Riverdale Mills CEO Jim Knott Jr. sat down with WBJ to explain, whatever their intent, Trump’s tariffs are making business more difficult for this 45-year-old firm.

Already a Subscriber? Log in

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

What has been the impact of tariffs on Riverdale Mills?

Under the first Trump Administration, we paid about $1 million worth of tariffs. So far this year, we’ve paid about $500,000 since the steel tariffs were reinstituted.The intent of the tariffs is to bring business and jobs back to the United States. Is this approach working?

I don’t think additional steel-producing capacity in the country is needed, because there’s plenty of capacity worldwide. One of the things people lose sight of is only 2% of the steel the United States consumes is from China. A lot of finished products made from steel come from China, and they’re not being tariffed. If you’re going to continue with tariffs, they should be on derivative products made from steel. Leave the raw materials alone. The other issue is we export 40-50% of what we make. That means a Chinese or European competitor is paying $400 to $500 for a ton of steel, while we’re paying $1,000 to $1,100. That automatically handicaps us from a production standpoint. We run a tight ship in terms of labor and other costs. We’re highly automated. What allows us to compete is being able to source our materials competitively, and the tariffs prevent us from doing that. I don't really look at Trump’s intent with the tariffs. I look at the outcomes, and what happens in our particular circumstance. The outcome is not great. We export a lot of the product, so handicapping us with high raw material costs tends to hurt us.Why are Canadian steel producers critical to Riverdale’s operations?

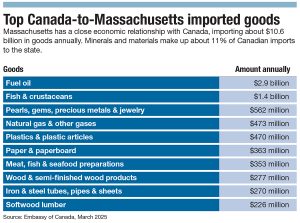

There are very high-quality producers up in Canada. One of them is called ArcelorMittal, and the other one is Ivaco. Both make high-quality materials, but what you have to remember with steel prices, a lot of the cost associated is with transportation. When we ship products from Canada, we have about a penny or a penny-and-a-half per pound in freight costs. If I reach out to plants in South Carolina, Texas, or Chicago, it costs 6 to 9 cents. It’s better for us to trade with our local partners in Canada. Some of the new mills being built are even further out west. That makes it even more difficult, and we don’t see much steel coming up from Mexico that is cost effective.How are the markets handling the uncertainty caused by the sudden course changes with Trump’s tariffs and social media posts?