Eleven days after the $349-billion program launch, a small percentage of businesses who applied for coronavirus relief funds under the federal Paycheck Protection Program have received the funds, according to a new national crowdsourcing tracker set up by a Miami entrepreneur couple.

Through Tuesday morning afternoon, 4.0% of the nearly 7,000 businesses who have reported their status to the site said they’ve gotten funds through the Small Business Administration program established in the $2-trillion CARES Act passed by Congress in response to the economic fallout from the coronavirus pandemic.

The U.S. Small Business Administration’s Massachusetts office wasn’t immediately available Monday afternoon to confirm the figure.

PPP is designed to provide loans of up to $10 million to businesses and nonprofits with fewer than 500 employees, as a way to help them stay afloat as much of the American economy has been shut down in order to stem the spread of the coronavirus. A portion of the PPP loans can be forgiven, particularly if businesses use the money to keep people employed.

The median company size of the applicants who told the COVID Loan Tracker’s survey they received funds has been 16 employees, and the average loan $165,000, according to the website. Those who’ve received funds have gotten it in five days, and 91% received the amount they requested. Small or regional banks have provided 84% of loans.

Another SBA coronavirus relief program, Economic Injury Disaster Loans, have been slower, with 1.5% of applicants who filed out the website’s survey receiving funds so far. In those cases, the average payment time has been 14 days and the median amount has been $6,000. The median size for a company receiving funds has been six employees.

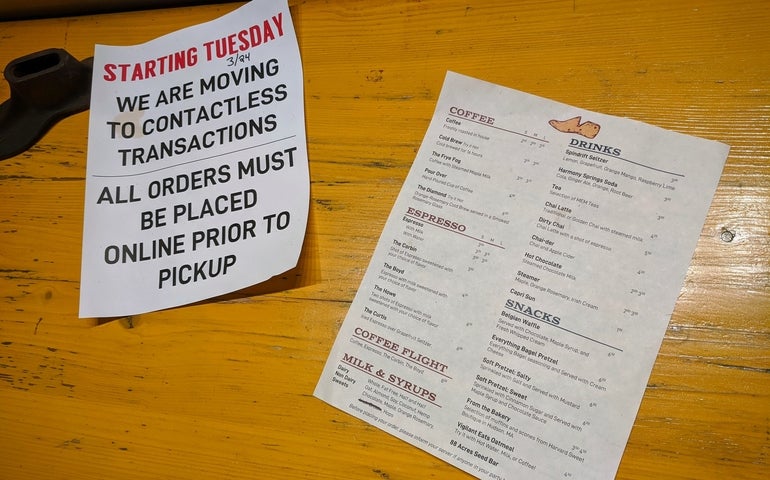

Of all small businesses seeking help, the highest proportion, 12.8%, have been in retail. Construction makes up another 12%, and hotel and food services make up 8.9%. Just over half, or 53.7%, said receiving the full amount of their PPP application would satisfy all their credit needs.

As of Tuesday morning, the website said it had more than 6,860 small businesses reporting up to $2.8 billion in loan applications. The site has estimated 132,350 employees are at risk without payments.

The website was created by husband and wife Duncan and Rita MacDonald-Korth, small-business owners who said they were frustrated by a disconnect between what political leaders were saying and a lack of funds being received by businesses.

“Our goal is to help the small business community and empower journalists with the data they need to keep leaders accountable for the promises they made about the PPP program,” the couple said in an article on Nasdaq.com.

EDITOR’S NOTE: This story has been updated from its original publish date of 5:52 p.m. on Monday, April 13, to reflect the numbers updated on the COVID Loan Tracker as of 11:30 a.m. Tuesday, April 14.