You can define success in myriad ways: holding your ground; uncompromising ambition; the relentless pursuit of excellence; steady as she goes; staying a step ahead. The one thing shared in common by the most-heralded and well-run companies Worcester Business Journal has chronicled over 35 years is a bit of all these things.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

You can define success in myriad ways: holding your ground; uncompromising ambition; the relentless pursuit of excellence; steady as she goes; staying a step ahead. The one thing shared in common by the most-heralded and well-run companies Worcester Business Journal has chronicled over 35 years is a bit of all these things.

As complicated as finding success can be, it often comes down to the basics: an undeniable idea; a family legacy of never being satisfied; or a straightforward philosophy.

Laroy Starrett, who founded Athol-based toolmaker L.S. Starrett Co., in 1880, may have said it best when he explained the elemental notion behind his business: “To invent something useful that people would want.”

Not long after Starrett developed his company’s seminal tool, the combination square, Polar Beverages was springing to life in 1882. The scions of Dennis Crowley would not disappoint. In 1905, Peter Consigli & Sons Masonry began a tradition of building excellence. Flexcon was born in a rented Spencer garage in 1956, and the McDonough family never looked back. EMC Corp. wasted little time exceeding expectations after its 1979 founding. And TJX Cos., like WBJ, opened its doors in 1989, beginning its singular quest for dominance.

Here we take a periodic look back at these half-dozen headliners – the ups and downs, the achievements, and the important people. What better place to start than the beginning? Our beginning: 1989.

Two years after Ben Cammarata was named the first president and CEO of TJX Cos., and months after its parent company, Zayre Corp., sold its nearly 400 stores to Ames Department Stores, the discount retail behemoth TJX was born.

Hired away from Marshall’s in 1976, Cammarata was the brains behind TJ Maxx, which opened its first store in Auburn in 1977. By 1987, and with Zayre’s fortunes flagging, TJX Cos. – already featuring TJ Maxx, Hit or Miss, and Chadwick’s of Boston catalog – was formed as a subsidiary. But not for long.

In the wake of nearly $70 million in operating losses in the first half of 1988, Zayre’s sale of its entire chain to rival Ames for more than $550 million allowed it to buy out the minority owners of TJX – and set in motion one of the great retail success stories in Central Massachusetts.

Zayre merged with TJX in June and changed its name. Soon it would begin trading on the New York Stock Exchange.

The same year TJX brought in Cammarata, EMC found its longtime home in Hopkinton. By 1989, the company’s foundational memory boards were being usurped by its data storage business – an important development since EMC would experience its second straight year of losses despite having achieved a key goal of co-founder Richard Egan: EMC began trading on the NYSE in 1988.

While Neil Young was “Rockin’ in the Free World,” and Tom Petty was “Free Falling,” Anthony Consigli began working for his father, Henry, as a project manager and superintendent for Consigli Construction Co.

As the 1990s got underway, acquisitions, expansions and transformative products abounded.

L.S. Starrett purchased Sigma Optical, a United Kingdom firm that designed and manufactured optical measuring projectors, and formed the Starrett Precision Optical Division. TJX acquired Winners Apparel of Canada, a Toronto-based chain of five off-price family apparel stores, which would grow into Canada’s largest off-price retailer of family apparel and home fashions.

EMC introduced its flagship product, Symmetrix, the enterprise storage system largely credited with turning the company into a multi-billion-dollar business.

By 1992, the Framingham-based TJX had launched HomeGoods, a popular retailer featuring discounted home decor that now has more than 900 locations. And Ralph Crowley Jr. and Mike Ruettgers had taken the reins at Polar and EMC, respectively.

1994

EMC became a Fortune 500 company after posting record 1993 revenues of $783 million. With 14 consecutive profitable quarters in its rearview, the computer storage giant was listed at number 412 on the magazine’s list of largest U.S. industrial corporations.

EMC revenues grew 76 percent in 1994 to $1.37 billion, with the company now employing more than 3,200.

Two years after Neil McDonough, son of founder Myles, was named president, Flexcon ranked as the sixth-largest private company in Central Mass., with revenue of $225 million, a 12.5-percent increase over the prior year. Polar Beverages joined Flexcon on the list, at number 23, at more than $65 million.

Polar had plenty besides profits bubbling to the surface.

Crowley and brother Christopher Crowley grappled with an uncle over the terms of a 1986 family-company succession agreement, a dispute that included a lawsuit and was eventually settled, paving the way for the new generation of Crowleys’ dramatic expansion.

In other family business news, Anthony Consigli – an inaugural WBJ 40 Under Forty honoree – took the reins of the Milford-based construction outfit. Today the CEO of a multi-billion dollar company, the fourth-generation president inherited a firm with 15 employees.

