The couple bought the house in 2004 — three bedrooms, 1.5 baths in a “very desirable” Worcester neighborhood — for $282,000. A few years later, they tried to sell it, advertising a $249,000 price tag.

But the house didn’t sell. And now it’s listed for rent at $1,650 a month.

The story, found in old real estate listings and property records, is getting more and more common, according to real estate professionals in Central Massachusetts.

With many homeowners unable to sell their houses for anything like what they spent on them, there are far more single-family homes on the rental market than there were a couple years back. And with many potential homebuyers skittish about the market, there’s also far more demand for high-end rentals of all kinds.

“In general, the $1,600 to $3,000 [a month] rental in Worcester was pretty much nonexistent even a year or two years ago,” said Edward Murphy, CEO of WeRentCentralMass.com. “Now it’s a very active market in the city.”

Buyers Being Wary

Murphy said many people who might otherwise be interested in buying a home have lost confidence in the real estate market and are waiting to see whether prices have hit bottom. And he said there’s a whole new market in people who have gone through a foreclosure or sold their home and have no interest in buying again. He said two or three people in that position end up in his office every day.

Stephanie Pandiscio, who sells homes with Foster-Healy Real Estate Inc. in Athol and serves as president of the North Central Massachusetts Association of Realtors, said she also gets more calls on her rental listings these days, often from people who have lost their homes or are walking away from untenable mortgages. But she has more to offer such callers these days too.

“More homeowners are renting just due to the fact that they’re not able to sell their homes,” she said. “They start to get a little anxious about losing their home, and also they have a price in mind and if they’re not going to get that certain price they’re just not going to accept anything else.”

Pandiscio said she’s seen owners rent out their property and go live with parents for a while, in the hopes that prices will recover. But she said they’re likely to be disappointed.

“I think they think the prices of homes are going to go up a lot higher, and they probably aren’t going to be doing that,” she said.

Pandiscio and Murphy of WeRentCentralMass.com, both said they also see homeowners deciding to rent their houses out of desperation. Often they’re underwater on their mortgages and can’t convince their banks to take a loss on a short sale.

By renting, Murphy said, “most people who have a fixed mortgage can end up covering the mortgage, or losing a few hundred dollars a month.”

He said they typically hope they can buy themselves some time and get the money together to pull themselves back out of the hole.

Fear Of Renting

Generally, real estate agents say, it takes a certain amount of pressure for a homeowner to go the rental route. George Symula, a real estate agent with TP Hazel Sotheby’s International Realty in Harvard, said owners worry about tenants damaging their property, and about the trouble associated with getting rid of a difficult tenant.

“We agents try to do due diligence for our clients and look at references and all those kinds of things,” Symula said. “But you can’t prevent some things from happening.”

Murphy said his agency takes precautions to protect rental homes, including recommending that the owner meet the potential tenant before agreeing on the rental. He said there are cases where people who took meticulous care of their homes end up losing them anyway, and they can be excellent tenants for owners who are protective of their property.

“Sometimes it’s a great match,” he said.

Running counter to the fear of damage from tenants is the fear of leaving a house empty, Pandiscio said. She said owners forced to move for a job, or people who inherited a house after the owner died, may not want to deal with the hassle of heating or winterizing an empty house, or with the fear that the house will be burglarized for the copper pipes.

“You don’t know what’s going to happen,” she said. Aside from frustrated home owners, another reason for an increased supply of higher-end rentals is investors with the time and money to improve apartment buildings.

Paul Novak, vice president of Worcester apartment rental company Gold Star Associates, said he’s seeing a number of local people who might once have flipped single-family homes buying apartment buildings instead.

Murphy agreed that Worcester apartments are getting nicer, on average, and he said there’s good demand from professionals who can afford rents of $1,200 or more a month. A few years ago, he said, if those people weren’t buying houses they probably would have ended up settling for cheaper, less attractive apartments.

“Traditionally in Worcester there were no renovated, nice two- to three-bedroom apartments with granite and stainless steel,” he said. “There are a lot of people moving up, I would say, to the nicer properties.”

Murphy said investors get a good return from the buildings they fix up, and he said that in the process neighborhoods like Main South are changing as fewer apartments are available for low-income families.

“I think it’s driving some of these families out of the area…” he said.

Murphy said the market for low-priced apartments is also being squeezed by subsidized tenants. He said charities are helping pay rent in lower-end buildings for an increasing number of people moving out of shelters, and refugees from other countries.

At the same time, Novak said, other cheap apartments are disappearing from the market completely.

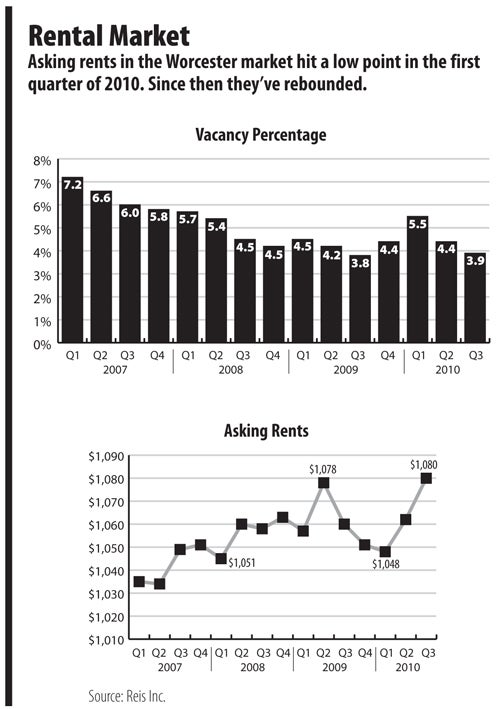

Still, rents haven’t soared. Average asking rent has hovered between $1,000 and $1,100 over the past four years, according to real estate data company Reis Inc.

But the data do show that the rental market has gotten much tighter. The Worcester vacancy rate in the first quarter of 2007 stood at 7.2 percent. As of the third quarter of 2010, it was 3.9 percent.

“There’s nothing out there,” Murphy said. “And when it becomes available it goes pretty quickly.”