space since its founding in 1998, according to CoStar.

Wood Partners is majority owned by Fayez Sarofim & Co., a global equity investment management firm based in Texas managing $25 billion for institutional and high net-worth clients, according to the firm’s LinkedIn page.

When developing The Cove multifamily project with its 173 units in the Canal District, Boston-based V10 Development President John Tocco was glad to have the financial support of three banks, led by Lowell-based Enterprise Bank with $58.5 million in financing. Weymouth-based South Shore Bank and Webster First Federal Credit Union also participated.

That addition to the project’s capital, combined with a bit of fortunate timing, allowed The Cove to get over the finish line and open for some residents this fall.

“The market was just really starting to turn,” Tocco said. “It started, and it was at that early stage, so we're able to lock in a decent rate. At the time we thought it was high, but … we're in decent shape now with what rates are today.”

If the project had started just a few months later, it would have been much harder to complete given the changes in the financial landscape, Tocco said.

It’s too soon to know exactly how fast The Cove’s occupancy rate will climb. The building opened an initial phase of 112 apartments, with the remainder expected to come online by the end of 2024. A first-floor restaurant and candlepin bowling center is expected to follow in early 2025.

The building’s average asking recent price of $2,468 has caused some sticker shock on social media, particularly from the Central Massachusetts’ lifelong residents, who are confronting a rising cost of living.

Tocco thinks it’s all relative. While the building’s tenant demographics have yet to shake out, renters from as far away as California have moved in. Those moving from cities like Boston have noted the Canal District’s most expensive digs are a steal compared to rents seen elsewhere.

“We recently had a gentleman move out here from the Seaport,” he said. “When you’re comparing it to the sticker shock of the Seaport, he thinks he’s getting tremendous value.”

Moving forward

The City of Worcester is doing an admirable job of helping housing developments reach completion, Smith said.

“I hold Worcester in high regard with respect to its promotion and support of housing, and I think they do what they can to encourage it in a responsible and fair way,” he said.

Some ways the City could boost multi-family projects include reconsidering minimum parking requirements, which can force developers to build more parking infrastructure than needed and has the potential to run counter to the City’s goal of making Worcester more walkable and transit-oriented, he said.

Another option would be tweaking the City’s inclusionary zoning rules, he said. Regulations say any developer who is choosing to make payments-in-lieu of adding affordable units to their project must pay a fee equal to 3% of their total construction costs.

With construction costs already ballooning, developers of large housing projects who are facing large payments may move on to a different municipality, resulting in no contribution to the affordable trust fund.

Smith says adding a cap to the total amount of payments-in-lieu or modifying the 3% figure may be a win-win.

Either option “would entice developers to the city and also potentially add some more dollars to the affordable housing trust,” he said.

While from Smith’s perspective he feels boards were beginning to become weary of giving developers perpetual extensions for projects, Gov. Maura Healey signed the Permit Extension Act in November. In the name of job creation and economic development, this bill takes this decision out of the hands of local authorities in regards to some housing projects, giving them an additional two years beyond its otherwise applicable expiration date.

“That's a huge win for developers who may have been at their last ability to request extensions,” Smith said.

For projects still languishing in the pipeline, Jacobs of NAI Glickman sees two potential sources of relief in the future: more affordable housing initiatives and banks regaining interest.

“The federal government, the state, and cities are offering higher affordable housing incentives in 2025, so that will certainly motivate that sector to continue developing,” he wrote. “Many banks and private investors are poised to rejoin the multi-family market rate sector as well, so I believe activity will increase overall next year.”

Eric Casey is the managing editor at Worcester Business Journal, who primarily covers the manufacturing and real estate industries.