On a trade delegation to Israel in March, Gov. Deval Patrick was joined by Astrid Khokhar, director of sales and marketing at a subsidiary of Devens-based American Superconductor Corp. Khokhar took the opportunity to tout the company’s status as “one of the world’s leading power technology companies.”

Since then, American Superconductor has announced that the Chinese company that is by far its biggest customer won’t pay for previously ordered shipments of wind turbine parts, has laid off 10 percent of its staff and has been hit by lawsuits from disgruntled shareholders. Its stock price has fallen from more than $20 to $9 per share.

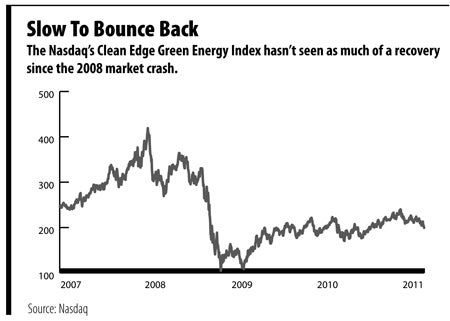

The clean-technology industry as a whole hasn’t seen that kind of a sudden fall, but its stocks aren’t booming the way they were a few years back, either. While the Nasdaq Composite Index has recovered to around its 2007 level, the Nasdaq Clean Edge Green Energy Index, which follows publicly traded clean-tech companies, has been hovering around 200, after hitting a high of 419 in December of 2007.

And then there’s former clean-tech poster child Evergreen Solar of Marlborough, which has acknowledged that it may be close to failure because of major challenges to its business model.

Long-term Wager

To some, all this might call into question the state’s focus in recent years on its clean-tech cluster. The 2008 Green Jobs Act promised to spend $68 million over five years to support green companies, train workers for jobs in the industry and otherwise promote clean technology. Some groups, including the Associated Industries of Massachusetts, have consistently criticized this kind of attempt to choose a particular industry for the state to back.

But some who follow the industry say there’s plenty of opportunity in clean tech, and Massachusetts is well positioned to cash in.

Ron Pernick, managing director of industry research company Clean Edge, describes stock performance in the clean-tech arena as “a story of extreme volatility.”

Clean Edge collaborates with Nasdaq to produce the Green Energy Index. Pernick says investments in publicly traded clean-tech companies can jump 60 percent one year, only to fall 60 percent the next year.

Still there’s no doubt the sector has grown massively over the past decade. A report by Bloomberg New Energy Finance shows new investments in public-market clean energy companies standing at just $100 million to $400 million per quarter in 2004 and then rising into the multibillion-dollar range with big jumps and drops from quarter to quarter. By far the best period for the measurement was the fourth quarter of 2007, where investments reached $12.4 billion, but the second best was the fourth quarter of 2010, at $8.8 billion.

If the sector is volatile, the individual companies within it are even more so. Evergreen Solar is one of the most obvious examples of a company that found that its new technology didn’t line up with a rapidly changing industry.

Regarding Evergreen’s announcements of its concern about its future, Bloomberg New Energy analyst Jenny Chase wrote, “Evergreen Solar started out during the silicon shortage with a beguiling technique to make wafers without wasteful slicing of silicon. Although the technology apparently does what it promised to do, the fall of silicon’s price since 2008, and the fact that the wafers are of non-standard size, clearly have devalued it.”

Pernick said there’s plenty of reason to be confident that green energy as a whole will keep advancing.

While really large-scale adoption of pure wind or solar energy won’t happen until there are breakthroughs in cheap, easy energy storage, he said states are demanding that utilities get at least some of their power from renewable sources.

Twenty-nine states have adopted renewable portfolio standards, some of them very rigorous. California, for example, promises that 20 percent of its electricity will come from renewable sources by 2017.

Michel Di Capua, lead researcher on U.S. analysis with Bloomberg New Energy Finance, said Massachusetts is drawing considerable interest from investors with its own renewable energy policies. He said the state is pushing solar power particularly hard, and offering good incentives for those willing to build solar projects.

Dan Berwick of Borrego Solar, a California-based solar installation company with an office in Lowell, said there’s currently a “frenzy” of interest in putting in photovoltaic arrays in Massachusetts. That’s because state policies demand that retail electricity providers pay for solar energy, which is creating more demand for the installations than there is supply. That will even out eventually, he said, but the state requirements will probably keep the projects going at a slower but steady pace in coming years.

Di Capua said the long-term effects of the support for solar aren’t guaranteed, but he said most market-watchers certainly see value in cultivating the clean-tech sector as a whole.

“The perspective of many policymakers is: Whoever’s going to be playing in the market stands to gain from the opportunities,” he said.