Douglas R. Starrett was named chairman and CEO of L.S. Starrett in September. After succeeding his father, Arthur, as president in 1962, he was responsible for one of the longest periods of sustained growth and profitability in the company's 125-year history. At the same time his son, Douglas A. Starrett, the current chairman, was promoted to president.

TJX Cos. was busy too. It launched T.K. Maxx in the United Kingdom, introducing its off-price concept to an international audience. By 2020 it would have more than 650 stores across Europe and Australia. The store was named T.K. Maxx to avoid confusion with British discount brand TJ Hughes.

A year later, TJX Cos. would acquire its chief competition, bringing the Marshalls brand and its 496 locations into its expanding portfolio.

And in 1996, Polar Beverages acquired longtime competitor Adirondack Beverages of Scotia, New York. Along with Adirondack, Waist Watcher, Clear ‘N’ Natural brands, and private-label accounts, the acquisition included a 600,000-square-foot production facility.

1999

Polar Beverages wasn’t done padding its portfolio – and wouldn’t be anytime soon. It acquired Venture Distributing, a leading distributor in the Boston marketplace with brands such as Nantucket Nectars and Arizona.

As acquisitions go, EMC was just getting started as well, paying a reported $1.1 billion for Data General Corp. of Westborough, the minicomputer pioneer. Data General’s work with computer storage systems and servers made the EMC marriage a smart match.

There were subtractions. John Nelson, the influential former top executive at both the Norton Co. and Wyman-Gordon, stepped down after four years as TJX Cos. board chairman. Soon after, Ted English became TJX CEO in January 2000. In his nearly six years in charge, the conglomerate added more than 900 stores and 50,000 employees. Its revenue increased from $8.9 billion to $15 billion, before English left to become CEO of Bob’s Discount Furniture.

As for Consigli, the family-run private company – with Anthony’s brother Matthew joining him at the helm since 1997 – generated $60 million in revenue in 2000, an 80-percent jump over 1999, and increased its employee ranks from about 20 to 130.

In 2001 – the year Egan retired to become U.S. ambassador to Ireland – EMC posted a staggering $945.2-million net loss in the third quarter, its first such loss in almost 12 years. In October 2002, EMC announced 4,000 global layoffs, including 1,500 in Massachusetts. Perhaps more consequential was the five-year alliance EMC formed with Texas-based Dell Computer Corp.

2004

In January, EMC completed its $625-million acquisition of VMware, a virtual software company, which over the next decade would provide increasingly larger shares of EMC’s revenues. The shopping spree stretched into October when EMC spent $50 million to purchase Dantz Development Corp., a maker of backup software products. Dantz became the 15th software company EMC had acquired since 2000.

In March, Carol Meyrowitz – today TJX Cos. executive board chair – was promoted to senior executive vice president. She held the role for less than a year before briefly taking on advisory positions for TJX and Berkshire Partners, a Boston-based private equity firm.

A month earlier, TJX reported a 17-percent increase in sales for the fourth quarter and a year-ending $658 million in revenue – an increase of $80 million, year over year – on sales of $13.3 billion.

Meyrowitz would return to the fold in October 2005 as president before eventually being tabbed as CEO in 2007 to replace Cammarata, who had served on an interim basis after English’s departure.

Consigli – now a company with 190 employees and $50 million in annual volume – continued its rapid expansion after winning a $19-million contract to convert 215,000 square feet of a former mill in Lowell into 154 units of market-rate and affordable housing.

Other projects included the ongoing $35-million addition to Milford-Whitinsville Regional Hospital and a $65-million joint venture project building the new Worcester Technical High School.

2009

By the time Neil McDonough was named WBJ’s Big Business Leader of the Year, Flexcon had 1,200 global employees, including 800 in Massachusetts. WBJ reported the Spencer-based company had annual sales between $350 million and $375 million.

In the wake of several major customers moving their operations to China, McDonough told WBJ that he was considering opening a Flexcon facility there after years of resisting the idea.

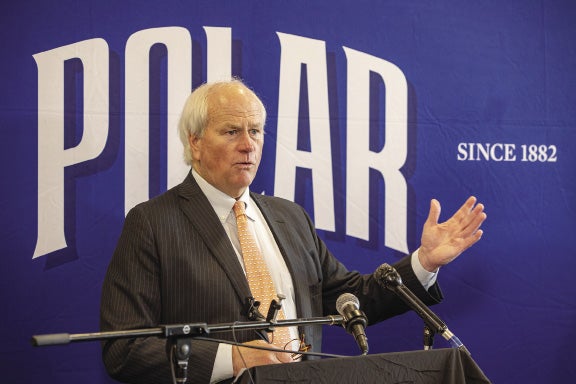

Polar, too, considered broadening its horizons. Telling the Telegram & Gazette in October that losing the local press was just not an acceptable possibility, Ralph Crowley Jr. led a group in a bid to buy Worcester’s paper of record from The New York Times Co.

