As many families in Massachusetts climb out of a financial hole created by COVID-19, Rep. Joan Meschino said Tuesday that efforts by the state to claw back overpayment of unemployment benefits during the pandemic has created anxiety and hardship for untold workers who spent the money to cover everyday living expenses.

“It was all in good faith. People spent the money. They don’t have it. And now (the Department of Unemployment Assistance) is looking for it back and it’s causing a tremendous amount of stress and anxiety,” Meschino said.

While the full scope of the problem has not been made clear, it is not unique to Massachusetts. Many states, according to legislators and attorneys, are dealing with overpayments that stemmed from the speed with which states and the federal government rolled out emergency programs that offered workers enhanced payments for longer periods of time.

Meschino said she and virtually every House colleague she has spoken with about the issue can point to constituents who have reached out concerned about being able to repay excess benefits they received through no fault of their own.

The Hull Democrat has filed legislation (H 4202) backed by the AFL-CIO and others that would clarify the standards used to determine whether a beneficiary of unemployment benefits qualifies for a waiver from having to repay excess benefits. Those waivers do not apply to cases involving fraud.

One of the stated criteria that would qualify someone for a waiver would be if the money was used to meet ordinary living expenses. Another would be if the DUA took too long to seek repayment, or made an error during the application process that led to the overpayment.

Meschino filed the bill in late September based on constituent cases handled by her office, and thanked the Committee on Labor and Workforce Development for scheduling a hearing quickly so that the Legislature might consider remedies.

“We recognize there’s an issue and DUA recognizes there’s an issue and we certainly want to work with everyone on this,” said Rep. Josh Cutler, co-chair of the Labor and Workforce Development Committee.

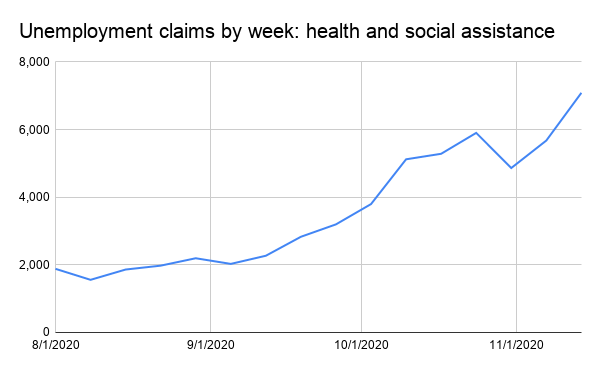

Meschino said many of the overpayments were made during a period when DUA was processing huge volumes of claims for unemployment benefits and trying to apply changing rules and administer new programs authorized by Congress to support unemployed workers during the pandemic.

One of the those programs, the Pandemic Unemployment Assistance Program, qualified a whole new class of worker — independent gig economy workers – for unemployment benefits who were never eligible in the past.

Meschino said the constituents who have called her office seeking help come from all sectors, including the gig economy, tourism and hospitality. Her bill would also seek to address language, technology and other barriers preventing workers from applying for waivers from overpayment.

John Drinkwater, of the AFL-CIO, said the union has helped hundreds of workers navigate the unemployment insurance system and resolve issues of eligibility, but he said not all cases involving overpayment waivers can be easily adjudicated.

“They don’t have the money to repay because they spent it on their families,” Drinkwater said.

Meschino said she has met with the Department of Unemployment Assistance to discuss the matter, but both she and the Greater Boston Legal Services told the News Service they have been unable to obtain detailed information from the agency on how many waiver applications DUA has processed, the scope of the overpayments, and how many people might have been impacted.

The department did not respond to Meschino’s bill or the provide details on the scope of the problem, but Greater Boston Legal Services estimated that up to 72 percent of the overpayments were made through federal programs with no impact on the state’s budget.

If that held true, much of the recouped benefits would revert back to the federal government and would not impact the solvency of the state’s unemployment trust fund. Faced with a quickly depleted fund as unemployment surged, the Legislature authorized $7 billion in borrowing to replenish the UI fund, allowing employers that pay into the system to spread that cost over 20 years, but business groups have been urging the use of one-time American Rescue Plan Act funds to reduce the burden.

“Uncollectable criminal fraud and overpayments have been an issue in all states, including Massachusetts,” said Jon Hurst, president of the Retailers Association of Massachusetts. “Employers should not be charged for any criminal fraud or administrative overpayments. Any such unrecoverable costs should be considered as ARPA and surplus FY ’21 funds are appropriated.”

Based on research done by the National Conference of State Legislatures and the U.S. Department of Labor, Hurst said there could be as much as $1.6 billion in UI overpayments and fraud in Massachusetts.

Greater Boston Legal Services, also using Department of Labor data, estimates that the total value of overpayments could be between $1.58 billion and $1.92 billion, with $531 million of that coming from state dollars.

Hannah Tanabe, a staff attorney with Greater Boston Legal Services, testified that the Meschino bill would “make it clear” when overpayment recovery should be waived and make sure DUA communicates in “plain language” with claimants regarding their options to seek a waiver.

“The current standards for waiving overpayment are insufficient,” Tanabe said.

Tanabe referenced a client referred to her by the Chinese Progressive Association who was told she owed $7,000, but didn’t understand why. Due to DUA erroneously applying her past employment and wage history to her application, the client received $193 in weekly benefits in excess of what she qualified for.

Even though the error was not the woman’s fault, Tanabe said it was unlikely she would qualify for a waiver because she and her husband have since returned to work and their income slightly exceeds their expenses. And, still, their family would find it difficult to repay $7,000 that was spent to get through the pandemic.

“She would significantly benefit by the relief afforded by this bill,” Tanabe said.

The current process allows DUA to waive repayment if it would “defeat the purpose of benefits” or if it goes against “equity and good conscience.” Experts said those criteria apply to cases where repayment would lead to a family’s expenses exceeding their income, or if a family gave up their right to seek other assistance, such as food stamps, because they were receiving unemployment benefits.

The federal government allows states to set their own standards for what goes against equity and good conscience when considering waiver requests.