Restaurants are bringing in far less money for food and drink during the coronavirus pandemic – and it’s showing both the hit the industry has taken this year as well as the financial toll declining tax revenue will have on cities and towns.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Restaurants are bringing in far less money for food and drink during the coronavirus pandemic – and it’s showing both the hit the industry has taken this year as well as the financial toll declining tax revenue will have on cities and towns.

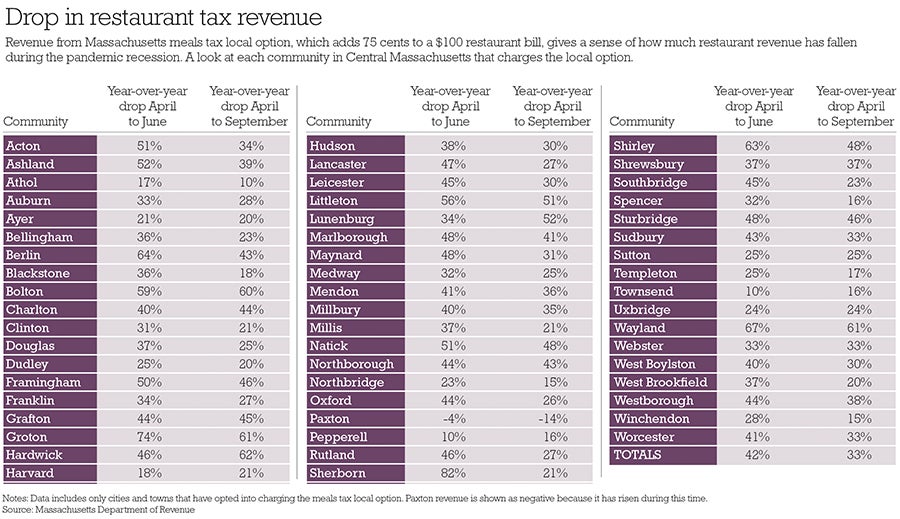

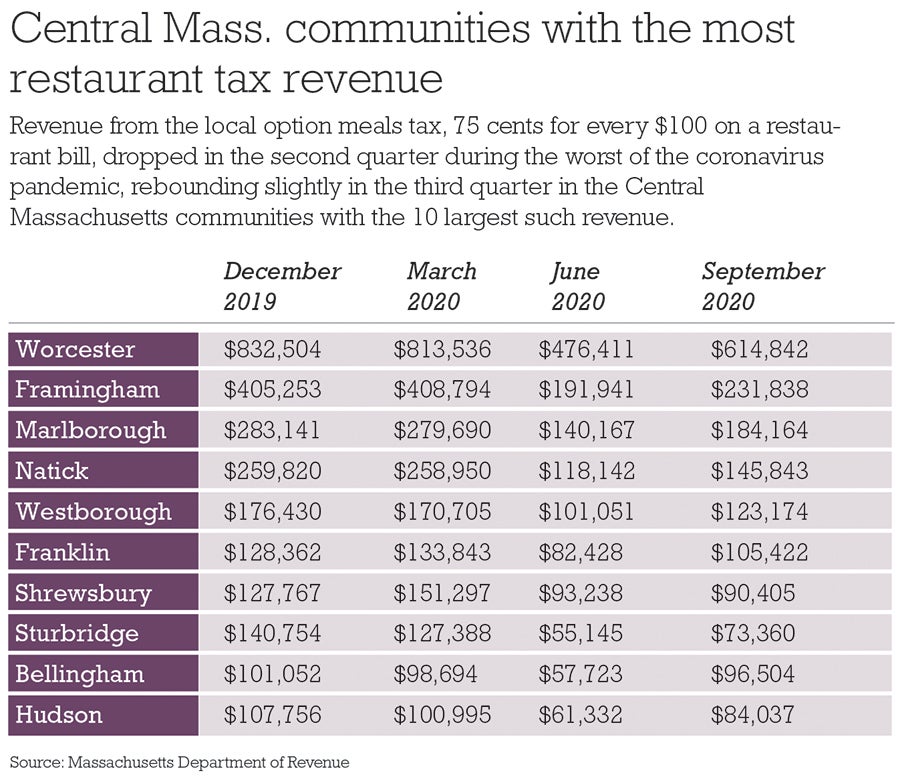

Across Central Massachusetts, revenue from taxes on restaurant bills plunged 42% in the three months spanning April to June, which covered what was largely the worst of the early phase of the pandemic locally, as well as the tightest government restrictions on business operations. In the six months ending in September, that revenue dropped 33%.

