Home prices are soaring, and there’s virtually no inventory on the market. It’s a phenomenon not at all unique to Central Massachusetts.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Home prices are soaring, and there’s virtually no inventory on the market. It’s a phenomenon not at all unique to Central Massachusetts.

Single-family home prices had already been on a long, steady climb across Massachusetts, which has one of the country’s most expensive residential real estate markets. The coronavirus pandemic, despite the coinciding recession, has only made prices rise higher still.

“COVID just magnified it 10 times,” said Mike DeLuca, the president of the Realtor Association of Central Massachusetts.

Few areas of the residential real estate sales market have been untouched by the pandemic.

Open houses are being held with staggered appointment times so crowds that often arrive for showings can tour a home safely. Areas popular for second homes, such as on the Cape and Islands or in the Berkshires, are seeing the highest spike in demand. Bidding wars are far more common in places that rarely, if ever, saw them before.

But most of all, a withering supply of homes and sky-high demand have sent prices virtually everywhere into territory that in some Central Massachusetts towns might have been impossible to believe a year or more ago.

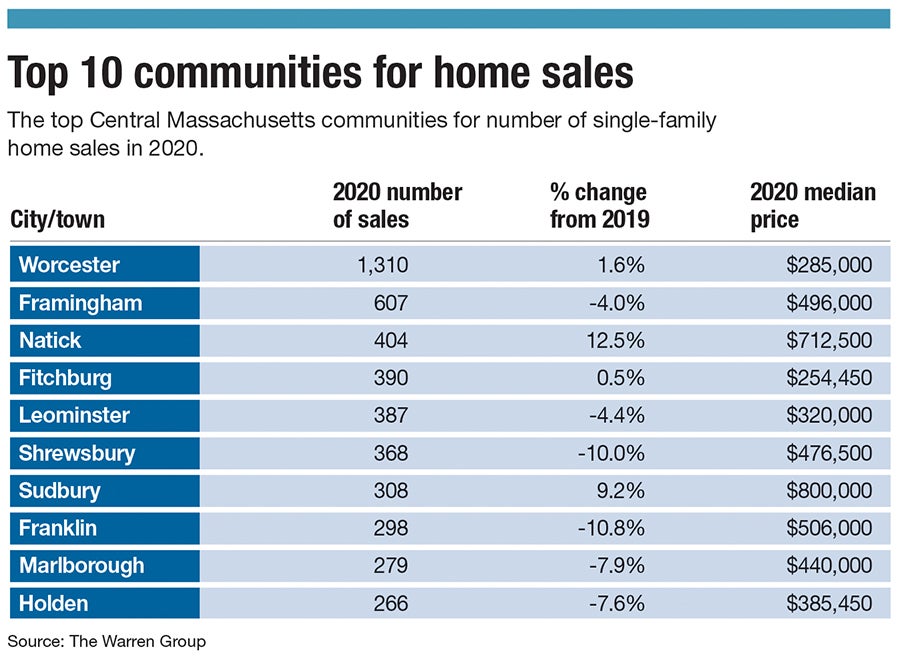

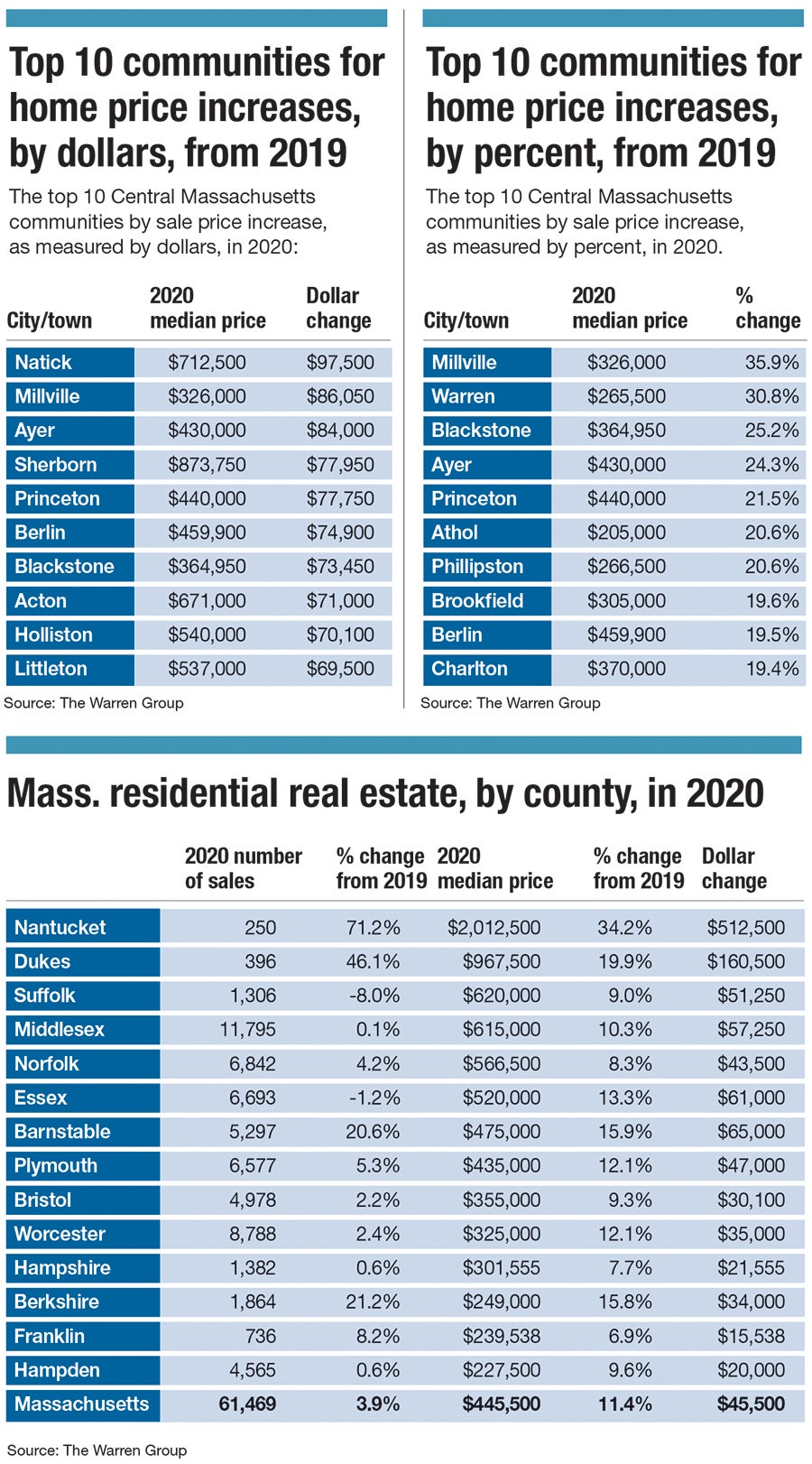

In just a year’s time, median home prices in Ayer, Millville and Natick rose by $80,000 or more. Prices, in some cases skewed a bit by a small number of sales, rose by 20% or more in towns spanning both the region’s geography and range of affluence: Athol, Blackstone, Phillipston, Princeton and Warren, in addition to Ayer and Millville.

“If you had to boil the market down to one word, it’s inventory,” said DeLuca, a Realtor with Coldwell Banker in Worcester. “There was no inventory before COVID, and it’s worse now.”

Pandemic sets prices soaring

The pandemic has sent some residents fleeing from a few of the country’s highest-price markets such as New York City and the San Francisco Bay Area. Greater Boston has so far avoided that fate, perhaps at least in part because of its reliance on colleges, hospitals and life sciences companies whose work largely can’t be done remotely, said Steve Medeiros, the president of the Massachusetts Association of Realtors.

For Central Massachusetts, that appears to have meant that people looking to leave crowded – and typically expensive – Boston neighborhoods might be looking to closer-by affordable communities. Why exactly someone is moving somewhere can never be fully known for sure, said Tim Warren, the CEO of The Warren Group, a Peabody-based real estate analysis firm.

“It’s impossible to tell from the data,” Warren said. “When you’re writing the deed, you don’t write down why you’re buying the house.”

Still, Warren said, Central Massachusetts is likely benefitting from a middle ground between denser cities seeing people move away during the pandemic and high-cost areas like Nantucket seeing price skyrocket as wealthy buyers pick up second homes.

Tim Long, a realtor and sales manager at Milford’s Fafard Real Estate, said he’s seen significant demand for the company’s new area developments, including Westminster Place in Holden and Patriot’s Landing in Uxbridge, particularly from first-time home buyers.

“Those have been really hot,” Long said.