At the time, Polar Beverages grew into a $320-million juggernaut and had acquired 34 companies over the last two decades under Crowley's leadership. The Times Co. eventually sold the T&G and the Boston Globe in 2013 to Red Sox owner John Henry for about $70 million.

EMC announced in January it would reduce its workforce by about 2,400 employees over the next 18 months. Of its 42,000 workers worldwide, about 9,000 were employed in Massachusetts and some 600 jobs were expected to be eliminated locally.

While manufacturing job numbers in the state cratered, L.S. Starrett approached the recession differently. The global precision toolmaker cut local workers’ hours and began taking advantage of the state’s WorkShare program, which uses unemployment funds to pay a portion of workers’ wages while their hours are reduced.

In August, EMC’s Egan died at 73 in Boston after suffering from terminal lung cancer.

2014

Flexcon's McDonough wasn’t just thinking about bringing his company to China. In March, the adhesive coating and laminating innovator announced the opening of Flexcon Asia Limited in Hong Kong.

Meyrowitz, the influential TJX chair and CEO, topped WBJ’s list of highest-paid public company CEOs with more than $25.5 million in total compensation. She was joined in the top 20 by EMC’s Joseph Tucci (No. 3, with $11.2 million) and Douglas A. Starrett, (No. 13, $827,674).

EMC reported sales of $24.4 billion, but with only $2.7-million profit. By early 2015, the company had announced a restructuring plan, expecting to eliminate several jobs – but by the end of 2015 much bigger changes were afoot.

Dell Technologies announced in October 2015 that it would acquire EMC for $67 billion, the largest tech deal in history. “You’ve really got to think in terms of technology hubs,” Tucci said. “This new combined company will have three great, major hubs in the U.S.”

The deal closed in September 2016.

After collaborating with the Glen Research Center, Flexcon signed a deal with NASA in July 2015 to manufacture and market its proprietary polyimide aerogel, which is used in thermal applications like spacesuit insulation.

Already known for its philanthropy and community engagement, Consigli was named Corporate Citizen of the Year by WBJ, and the brothers each received Preservation Massachusetts awards for their work restoring historic buildings.

TJX finished its fiscal 2014 on a high note, reporting a fourth-quarter net income of $648.2 million and an annual net income of $2.2 billion. The company also announced it would raise its minimum wage to $9 an hour by June 2015 and $10 in 2016, the same year Ernie Herrman took over as CEO.

Lavon Winkler joined Flexcon in 2017 as president of Flexcon North America, with McDonough remaining chairman and CEO, before eventually rising to CEO in 2020.

2019

After going public late in 2018, Dell Technologies saw its stock price soar to $70 per share in May before experiencing months of fluctuation. At the same time, Dell EMC’s sharper focus on cloud storage and security helped bolster its parent company’s 31.5-percent share of the global external storage market.

Now a $1.6-billion company, Consigli – Engineering News-Record’s 2019 New England Contractor of the Year – announced in June the acquisition of T.G. Nickel & Associates, a New York-based contracting firm.

In two weeks in April 2020, Flexcon made 60,000 face shields and donated 30,000 to healthcare facilities across Massachusetts and as far west as California as doctors and nurses grappled with how to safely treat patients during the early days of the COVID-19 pandemic.

In July of that year, Polar Beverages announced a franchise agreement with longtime partner Keurig Dr. Pepper to allow for the national distribution of Polar products.

Aimee Peacock, who joined Flexcon North America as chief financial officer, was promoted to president in 2021, the first woman to hold that position.

2024

Peacock has been CEO of Flexcon Global for about a year, aligning Flexcon Europe, Asia, and North America under one global executive team. Under Peacock’s leadership, Flexcon launched a new brand in late 2023 highlighting its evolution as a provider of innovative coatings and functional technologies.

L.S. Starrett became a private company earlier this year after its merger with private equity firm MiddleGround Capital. Douglas A. Starrett told the Athol Daily News in March going private could save the company about $3 million annually on Securities and Exchange Commission filings and other regulatory costs.

Herrman sold 15,000 shares of TJX in September for an average price of $117.54, according to an SEC filing. The sale netted the CEO, who still owned some 536,000 shares of the company, more than $1.7 million.

The same month Consigili Building Group completed its acquisition of substantial shares of Australia-based construction services firm Lendlease’s New York and New Jersey operations, adding a $1.8-billion portfolio and 400 employees to the fold.

Today the heralded builders employ more than 1,800 from 14 regional offices as far-flung as the Caribbean.

And tomorrow the leaders of all six of these powerhouse companies will wake up thinking of new ways to innovate, expand, and endure.