Revenue dropped the sharpest in the second quarter of the year – by half or more – in communities including Littleton, Ashland, Natick, Acton and Framingham, according to a Worcester Business Journal analysis of Massachusetts Department of Revenue data. Even including the six months through September, when restaurants were generally able to serve in outdoor spaces and even indoors, revenue remained down by half or more in Hardwick, Groton, Wayland, Bolton, Lunenburg and Littleton.

Meals tax revenue isn’t an especially large source of funds for cities and towns, but it does help indicate the sudden economic reversal of fortunes for communities.

In the six months ending in September, Central Massachusetts communities lost more than $25 million in sales tax revenue, according to state data. Much of those funds go to the state, but communities often opt to add 0.75% onto restaurant bills for revenue they’re able to keep locally.

Pandemic’s restaurant casualties

Dropping restaurant revenue reflects not only fewer people going out to eat, but also those that have closed. The Massachusetts Restaurant Association estimates almost a quarter of all eateries have closed this year.

In Worcester, for example, the restaurants Wexford House, Save Point Tavern, Corner Grill, Blue Shades and Shangri-La have closed permanently. Among two of the city’s most renowned, deadhorse hill has retooled its offerings with reduced hours and Armsby Abbey has shuttered indefinitely. At the Grid District downtown, four eateries will close for at least the winter: The Worcester Beer Garden, Franklin Street Fare, Revolution Pie + Pint and Craft Table & Bar.

By happenstance, a series of Worcester establishments closed within a few months before the pandemic hit, including Dive Bar, DaCosta’s, 7 Nana, C’Mondz and Wild Willy’s.

Save Point Tavern, which offered video games, said in a Facebook post it was doing well and could have kept operating if not for the pandemic.

“We almost made it to 1 year, but with the COVID and the crazy restrictions the hospitality industry has been to face, it was all [too] much to bear for such a new unique concept such as ours,” the bar said. “We started off strong and by all accounts we were on track for success, until COVID.”

Among others, The Chateau, Christina’s Cafe and Not Your Average Joe’s restaurants in Westborough have closed, along with Jube’s Family Restaurant in Northbridge.

Tough future

Mike Elmes, a business professor at Worcester Polytechnic Institute, isn’t confident restaurants will have easier days ahead, now that the weather is colder and coronavirus cases are rising.

“Given how easily this virus is transmitted via aerosol droplets in closed spaces, it is not clear to me how many customers will risk eating in restaurants in spite of the precautions that restaurants are taking,” he said.

The Massachusetts economy as a whole has been hit harder than most states, with a September unemployment rate of 9.6%, the country’s seventh worst. The state ranked last in the nation in June and July.