Prices in Central Massachusetts spiked in 2020 in most cities and towns, but because the same phenomenon took place nearly everywhere, the region was not a standout across Massachusetts or nationally.

Across Massachusetts, home prices rose 11.4% in 2020, just below Worcester County’s 12.1%, according to The Warren Group. Because the state’s median price is higher than Worcester County’s, a typical sale in Massachusetts grew by more: $45,500 compared to $35,000.

Nationally, home prices last year rose even more: by 13.1%, or nearly $44,000, to hit a median of $334,000, according to the real estate website Redfin. Demand grew so high one-third of homes sold above their listing price, according to Redfin.

The national data may help indicate the growing popularity of lower-tax states during the pandemic, which has allowed some people to work remotely. The Pioneer Institute, a Boston think tank, said in a Feb. 1 report Massachusetts has been losing residents particularly to Florida and New Hampshire – which both lack an income tax – to the tune of $20.7 billion in lost adjusted gross income in the quarter-century ending in 2018.

Spike expected to continue

Housing prices are expected to continue to climb, if not quite at the same rate as in 2020.

The National Association of Realtors has predicted home sales in the Worcester metropolitan area – Worcester County and Connecticut’s Windham County – will rise in 2021 by 4.5%. The Boston metro area, which includes Middlesex County, is projected to see prices climb by 5.7%.

A group of 20 economists surveyed by the National Association of Realtors in December predicted annual median home prices to increase by 8% this year and by 5.5% in 2022. Interest rates are expected to rise slightly but remain low.

Among other predictions, the association is expecting a few other factors to shape the housing market nationally. Millennials, larger than any generation before it, will age into home-buying years at the youngest end of the generation and look to trade up among the older end. Mortgage rates could rise to 3.4% by the end of the year, undoing much of the benefit a low interest rate gave in offsetting fast-rising prices.

If remote work continues past the end of the pandemic, suburbs could continue to benefit from rising demand, the National Association of Realtors said. That’s one of a few unpredictable patterns for the year, along with how effectively the pandemic is controlled and whether the country is able to avoid a double-dip recession, with lower-income workers, particularly in service industries, remaining out of work.

Massachusetts housing experts interviewed see two main reasons for continually rising prices: little inventory, which pushes up prices, and very low interest rates, which can make higher-priced homes more affordable over the life of a mortgage.

“You’re going to definitely see a strong housing market in 2021,” Medeiros said. “It’s not going to change with demand and all of that.”

Gov. Charlie Baker has pushed for more new-home construction and to make it easier for projects to win needed zoning changes at the community level, but those changes, even if enacted, won’t make a significant difference soon, Medeiros said. Costs of building new homes will remain high, often forcing high sale prices for anything not built with affordability restrictions.

“I don’t see prices going down. I really don’t,” DeLuca said, putting his projection in the simplest economic terms. “There’s too much demand and not enough supply.”