With the coronavirus remaining a part of life in the United States and the national economy now in a recession, startups are facing a time when survival could be more difficult than it has in years.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

With the coronavirus remaining a part of life in the United States and the national economy now in a recession, startups are facing a time when survival could be more difficult than it has in years.

Industry leaders in Massachusetts, though, see reasons to think young firms will continue, whether it’s because of existing relationships, a range of potential funding sources, or, in some cases, the critical nature of the work they do for industries in need.

Investors are looking for innovation during challenging times, said Donna Levin, Worcester Polytechnic Institute’s executive director of innovation and entrepreneurship.

“You have investors for the first time really wanting us to innovate ourselves, where normally there's a process of people doing due diligence, getting to know you, double checking your technology, or your invention,” Levin said. “Now, people are willing to move really quickly, for perfect ideas.”

Levin sees opportunity for new ideas within this challenging time and credits past startups who started during recessions.

“If we look back at other points in time in history, let's go back to the last recession – you had Dropbox, Blackdoor, Fitbit, Smashburger, Zocdoc, Airbnb, Beyond Meat, Rent the Runway, Uber, Venmo, Slack, Credit Karma,” Levin said. “All of these startups are companies that we know of now, that we no longer think of as a startup, and all got going during a recession. If you go even further back to the Great Depression, you had General Motors, GE, and even things like the Monopoly game invented.”

Life sciences advantage

The ability to judge if a startup will survive in a period of economic uncertainty can stem from what industry they are in and how well they adapt to the changing environment.

When looking at life sciences, John Hallinan, the chief business officer overseeing innovation services programs at the Cambridge-based Massachusetts Biotechnology Council, sees startups in the life sciences industry faring better than those in others.

“I think 2020, if you look at it just as one year, it’s difficult to say that the pandemic is drastic in effect on our industry then it is on others,” Hallinan said. “We have continued to see first round funding, we continue to see vibrant fundraising from venture capital firms ... That's going to translate into more investments and first-time investments, so again, I think that it is pretty positive overall.”

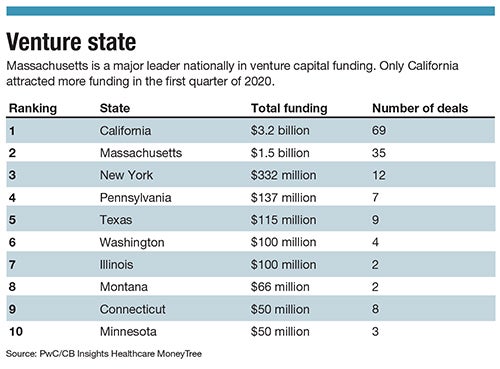

The life science industry in Massachusetts is a standout nationally.

Employment in the biopharmaceutical industry in the state has jumped 35% in the past decade, and life science lab space has ballooned by 70%, hitting 30 million square feet last year, according to MassBio.

The industry is not immune to economic disruption, Hallinan said, but it is in a good position because of firms’ development of products that help patients with better immunity and health.

“Other countries are having similar problems in regards to health and the aging population, and the industry is helping provide products that serve the needs of those patients” Hallinan said. “Long-term, things are very good for the industry. We are also very heavily focused on creating solutions for the coronavirus.”

Jon Weaver, president and CEO of Worcester-based Massachusetts Biomedical Initiatives, agrees finding success as a startup will progress faster in life sciences.

“Biotech is going to come back faster than a lot of industries, and a lot of industries are really hurting through this,” Weaver said. “We are lucky that hopefully, the solution for all of this is coming from the biotech industry and hopefully as a result that industry is going to come back pretty quick.”

The hold on investment capital

Overall, when looking for investors and or public funding, Weaver sees investors being more cautious.

“On the private capital side, I think that a lot of the investors are in a wait-and-see mode,” Weaver said. “A lot of them and their capital reserves have declined, and I think they have a lot of their own existing investments that they have already made, that they want to make sure that they can cover.”

Ari Glantz, the director of development and strategic initiatives at New England Venture Capital Association in Cambridge, sees a more cautious approach from investors changing who benefits from their financing.

“In times of uncertainty, risk tolerance is often one of the first things to drop, so the bar for first-time founders, seeking brand new investor relationships, is probably going to be higher then it might have been three months ago,” Glantz said. “Investors who have an existing relationship with an entrepreneur are likely to be more open to continuing those engagements.”

Later-stage startups are in a better position to succeed than those in earlier stages.

“It is harder for some of the earlier-stage companies that are maybe about to go to a Series A round or about to go to a new round,'' Weaver said. “They don’t have a lot of institutional investors at this stage and that funding milestone is probably going to get delayed.”

Glantz said uncertain times result in challenging circumstances for fundraising.

“The times of economic uncertainty always present a challenge for early stage fundraising, and we are certainly in one of those times right now,” Glantz said.

Weaver said opportunities for startups are available throughout the pandemic and economically trying times through strategic partnerships.

The National Institutes of Health, with its Small Business Innovation Research program, has continued through the pandemic and aided early-stage companies, Weaver said.

“The landscape is different right now, and I think the venture world will come back and hopefully come back soon; but there are still a lot of ways for companies to make progress even in this environment,” Weaver said.

Fundraising can come from various outlets and so can opportunity, said Levin, who expressed optimism about fundraising during the recession.

“There are a ton of other options outside of venture capital,” Levin said, noting available potential support from the organization Entrepreneurship for All or the U.S. Small Business Administration.

“Depending on how much money you need to keep your business going, or to make your business happy,” she said, “you may have to look a little harder, but there are opportunities that are still out there.”