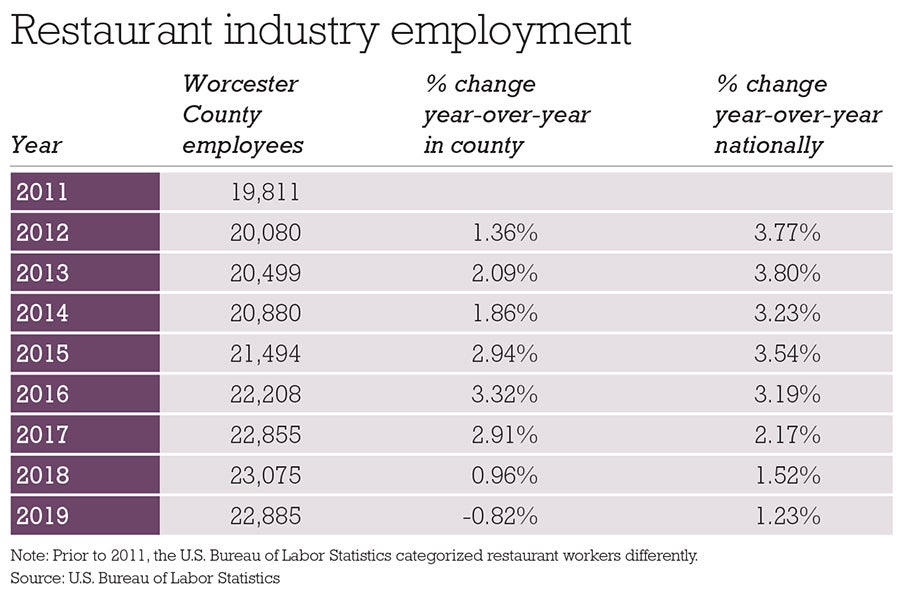

The state’s food and accommodation industry has included more than 1,500 new unemployment claims each week since mid-September, and since March has had more than 170,000 unemployment claims, according to the Massachusetts Executive Office of Labor and Workforce Development. That’s made it the hardest hit industry in the state.

In fact, the Massachusetts restaurant industry has been the hardest hit of any in America, according to the National Restaurant Association, with 7,900 restaurant jobs lost as of September. The next closest state, Florida, with a population three times larger, lost 4,600.

To Elmes, a further erosion of Worcester’s restaurant scene could be harmful for the city more broadly, both in terms of lost jobs, declining tax revenue and more vacant buildings – as well as more intangible effects.

“The loss of restaurants in the city would be a significant loss for the community and likely a big hit to the local economy,” he said. “It might also hurt Worcester’s reputation as an up-and-coming city.”

The national picture for restaurants isn’t quite as bleak as what’s taking place in Massachusetts.

Restaurant sales were down 15% in September compared to February, before the pandemic hit in earnest, according to the National Restaurant Association. The low point was April, when sales were down 54% compared to February. Sales began picking up significantly in May and June, before the first wave of cases spread to all areas of the country.

Between March and September, sales were down nearly $162 billion from expected levels before the pandemic, the association said. Restaurant employment in 47 states and Washington, D.C. remained below February’s pre-coronavirus level, including every state in New England except Connecticut.

A survey by the association in September estimated 100,000 restaurants had closed six months into the pandemic, with 40% of restaurateurs not sure they’ll survive another six months.

Low revenues create budget problems

A silver lining exists in how drops in sales revenue may affect municipalities, or at least Worcester specifically.

A study in April by the Brookings Institution found Worcester’s tax structure, which doesn't rely on income or sales tax to support the municipal budget, should shield it from the worst fiscal effects from the coronavirus pandemic. It’s a tax structure generally shared by other Massachusetts cities and towns.

Brookings, a Washington, D.C., public policy group, analyzed 140 of the nation's largest cities, looking at how each relies on what it calls elastic sources of revenue, or those that can go up or down the most depending on the strength of the economy.

The group considered what share of jobs are at most risk, particularly those in the service industry, which can't be done remotely, and have generally seen the highest new unemployment claims during the pandemic.

In both counts, Worcester should fare relatively well, the group said. The city is one of 30 that Brookings said should see a fiscal hit in the longer-term, but not immediately.

What are known as local revenues – including the meals tax, excise tax, licenses and permits – make up 6% of Worcester’s revenue, compared to 45% from property taxes, which stay more stable year-to-year, according to a Worcester Regional Research Bureau analysis in September.

Another source of local revenue may fall further than restaurants: building permits. Through late October, the city’s revenue for the year for permits was $2.3 million, on track to fall by 19% from last year.

Statewide, the Massachusetts Department of Revenue has projected fiscal 2021 tax revenue – which covers July 2020 to June 2021 – to fall as much as 18%, or $5.2 billion, below what was expected before the pandemic hit.